Has the US Dollar Hit Bottom?

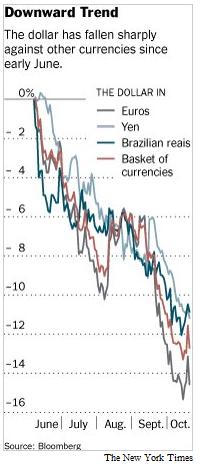

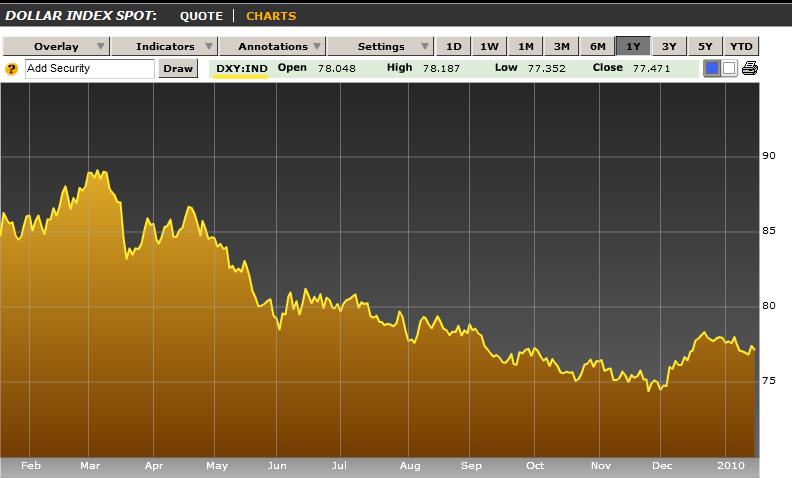

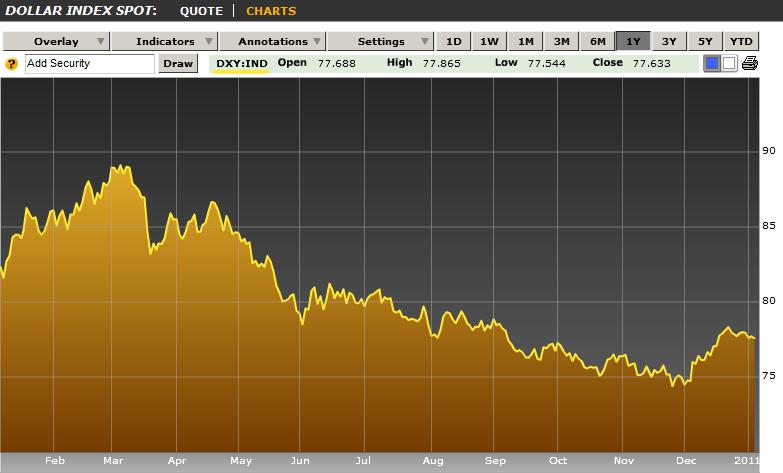

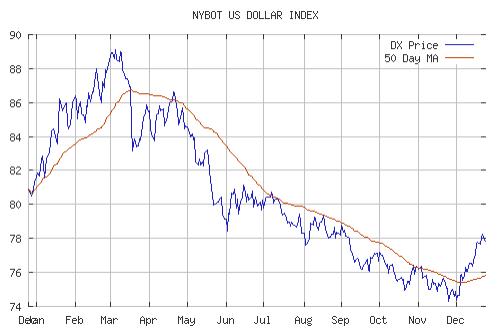

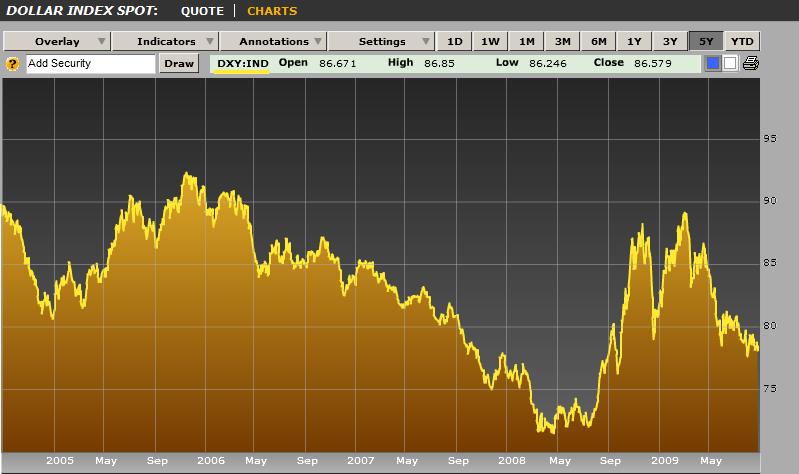

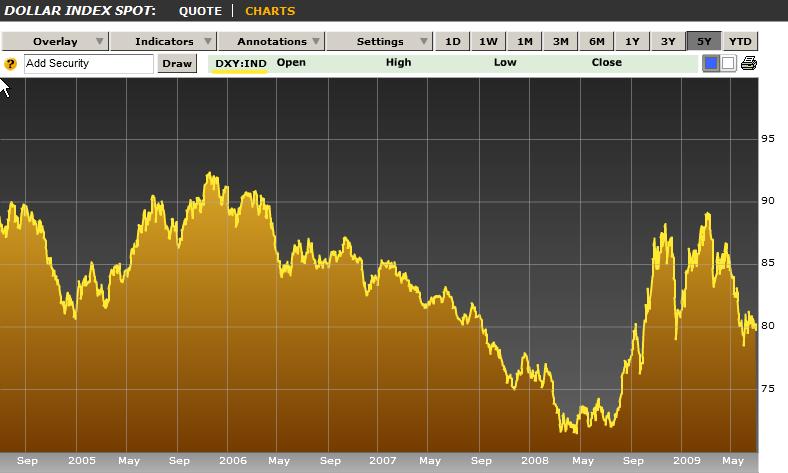

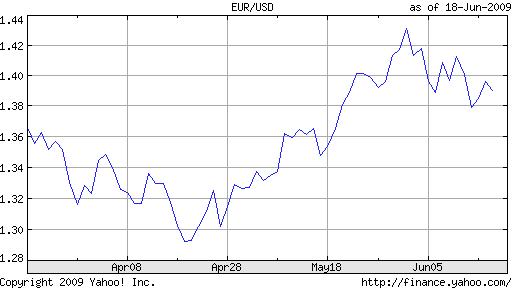

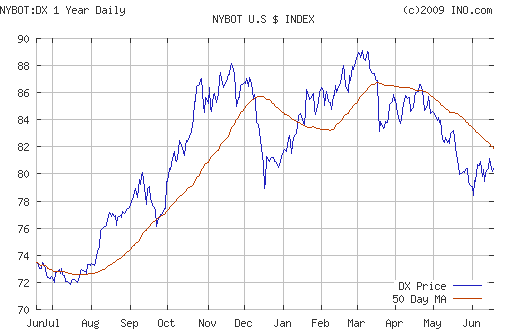

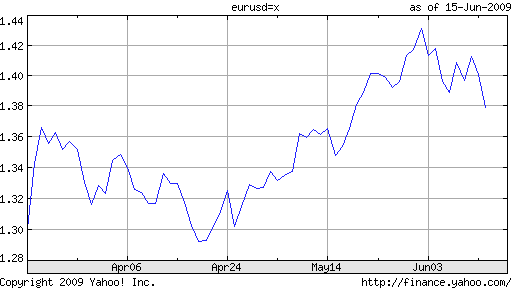

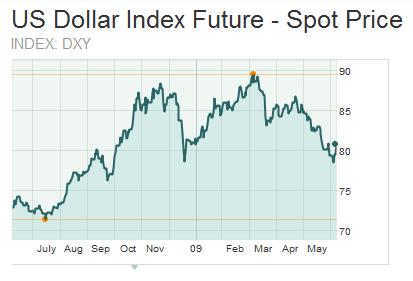

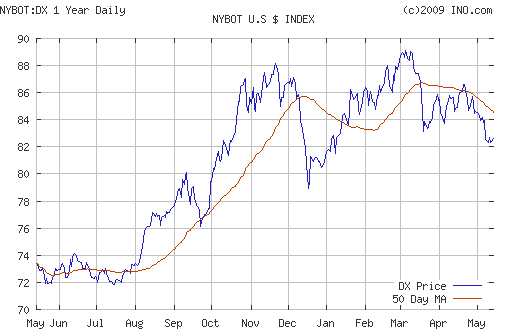

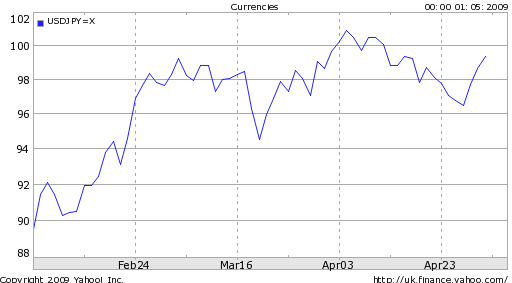

In April, I declared that the dollar would rally when QE2 ended. That date – June 30 – is now only a few weeks away, which means it won’t be long before we know whether I was right. Meanwhile, the dollar is close to pre-credit crisis levels on a composite basis, and has already fallen to record lows against a handful of specific currencies. In other words, it’s now do-or-die for the dollar.

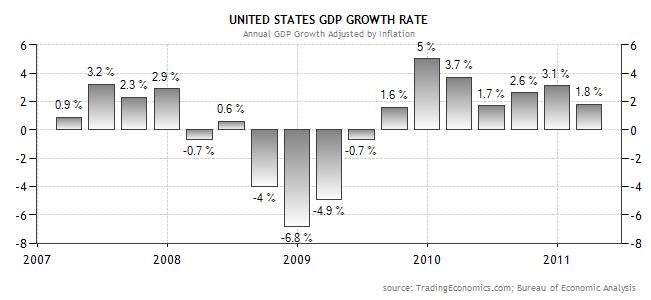

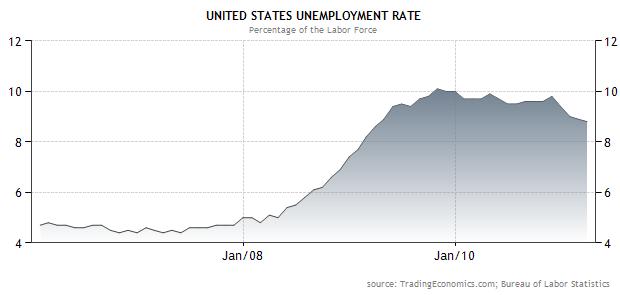

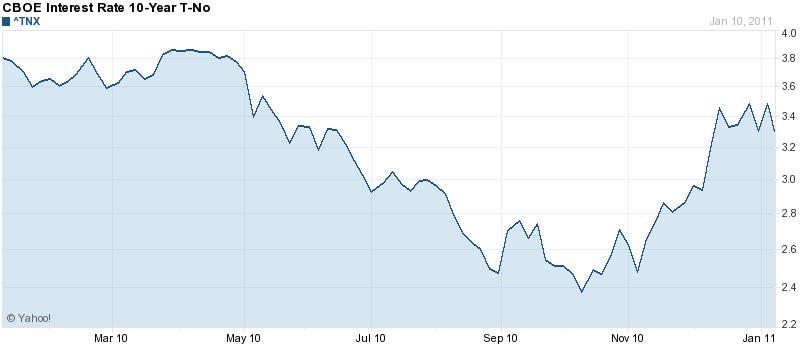

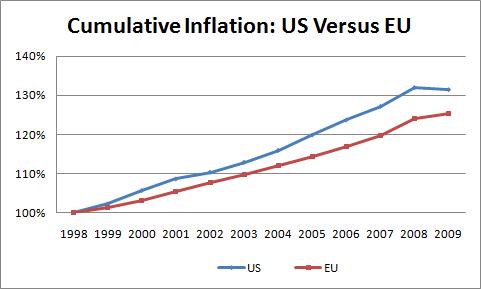

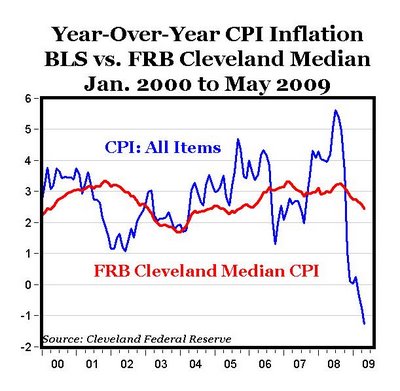

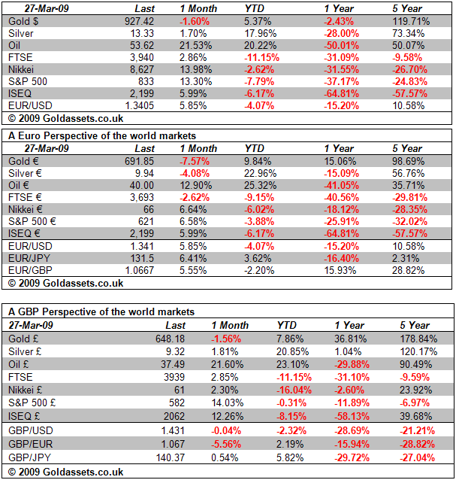

Since my last update, a number of things have happened. Commodity prices have continued to rise, and inflation has ticked up slightly. Meanwhile, GDP growth has moderated, the unemployment rate has stagnated at 9%, and the S&P has fallen slightly as investors brace for the possibility of an economic downturn. Finally, long-term interest rates have fallen, despite concerns that the US will be forced to breach the debt ceiling imposed by Congress.

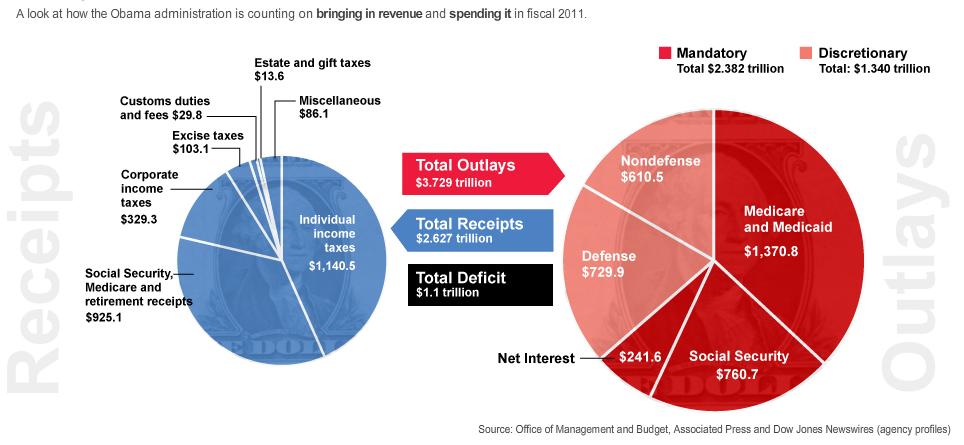

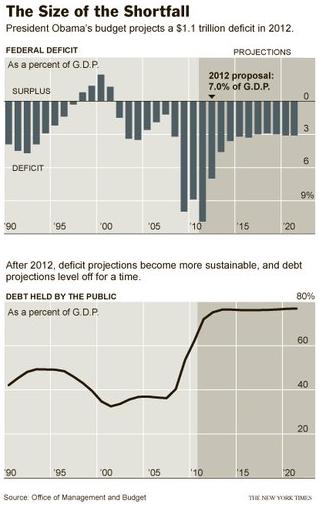

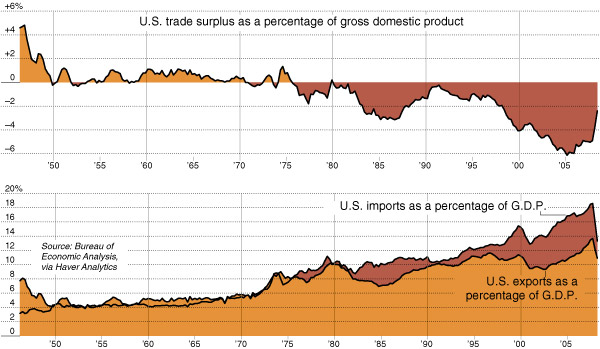

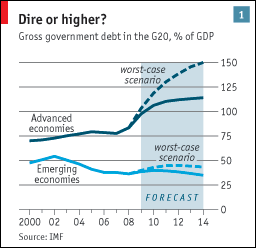

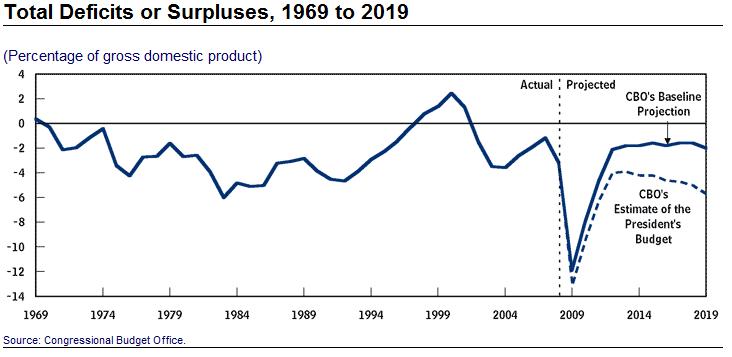

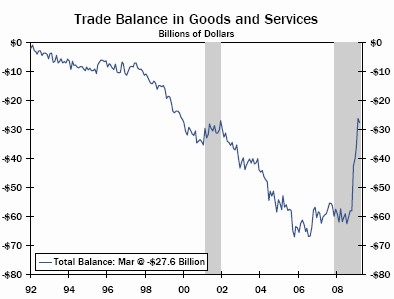

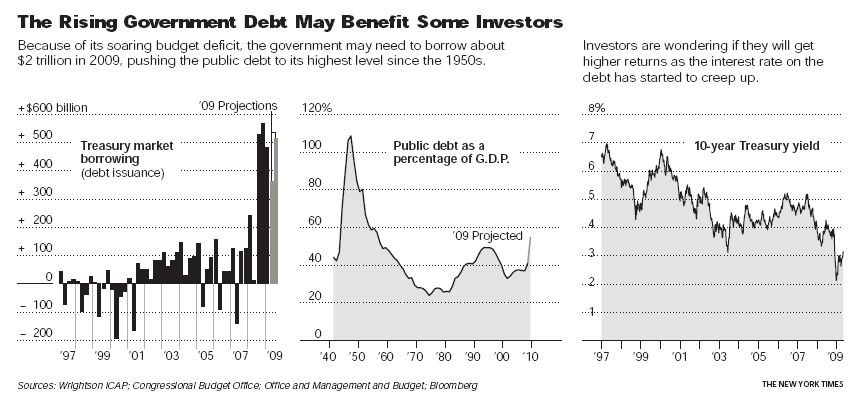

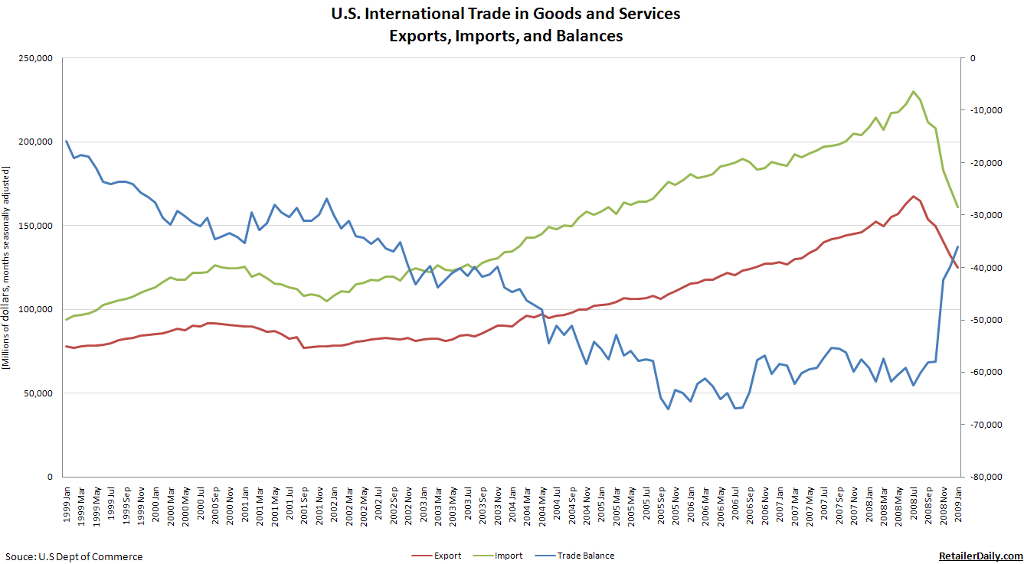

From the standpoint of fundamentals, there is very little to get excited about when it comes to the dollar. While the US is likely to avoid a double-dip recession (the case for this was most convincingly made by TIME Magazine, of all sources), GDP growth is unlikely to rebound strongly. Exports are growing, but slowly. Businesses are investing (in machines, not people), but they are still holding record amounts of cash. Consumption is strong, but unsustainable. The government will do what it can to keep spending, but given that the deficit is projected at 10% of GDP in 2011 and that Congress is playing hardball with the debt ceiling, it can’t be expected to provide the engine of growth.

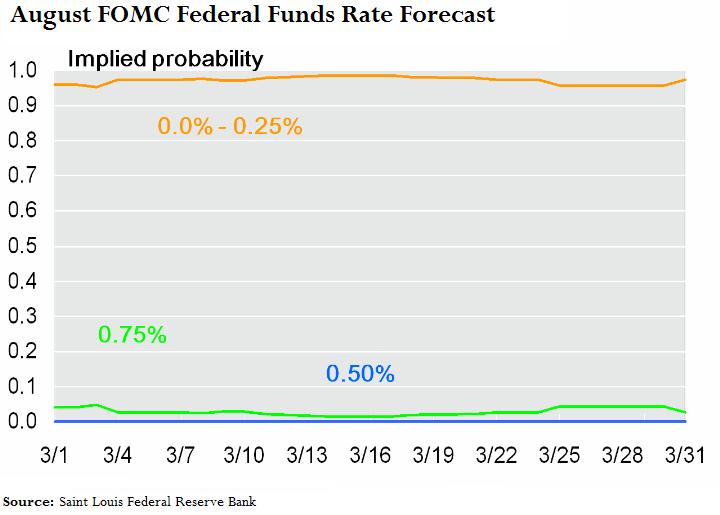

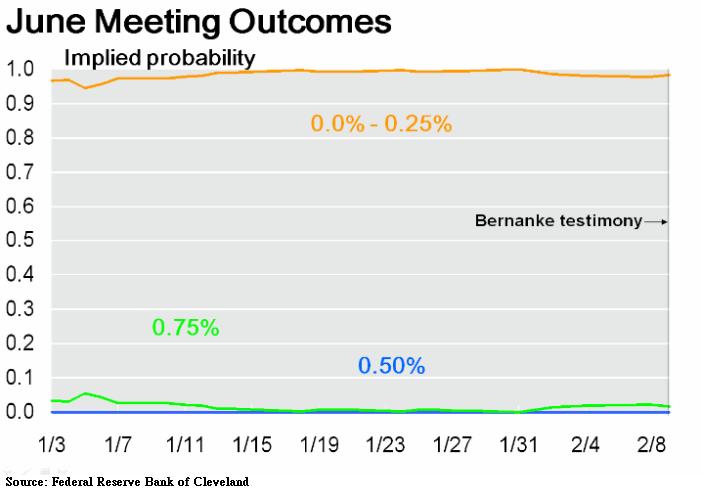

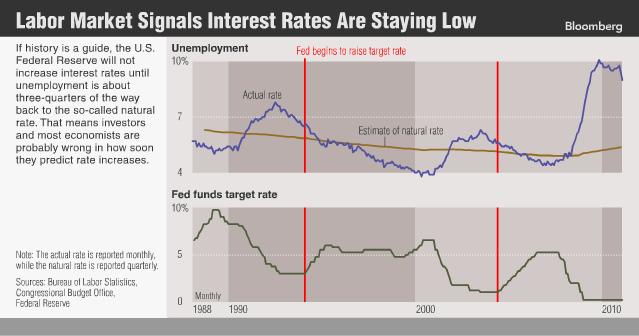

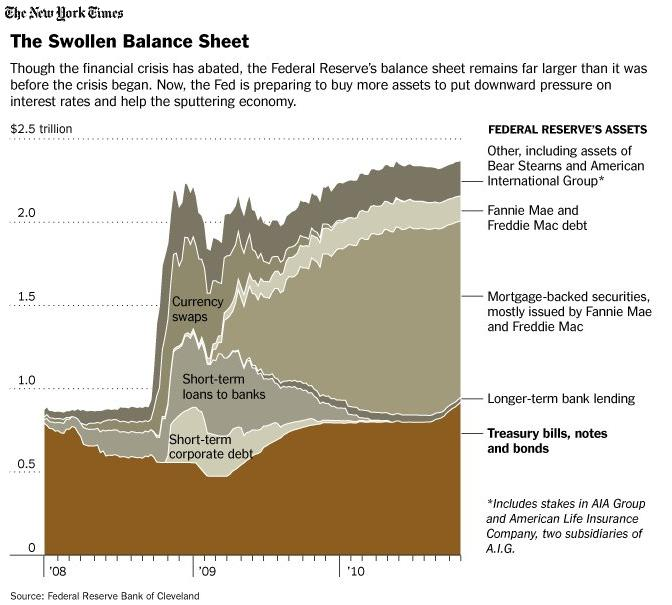

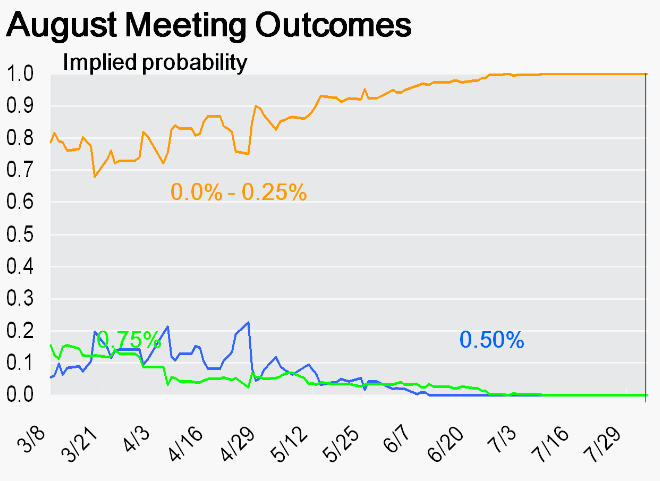

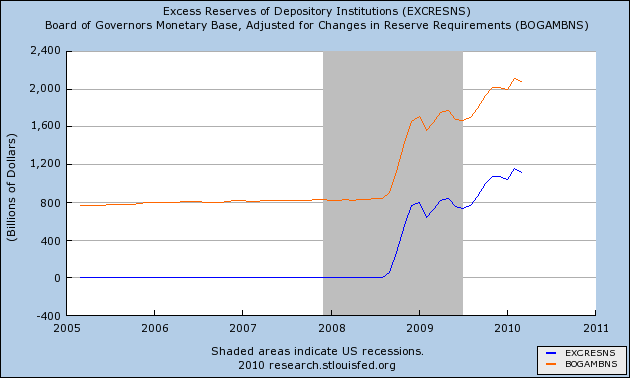

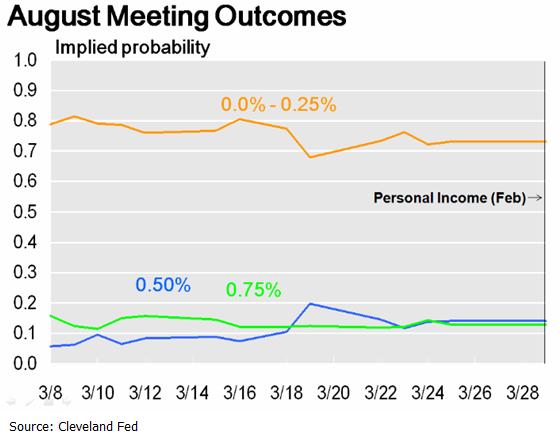

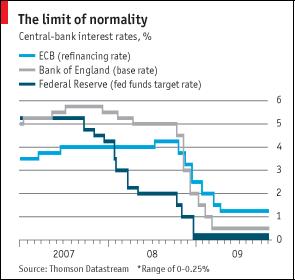

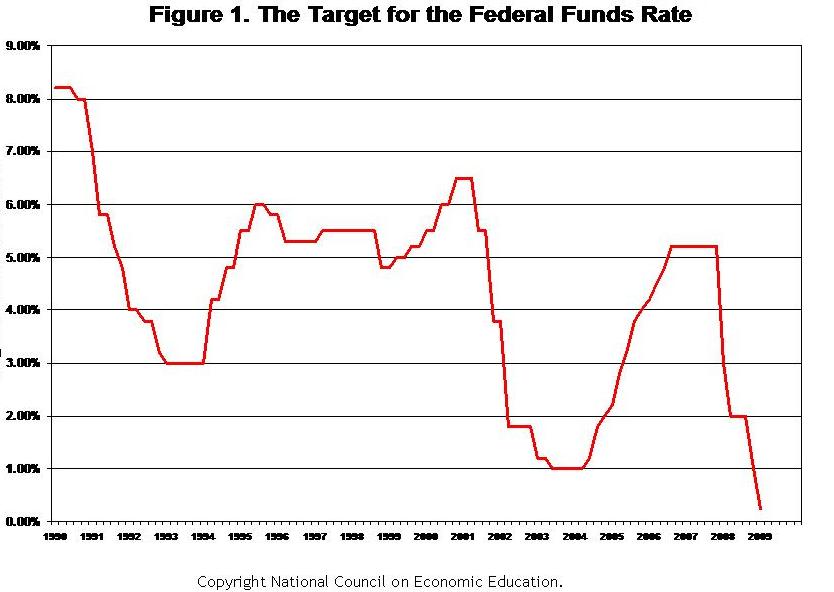

Meanwhile, Ben Bernanke, Chairman of the Fed, has implied that QE2 will not be followed by QE3. Still, he warned that “economic conditions are likely to warrant exceptionally low levels for the federal-funds rate for an extended period.” With low growth, high unemployment, and low inflation, there isn’t any impetus to even think about raising interest rates. In fact, Bernanke and his cohorts will continue to do everything in their power to hold down the dollar, if only to provide a boost to exports. Bill Dudley, head of the New York Fed, intimated in a recent speech that the Fed’s current monetary policy is basically a response to emerging market economies’ failure to allow their currencies to rise.

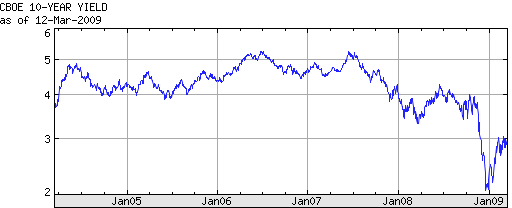

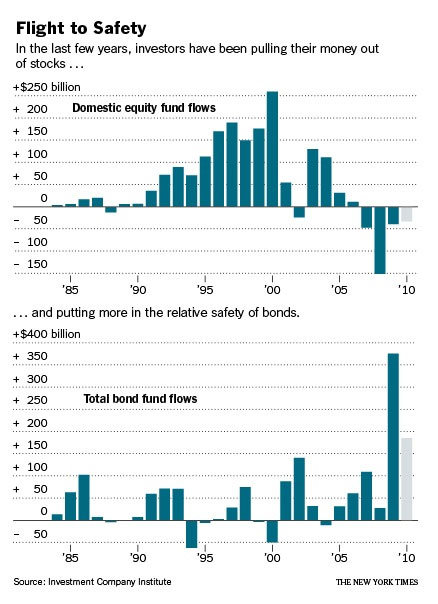

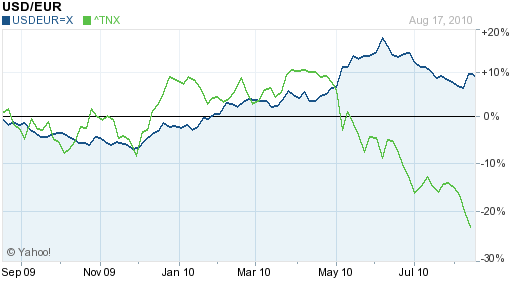

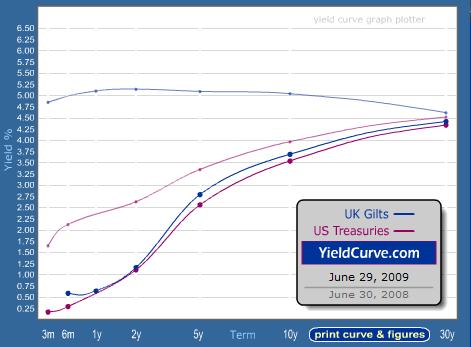

In short, if I was arguing that fundamentals would provide the basis for renewed dollar strength, I would have a pretty weak case. As I wrote a few weeks ago, however, there is a wrinkle to this story, in the form of risk. You see- the dollar continues to derive some significant support from risk-averse investors, as evidenced by the fact that Treasury yields have fallen to record lows.

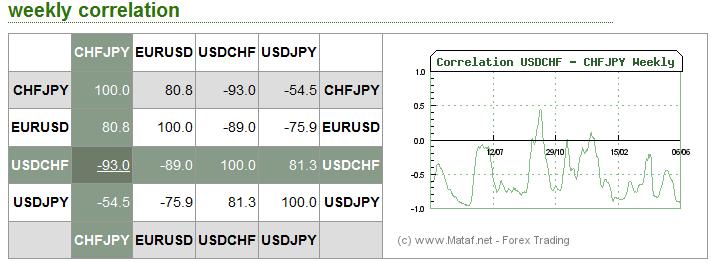

Ironically, demand for the US dollar is inversely proportional to the strength of US fundamentals. As the US economy has rebounded, investors have become more comfortable about risk, and have responded by unloading safe haven positions in the dollar. With the US recovery faltering, investors are slowly moving back into the dollar, re-establishing safe haven positions. While the dollar faces some competition in this regard from the Franc and the Yen, it still compares favorably with the euro and pound.

In fact, some traders are betting that the dollar’s fortunes may be about to reverse. It has fallen 15% over the last year, en route to a 3-year low. With short positions so high, it would only take a minor crisis to trigger a short squeeze. Said the CEO of the world’s largest forex hedge fund (John Taylor of FX Concepts): “We see a big upside USD catalyst in the next ‘3 or 4 days’ on the grounds that…’Our analysis of the markets has shown that they are very, very dangerous.’ ”

For what it’s worth, I also think the dollar is oversold and expect a correction to take hold at some point over the next month.

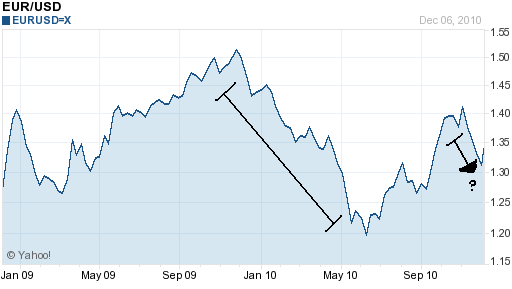

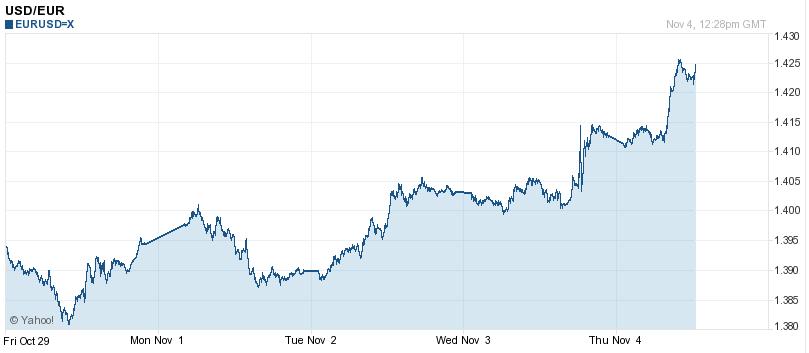

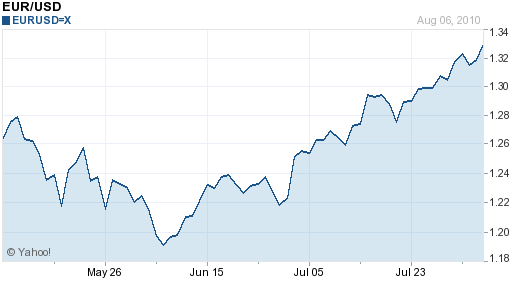

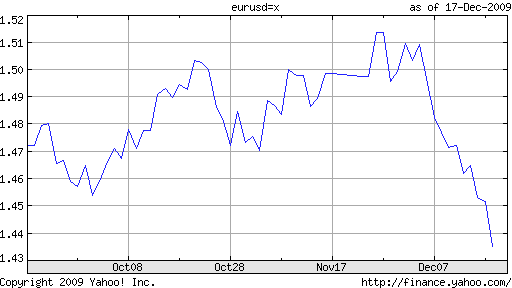

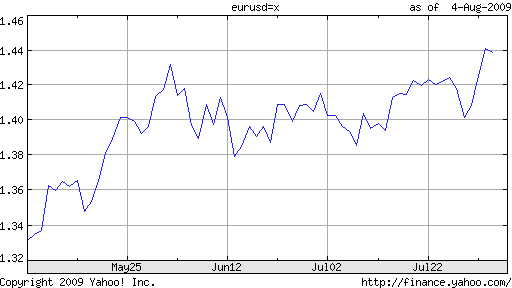

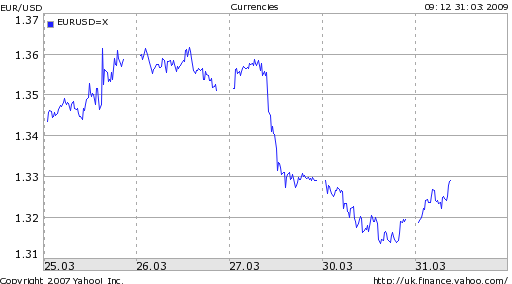

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to

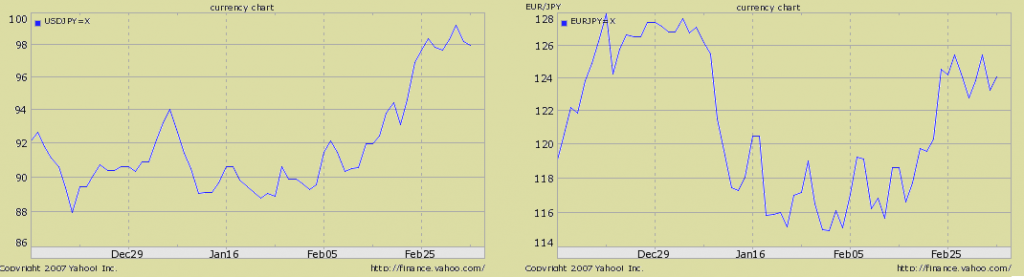

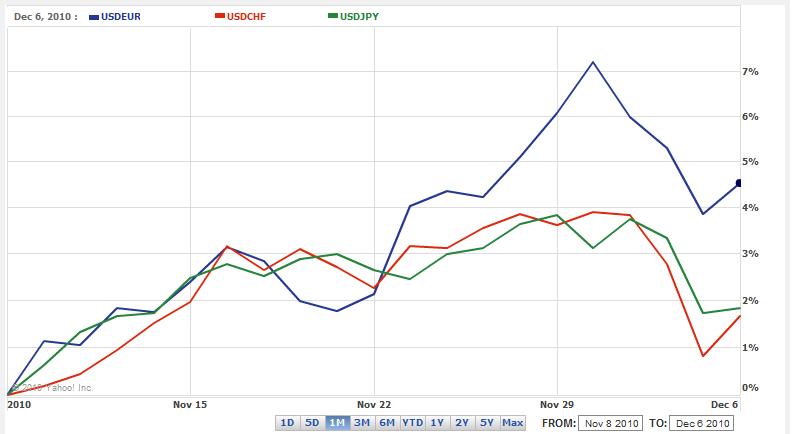

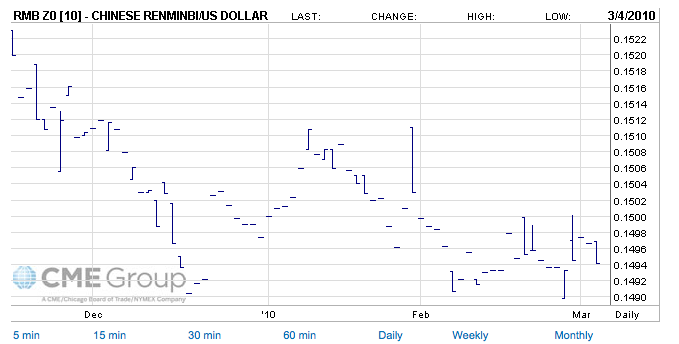

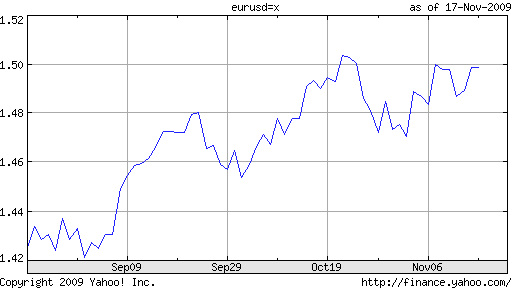

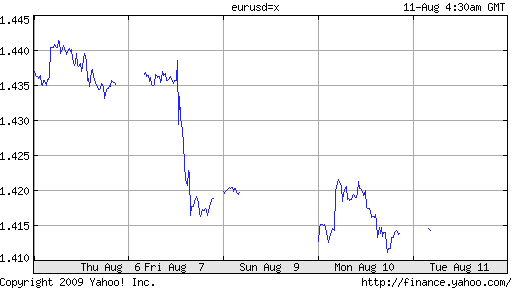

Many analysts are pointing to Friday, December 4, as the day that logic returned to the forex markets. On that day, the scheduled release of US non-farm payrolls indicated a drop in the unemployment rate and shocked investors. This was noteworthy in and of itself (because it suggests that the recession is already fading), but also because of the way it was digested by investors; for the first time in perhaps over a year, positive news was accompanied by a rise in the Dollar. Perhaps the word explosion would be a more apt characterization, as the Dollar registered a 200 basis point increase against the Euro, and the best single session performance against the Yen since 1999.

Many analysts are pointing to Friday, December 4, as the day that logic returned to the forex markets. On that day, the scheduled release of US non-farm payrolls indicated a drop in the unemployment rate and shocked investors. This was noteworthy in and of itself (because it suggests that the recession is already fading), but also because of the way it was digested by investors; for the first time in perhaps over a year, positive news was accompanied by a rise in the Dollar. Perhaps the word explosion would be a more apt characterization, as the Dollar registered a 200 basis point increase against the Euro, and the best single session performance against the Yen since 1999.

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.

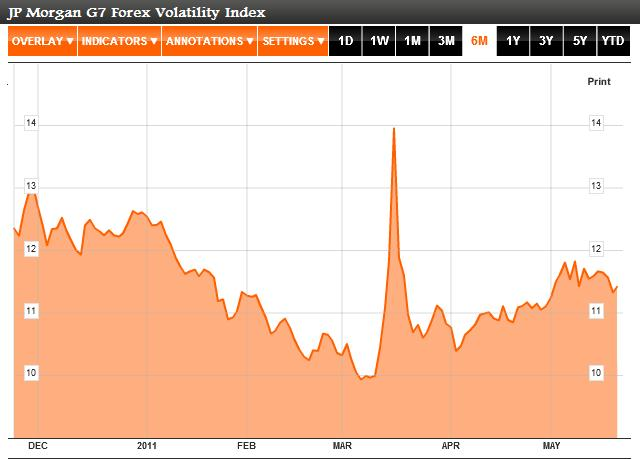

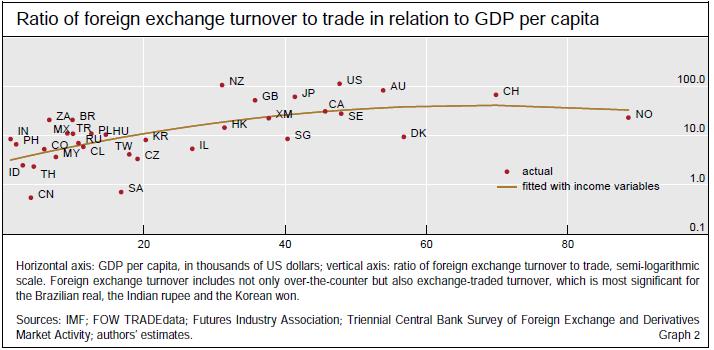

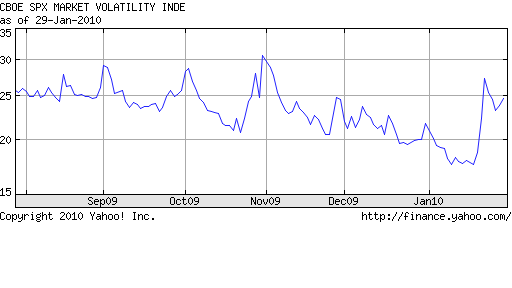

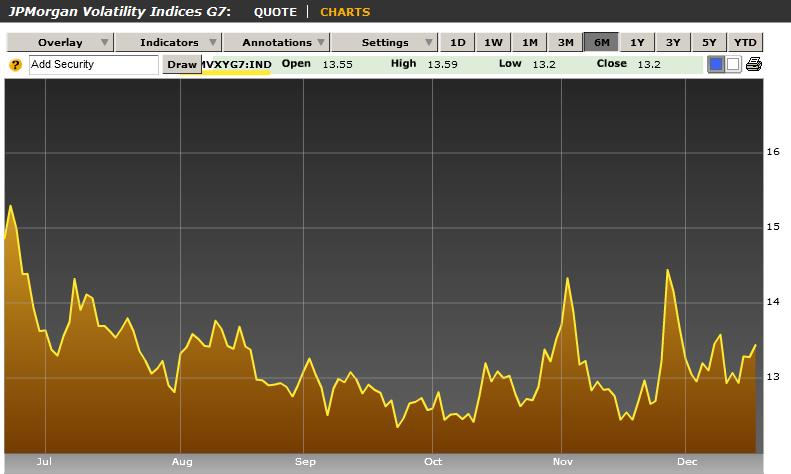

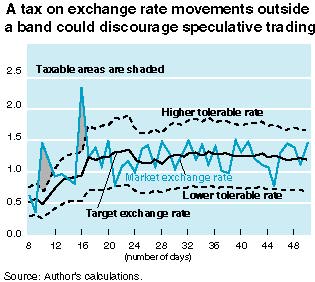

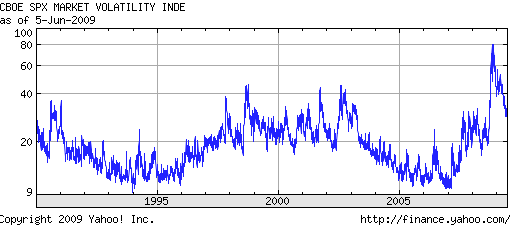

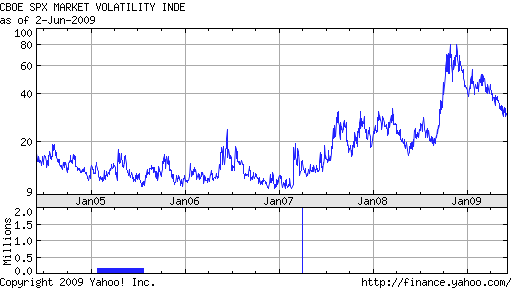

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations.

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations. Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility.

Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility. Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.)

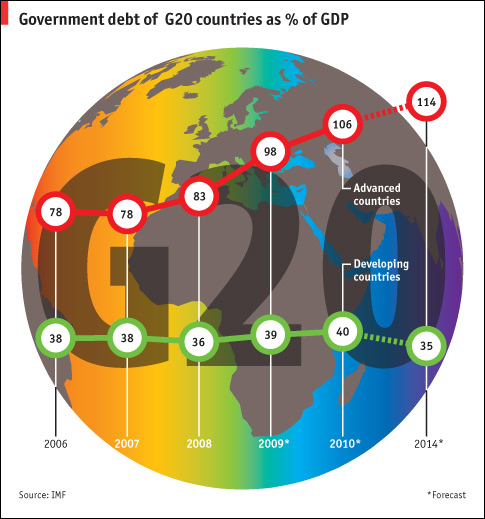

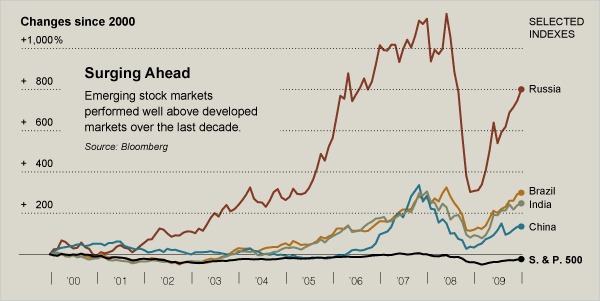

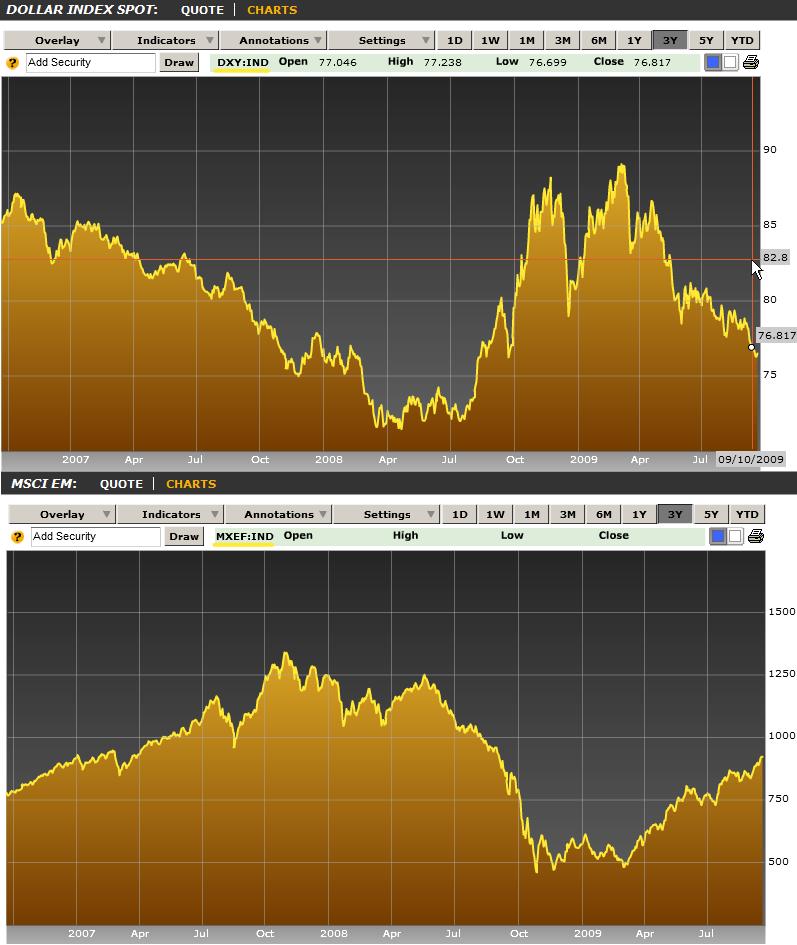

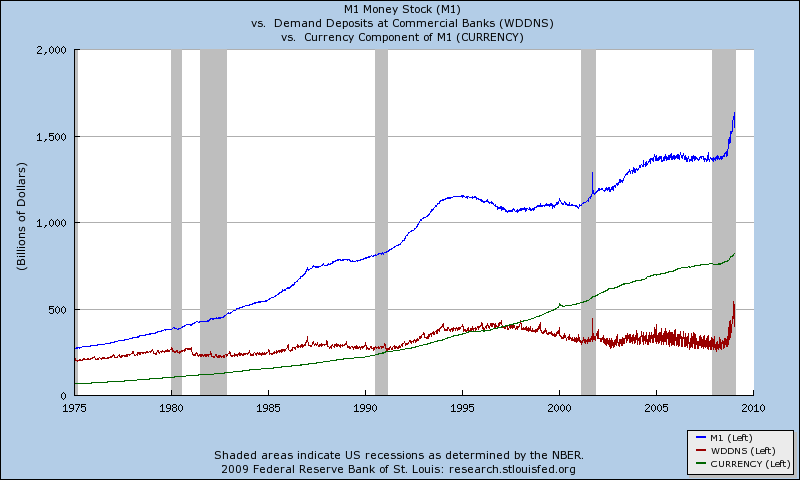

Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.) If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

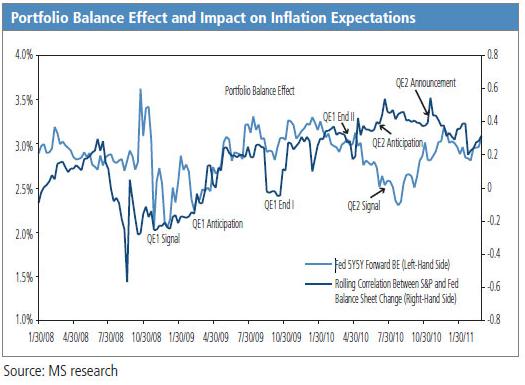

In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a

In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a

Nonetheless, the Fed made a point of emphasizing that the economy seems to be stabilizing: “Information received since the Federal Open Market Committee met in March indicates that the

Nonetheless, the Fed made a point of emphasizing that the economy seems to be stabilizing: “Information received since the Federal Open Market Committee met in March indicates that the

The difficulty with forecasting the current recession is that its causes are structural rather than cyclical. Argues one analyst: “It is unwise and foolish to treat this bear market like any other in the post-WW II period because it is totally unique; the scope and depth of the ongoing destruction of consumer and business credit, bank balance sheet compression and insolvency, consumer retrenchment and soaring unemployment should not be underestimated.” As a result, many economic models are out of date. “Economic forecasters have underestimated how bad it is because they have over-estimated the strength of the real economy and failed to take into account the extent of its dependence upon a buildup of debt that relied on asset price bubbles.”

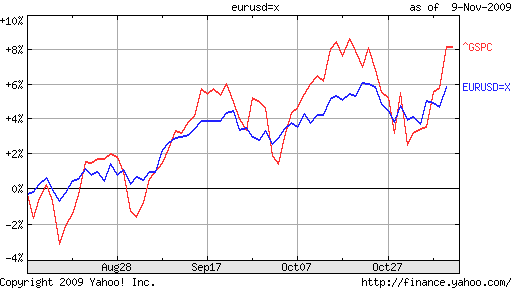

The difficulty with forecasting the current recession is that its causes are structural rather than cyclical. Argues one analyst: “It is unwise and foolish to treat this bear market like any other in the post-WW II period because it is totally unique; the scope and depth of the ongoing destruction of consumer and business credit, bank balance sheet compression and insolvency, consumer retrenchment and soaring unemployment should not be underestimated.” As a result, many economic models are out of date. “Economic forecasters have underestimated how bad it is because they have over-estimated the strength of the real economy and failed to take into account the extent of its dependence upon a buildup of debt that relied on asset price bubbles.” Ironically, an improvement in corporate profitability would further drive risk-taking and would thus have the effect of weakening the Dollar. One would think that an improved economic outlook would strengthen the Dollar. In actuality, financial and psychological factors continue to predominate in financial markets, and investors are looking for an excuse to dump the Dollar in favor of higher-yielding alternatives.

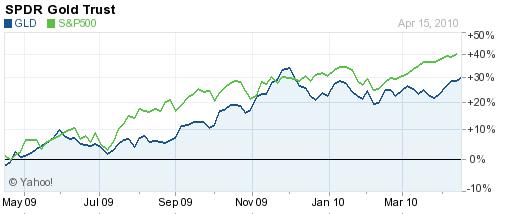

Ironically, an improvement in corporate profitability would further drive risk-taking and would thus have the effect of weakening the Dollar. One would think that an improved economic outlook would strengthen the Dollar. In actuality, financial and psychological factors continue to predominate in financial markets, and investors are looking for an excuse to dump the Dollar in favor of higher-yielding alternatives.

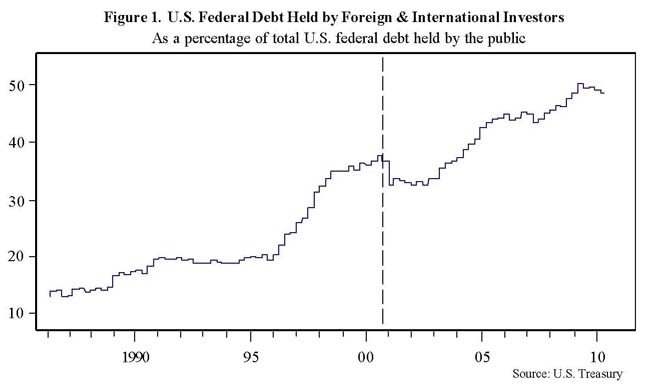

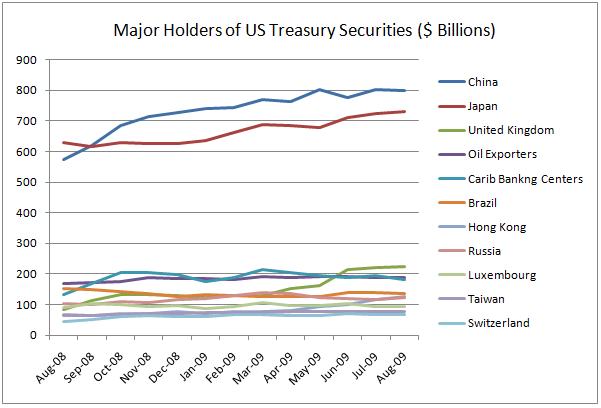

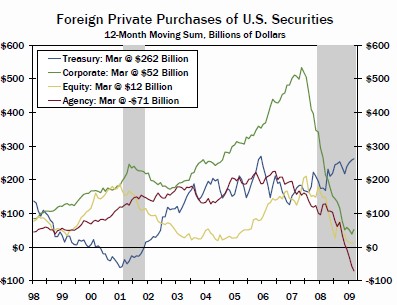

Even ignoring the potential political fallout from forex reserve diversification, such a move doesn’t really make practical sense. First of all, there isn’t a buyer sufficiently capitalized to relieve China of its US Treasury burden. “If China decided to sell off some of its U.S. Treasury holdings, it would scarcely be able to dump that in large blocks. And a partial selloff would surely lead to a slump in the Treasury market,

Even ignoring the potential political fallout from forex reserve diversification, such a move doesn’t really make practical sense. First of all, there isn’t a buyer sufficiently capitalized to relieve China of its US Treasury burden. “If China decided to sell off some of its U.S. Treasury holdings, it would scarcely be able to dump that in large blocks. And a partial selloff would surely lead to a slump in the Treasury market,