July 8th 2009

Inflation Update: US Prices Creep up in May

The debate over US inflation continues to be waged- in academic circles, among economists, and in the financial markets. There is no still no clear consensus as to the likelihood that the inflation will flare up at some point, as a result of the Fed’s easy monetary policy and the government’s record budget deficits. While the unprecedented nature of this crisis means that such a debate is still a matter of theory, that hasn’t stopped both sides from weighing in, often vehemently.

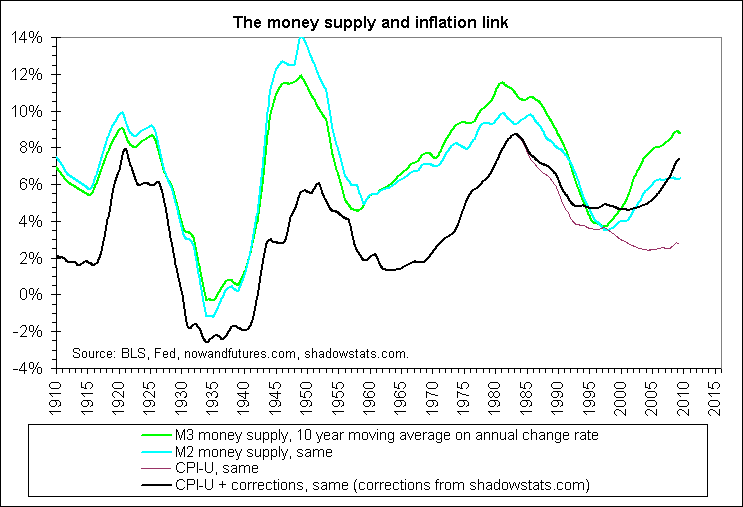

Admittedly, the risk of inflation in the short-term is still low: “With so much of the world ensnared by the economic downturn, demand for goods and services is weak, which tends to push down prices. Amid high unemployment, workers are in no position to demand wage increases.” Still, the Consumer Price Index (CPI) is already creeping up. The Fed’s “core” measure, which excludes food and energy prices, rose 1.8% from a year ago. If commodity prices continue to rise, the total CPI could soon become positive. (It currently stands at -1.3%).

Among academics and economists, the discussion is being framed relative to the Fed; specifically, can it – and more importantly, will it – move to unwind its quantitative easing program when the time comes? “If it acts prematurely to reduce the money supply, the Fed could stifle the recovery. If it waits too long, it could contribute to a jump in inflation. Its timing is going to have to be perfect,” says a former Fed economist.

This question remains divisive, as evidenced by the ongoing feud between the chief economist at Morgan Stanley and his counterpart over at Goldman Sachs. MS is concerned that the Fed will leave rates too long. According to one of his supporters, “The Fed absolutely has the tools and know-how, but the question is, will they have the guts to use them? I don’t think there is a snowball’s chance in hell they will be willing to tighten to slow inflation down.” Counters the GS camp: ““The Fed will be able to contain inflation pressures through a combination of raising interest rates and unwinding its balance sheets.”

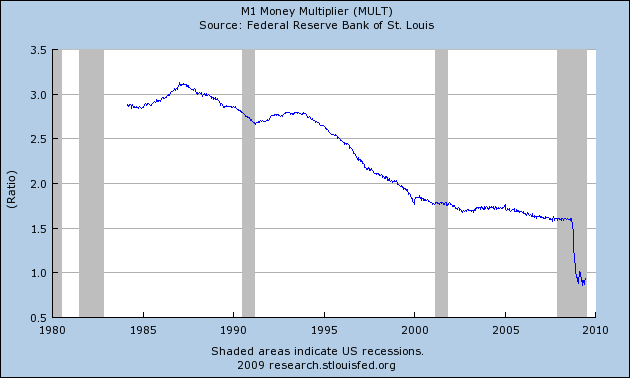

All of this talk seems premature when you consider that the money supply is barely growing, despite the Fed’s QE program: “M2, a gauge that includes savings and checking accounts, is 4.7 times the base cash supply, down from 9.3 times a year ago.”

“Of the $2.1 trillion that the Fed is injecting into the financial system, more than half, or 51 cents per dollar, is being posted back at the central bank by financial institutions in the form of excess reserves, a record high.” In other words, most of the Fed’s cash is not actually finding its way to consumers.

Financial markets are equally ambivalent, although erring on the side of caution. Treasury yields on the long end of the curve have risen over the last few months, though this can be attributable to several causes. More specifically, “The spread been nominal 10-year Treasury yields and comparable-maturity TIPS yields has increased from approximately 0.25% at the start of the year to 1.65% currently, reflecting a 1.4% increase in expected CPI inflation over the next decade.” Based on this, it’s clear that while investors don’t share the doomsday pessimism of inflation hawks, they are nonetheless growing increasingly concerned.

July 12th, 2009 at 5:36 pm

Something tells me that we could tread water for a little while yet, but the break will occur in November. Inflation could well pop at that stage and we could be on the way to all sorts of extra problems, perhaps a second wave of foreclosures.

Data to back that up – pure intuition, but hey, that’s about as good as any of the other predictive models, right?