December 4th 2010

Euro-Watchers Pull About-Face

Only last month, the Euro was on top of the forex markets. Especially relative to its “G4” competitors (Dollar, Yen, Pound) – all of which are plagued by economic uncertainty and loose monetary policies – the Euro was seen as a smart bet. In the last few weeks, however, the EU sovereign debt crisis resurfaced, and the Euro has plunged, losing 7.5% of its value against the Dollar. As a result, investors have pulled an about-face: instead of banking on the European Central Bank (ECB) to buoy the Euro through monetary restraint, they are now counting on it to hold the Euro together by adopting the same tactics as its counterparts.

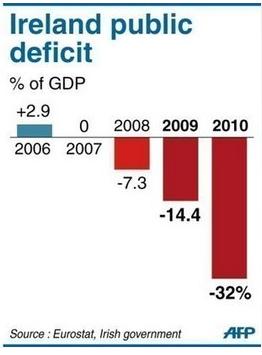

Before I explain what I mean here, I’d like to offer an update on the EU fiscal situation. In the last week, there were a handful of developments. First, Ireland accepted a tentative €85 Billion in aid from the EU/IMF, officially joining the ranks of an infamous club that also includes Greece. Still, it wasn’t clear whether such a bailout would also include Irish banks, which are seen as perhaps in deeper trouble than the Irish government. As a result, investors were unmoved, and S&P moved ahead with a cut to Ireland’s sovereign credit rating.

Naturally, rumors began to circulate that Portugal was also preparing a formal bailout request. Said one trader, “In Portugal the kind of language you’re hearing is similar to what you heard in Ireland a few weeks ago.” Despite promises to the contrary, Portugal’s budget deficit has widened in 2010. Interest in its most recent bond issue was healthy, but at the highest interest rate since the Euro was introduced in 1999 and more than .5% higher than last month.

Ultimately, bailouts of Greece, Ireland, and Portugal can be managed. It is a default and/or preemptive rescue of Spain – the other PIGS member – that worries investors. Its economy represents more than 11% of the EU and any hiccup would seriously shake the foundations of the Euro: “It may well be that we are approaching the endgame of this part of the crisis as Spain is of such importance that one can only imagine that the EU will regard it as the line in the sand that cannot be crossed.” While Spain is working hard to cut its budget deficit to a still-stratospheric 9.3% in 2010, investors have balked. As a result, interest rates in its bonds have surged to a post-Euro high (relative to German bonds), and credit default swap spreads (which insure against the risk of default) have risen substantially.

The problem with the EU sovereign debt crisis – like most credit crises, for that matter – is that they tend to be self-fulfilling. As investors begin to doubt the ability of institutions (governmental and otherwise) to service their debts, they naturally demand greater compensation for the (perceived) increase in risk. This further inhibits that institution’s ability to repay its loans, which only makes funding more difficult to attract, and so on.

It is ironic on multiple levels then that even as investors abandon the debt of EU member countries, they are hoping that the ECB steps in to fill the void they create. As I alluded to the title of this post, this marks a stunning about-face from only a few months ago, when the Euro was rising against the Dollar because of the ECB’s commitment to a responsible monetary policy. Nowadays, the Euro rallies only on news that the ECB is maintaining or expanding its intervention. For example, the Irish banking sector is “increasingly more reliant on the ECB funding,” and as a result, “The euro edged up…as the European Central Bank continued buying Portuguese and Irish government bonds.”

Based on this change in investor mentality, it seems unlikely that the Euro will recover its losses anytime soon. Of course, the ECB has nearly unlimited resources at its disposal. German central bank chief Axel Weber declared confidently that, “An attack on the euro has no chance of succeeding.” However, the ECB can never hope to fully supplant the important role played by private capital, and besides, “What we are experiencing at present is not a speculative attack but a justified depreciation due to unsolved problems.”

There are still plenty of optimists who believe that the fear will soon die down and that higher interest rates will attract some of the yield-hungry investors that are currently focused on emerging markets. Goldman Sachs forecast “the euro will rise to $1.50 by year-end 2011 as big economies in the area continue expanding.”

I think the most realistic assessment is somewhere in between. On the one hand, it seems unlikely that the Spain will default on its debt at anytime in the near future or that the Euro will cease to exist. On the other hand, the fact that investors now see the ECB as a savior for following in the footsteps of the Fed implies that there is no reason for investors to buy the Euro against the US Dollar.

December 10th, 2010 at 7:44 am

I think the euro zone will have more troubles in the future. Ireland and Greece are only the top of the mountain. So keep in mind that a lot of people bring their money to switzerland. Take a look at EUR/CHF.

December 13th, 2010 at 3:45 am

IF eur/Usd can’t stay above $1.25, It’s gonna be very difficult to get to $1.50 by year end 2011. Especially if dollar continues its appreciation.

December 18th, 2010 at 4:17 pm

“As investors begin to doubt the ability of institutions (governmental and otherwise) to service their debts, they naturally demand greater compensation for the (perceived) increase in risk.”

Seems to me like an economical perpetuum mobile. But what PIIGS countries do about it? Nothing. And there goes the chance for a little stabilization.