Forex Volume is Down – What are the Implications?

According to a recent report by the Reserve Bank of Australia (RBA), forex volume is down in nearly every major category. “However, turnover declined by over 20 per cent between October 2008 and April 2009 to US$2.5 trillion, to be at its lowest level in over two years, a move reflected in all six markets indicating global, rather than location-specific, causes. The largest markets – the United Kingdom and the United States – experienced the sharpest percentage falls.”

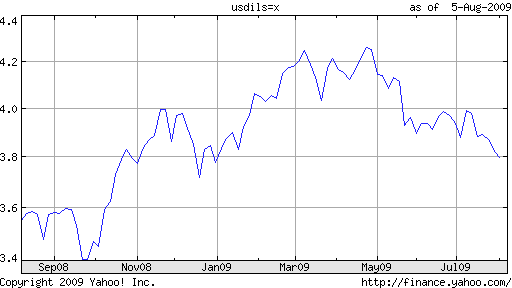

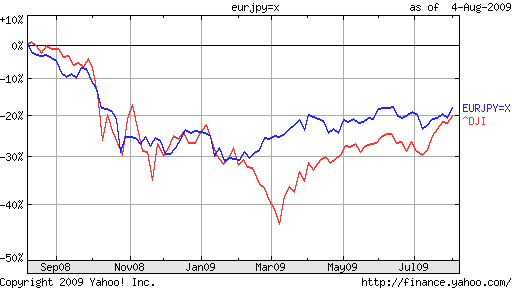

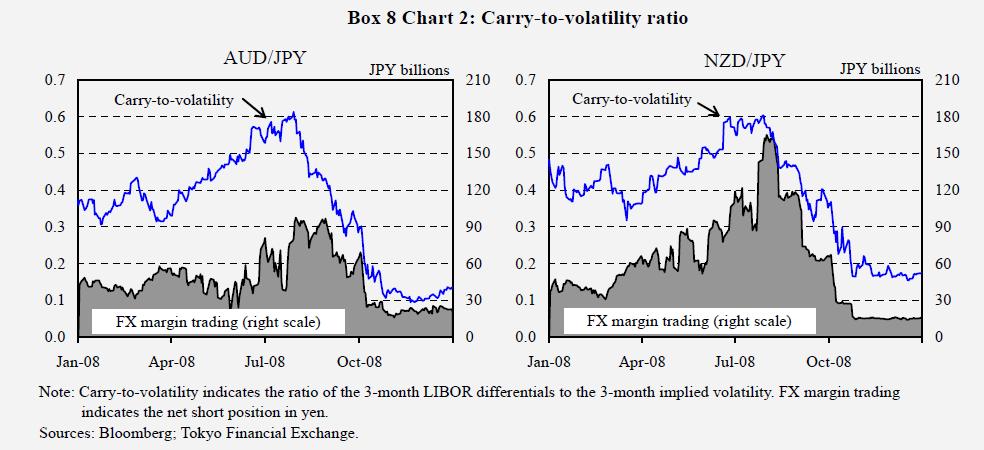

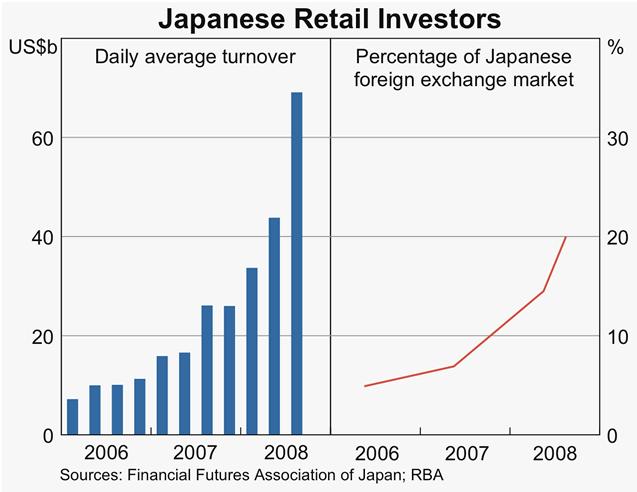

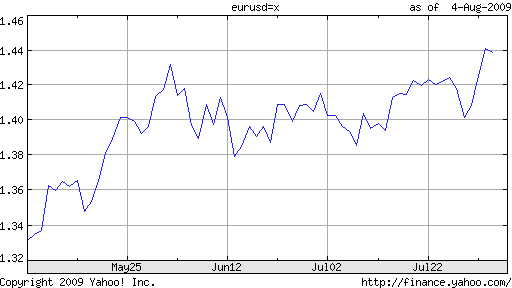

The report was based on a survey of the world’s six largest forex trading hubs – US, UK, Japan, Canada, Singapore, and Australia – and produced a few interesting revelations. The first is that forex volume peaked well after other capital markets. This can probably be attributed to the notion that there is never a bear market in forex. In other words, after stocks and bonds began to collapse in the summer of 2008, investors embarked on a mission, unprecedented in its speed, to move capital from risky countries to safe-haven countries. This switch, by definition, required the forex markets to facilitate.

This point is further illustrated by the fact that, “the decline in turnover of spot and forwards occurred somewhat later than that in foreign exchange swaps and derivatives….Spot turnover reported in October 2008 was likely to have been supported by large cross-border capital flows as investors sought to reduce risk by repatriating foreign investments. In addition, the high frequency and impact of news at the height of the crisis would have generated the need for investors to frequently adjust their positions.”

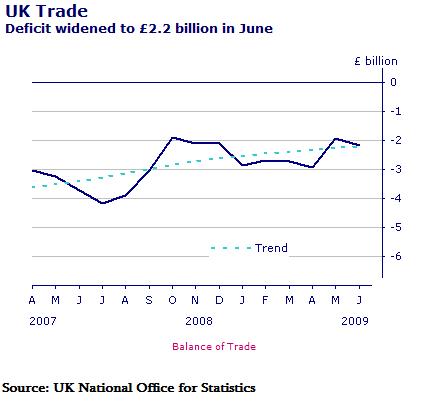

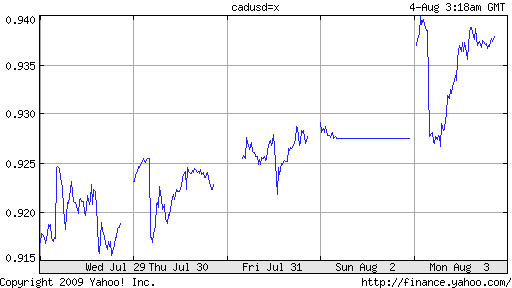

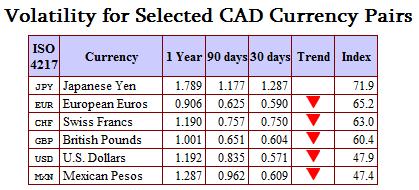

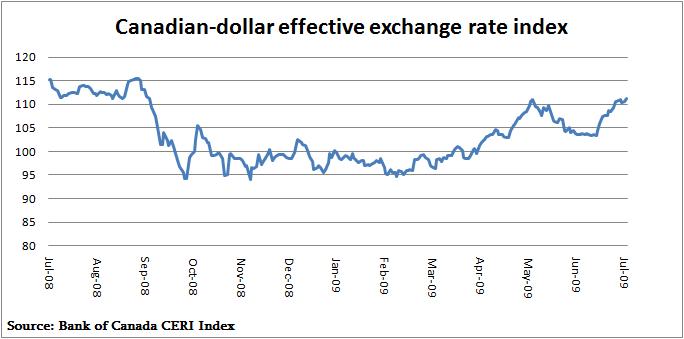

The final revelation is that the change in forex volume was not always commensurate with changes in trade volume. A general relationship between trade and forex turnover has been observed, although speculators ensure that currency is exchanged much more frequently than actual goods and services. The two currency pairs registering the greatest unbalance are the CHF/USD and CAD/USD. Forex volume for the former fell much more sharply than trade, while the opposite is true of the latter. One can only speculate as to why this is the case. As for the CHF/USD, forex volume probably suffered disproportionately more because both the Swiss Franc and US Dollar were perceived as safe haven currencies, in which case it would be relatively less useful to exchange them for each other. In the case of the CAD/USD, meanwhile, it makes sense to view the imbalance in terms of the spectacular decline in trade, which was largely a product of declining commodity prices.

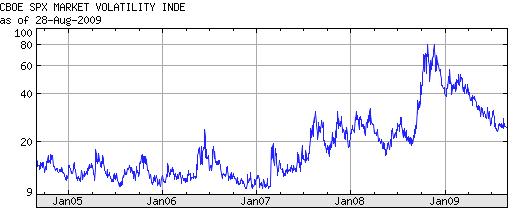

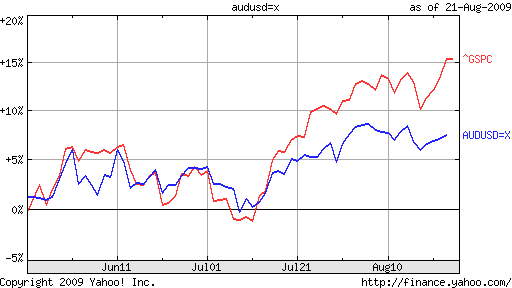

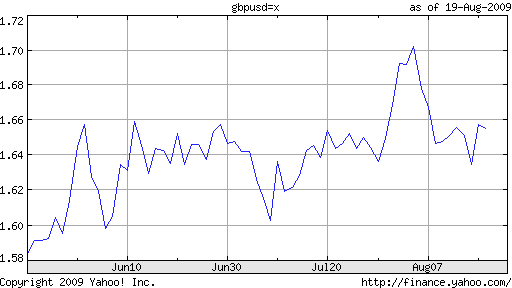

It’s impossible to predict whether forex volume will remain depressed. Given the efforts underway to increase regulation and curtail leverage, I don’t personally expect volume to recover for a while. As for the implications, the less might be to stick to the majors. If volume is declining, it will probably affect emerging market currencies most. Lower liquidity might translate into higher volatility. However, it’s worth pointing out that volatility has been declining ever since it skyrocketed after the collapse of Lehman Brothers last fall. In that case, it might be that investors are behaving more prudently with less funds to trade with.