Thai Baht Rises to 13-Year High

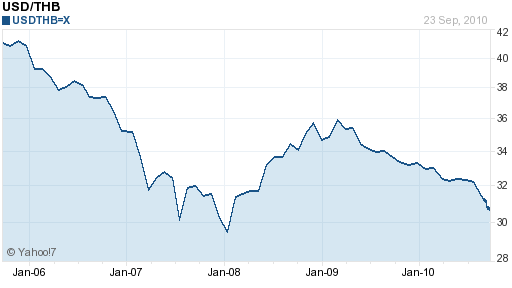

As I pack my bags and head to Thailand for a vacation (for forex research purposes…yeah right), I thought it would be appropriate to blog about the Thai Baht’s strength. The momentum behind the Baht has been nothing short of incredible, and as often happens in the forex markets, the currency’s rise is becoming self-fulfilling. It has already appreciated 8.5% over the last year en route to a 13-year high, and some analysts predict that this is just the beginning.

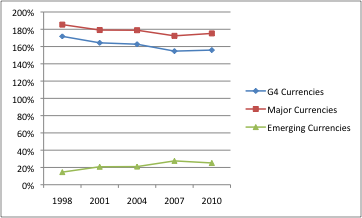

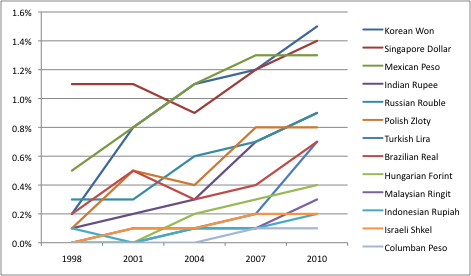

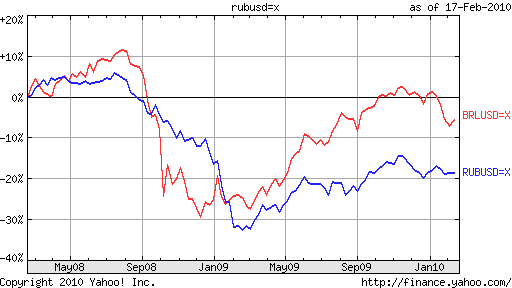

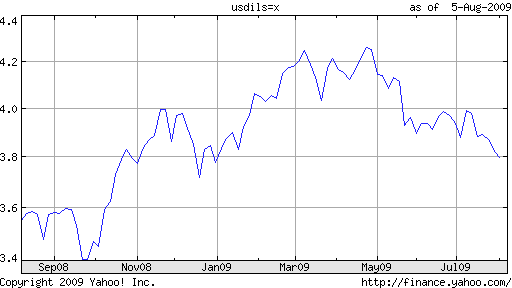

The last time I travelled to Thailand, in 2004, the Baht was trading around 40 USD/THB, compared to the current exchange rate of 30.7. That’s pretty incredible when you consider that during the intervening time, Thailand experienced a military coup and related political instability, as well as a financial crisis that dealt an especially heavy blow to the world’s emerging market currencies. And yet, if you chart the Baht’s performance against the Dollar, you would have only the faintest ideas that either of these crises took place.

To be sure, the financial crisis exacted a heavy toll on Thai financial markets and the Thai economy. Stock and bond prices lurched downward, as foreign investors moved cash into so-called safe haven currencies, such as the US Dollar and Japanese Yen. However, the Thai economy was among the first to emerge from recession, expanding in 2009, and surging in 2010. “Compared with a year earlier, GDP rose 9.1%, while the economy grew 10.6% in the first half,” according to the most recent data. Tourism, one of the country’s pillar industries, has already recovered, along with exports and consumption. Projected export growth of 27% is expected to drive the economy forward at 7-7.5% in 2010, according to both the IMF and Thai government projections. The consensus is that growth would have been even more spectacular (perhaps 1-2% higher) if not for the politcal protests, which were finally quelled in May of this year.

Despite concerns about risk and volatility, foreign investors are once again pouring funds in Thailand at a record pace. Over $1.4 Billion has been pumped into the stock market alone in the year-to-date. As a result, “Thailand’s benchmark SET Index has rebounded30 percent since May…helping send the SET to its highest level since November 1996.” Capital inflows are also being spurred by Thai interest rates, which are rising (the benchmark is currently at 1.75%), even while rates in the industrialized world remain flat. At this point, the cash coming into Thailand well exceeds the cash going out, which remains low due to steady imports and restrictions on capital outflows by Thai individuals and institutions. This imbalance is reflected in the Central Bank of Thailand’s forex reserves, which recently topped $150 Billion, more than 50% of GDP.

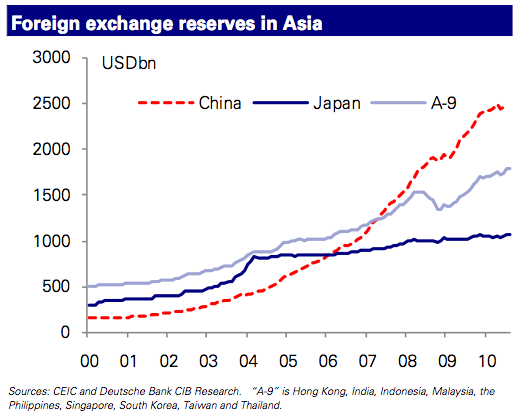

Anticipation is building that Thailand will use some its reserves to try to halt, or even reverse the appreciation of the Baht. After last week’s intervention by the Bank of Japan, such intervention is now seen not only as being more acceptable, but also more necessary. Due to pressure from the Prime Minister, the Central Bank has convened at least one emergency meeting to determine the best course of action. So far, members can only agree that restrictions on capital flows and lending standards to exporters should be relaxed.

For what it’s worth, Thailand’s richest man has urged the Central Bank not to act: “The effort is likely fruitless as foreign capital is expected to incessantly flood into Thailand because of the country’s healthy economic recovery and export growth. The baht as a matter of fact should become even stronger should Thailand’s politics remain in normal condition.” He is supported by the facts, which show that the Thai export sector has held up just fine in the face of the rising Baht, though perhaps only because other Asian currencies have risen at a comparable pace.

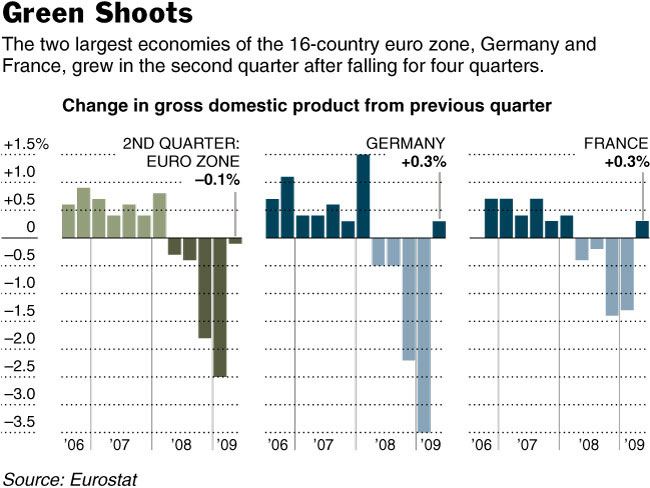

If other Central Banks were to step up their intervention – (Deutsche Bank has argued, via the chart below, that all “Asian central banks have for many years been more or less persistently in the market “stabilizing” their currencies, but with a clear bias towards preventing USD depreciation in this region”) – the Bank of Thailand would probably have no choice but to follow suit.

Otherwise, it might not be long before the Baht clears 30 USD/THB. My next post on the Baht, in 2015, will probably be in the form of a similar lamentation…