Gold Rises as “Alternative Currency”

Everything in forex is relative, right? Actually, it turns out this adage is wrong, as there is now a way you can short the entire forex market! I’m not talking about some innovative new financial product that you’ve never heard of, but rather something that everyone already knows about: Gold.

Before you accuse me of sounding like an infomercial, consider that while gold has been an investable commodity for quite some time, its trading pattern has changed recently, especially in the context of forex. Before, the link between gold and forex was inverse and clear: “When the greenback strengthens…this tends to pressure gold since it reduces the need to buy as a hedge against a soft dollar. Also, a strengthening dollar makes commodities generally more expensive in other currencies.” In other words, a rising Dollar is usually accompanied by falling gold prices, and vice versa.

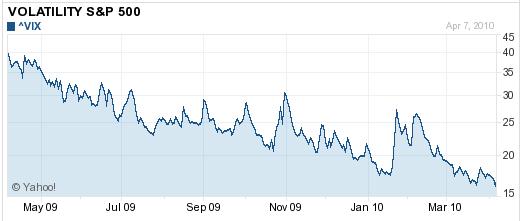

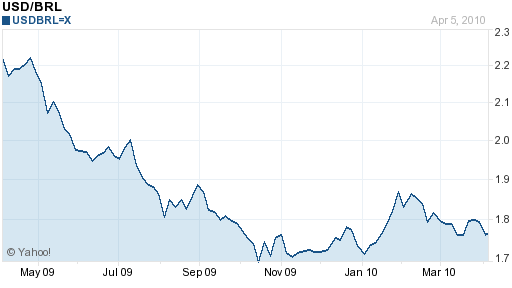

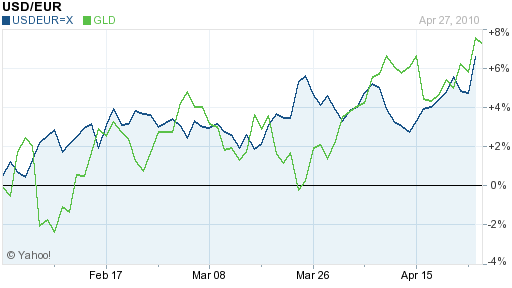

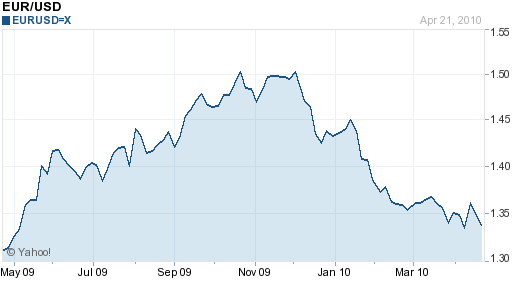

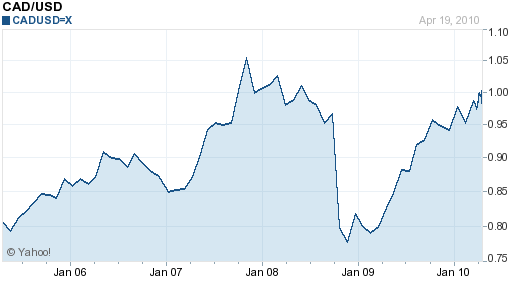

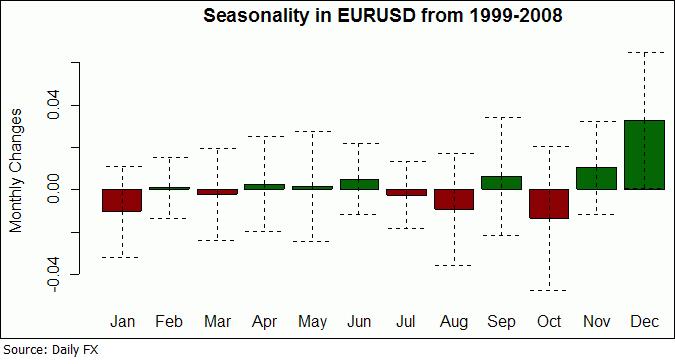

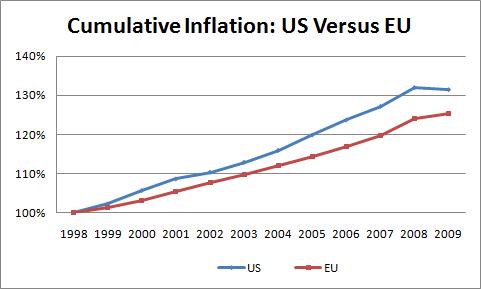

Over the course of 2010, this relationship has steadily grown weaker and weaker, and in the last month, it has almost completely broken down. To understand the rationale for such a change, one needs not to look any further than the sovereign debt crisis currently facing Greece and indirectly, the Eurozone. This crisis has affected the way that investors think about gold; while previously it was primarily viewed as an inflation hedge, now it is seen as a hedge against fiscal/financial crisis. In this regard, it has assumed the characteristics of a “safe haven” currency, much like the US Dollar.

“Gold is going to move higher regardless of what happens in the currency market, as long as there are fears of problems in Europe. People are starting to have more skepticism to a lot of these sovereign entities,” explained one analyst. At the moment, that means that the inverse correlation between the Dollar and Gold (Dollar Up = Gold Down) appears to have reversed itself, such that a rising Dollar is also accompanied by rising gold. In this case, there may be correlation (since investors are buying both gold AND the Dollar as safe haven vehicles) but there is no causation between the two as there was before.

At the moment, the correct interpretation is that anything is preferable to the Euro (whose sovereign debt problems are the most pressing). Thus, gold prices are rising at basically the same rate as the Euro as falling, and gold prices in local currency (EUR, CHF, GBP) terms are already at record levels.

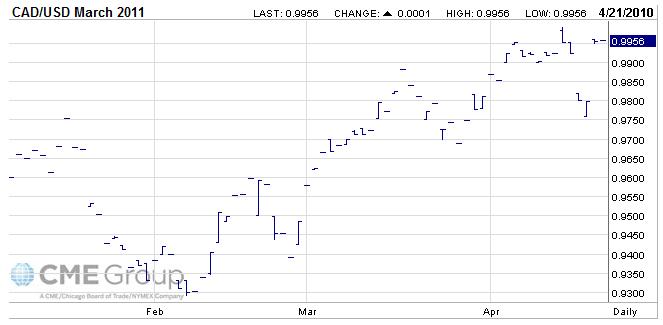

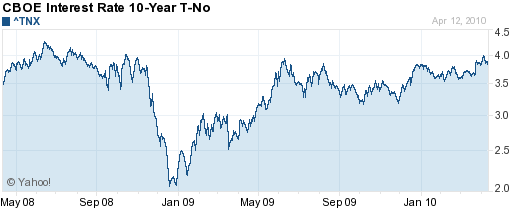

As for the future, however, many are betting that gold will distance itself from the Dollar as well, if/when the fiscal “problems” of the US escalate to the level of a Greek-style crisis. At this point, Gold will start to trade as an alternative to the entire forex market! In fact, gold contracts denominated in US Dollars have also been rising, which means that investors already perceive it as more than just an alternative to the Euro. (If this was the case, one would expect gold to appreciate in terms of Euros, but to remain constant or even fall when priced in Dollars. This clearly hasn’t happened).

Admittedly, gold is outside of my expertise, so I’ll refrain from personally making any predictions. According to Deutsche Bank, “If the correlation re-establishes itself before July, either the dollar must continue to decline or investment into bullion-backed funds must pick up in order to avoid erosion in gold prices.”

Regardless of what happens, my intention here is simply to point out the emergence of this trend, for its own sake. While it doesn’t have any serious implications about the internal dynamics of forex markets, it most certainly is important insofar as it reflects what investors (forex and otherwise) are generally thinking about. In this case, it signals that concern over the ongoing sovereign debt crisis isn’t going to abate anytime soon.

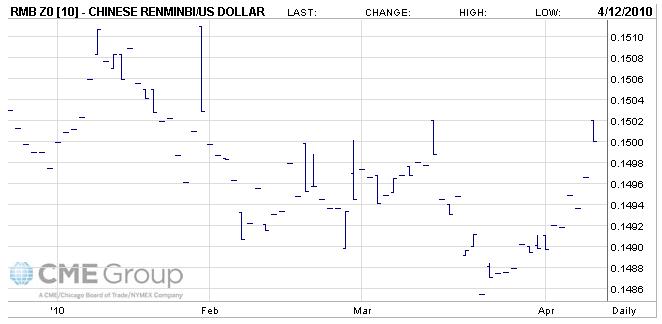

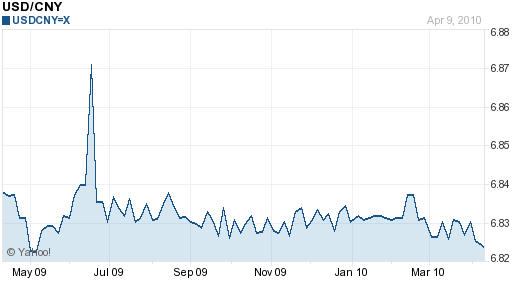

On the surface, it looks like President Obama deserves much of the credit for the sudden capitulation by China. From tire tariffs to a meeting with the Dalai Lama, he signaled that he was willing to play hard ball. As Senator Charles Schumer, one of the most vocal critics of China’s forex policy, said recently, “

On the surface, it looks like President Obama deserves much of the credit for the sudden capitulation by China. From tire tariffs to a meeting with the Dalai Lama, he signaled that he was willing to play hard ball. As Senator Charles Schumer, one of the most vocal critics of China’s forex policy, said recently, “