Competition Heats Up in Retail Forex

The last few weeks have witnessed a number of major developments in the retail forex world: more mainstream firms entering the fold, and existing firms are moving to beef up their forex operations. Not only will this permanently alter the competitive landscape, but it should also benefit traders in the form of more choice, lower prices, and increased transparency.

The Wall Street Journal was first to report that Charles Schwab is in the early stages of introducing forex to the array of financial products available to its customer base: “Schwab, the largest online broker, disclosed in a slide presented at its recent winter business update that it was ‘analyzing the forex opportunity’ in 2011.” Unbeknownst to me, TD Ameritrade made a stealthy entry into forex in 2009, though its purchase of ThinkorSwim. Ameritrade offers more than 100 currency pairs (and its trading platform even has information on the Netherlands Guilder!), and currency and futures trading now accounts for 6% of its volume. E-Trade (which rounds out the “Big 3” online discount brokers) currently enables customers to convert their unused account balances into five major currencies, but has yet to roll out a platform for trading currencies in real-time.

Some of the impetus is apparently coming from FXCM, which went public in 2010 and is aggressively marketing its trading platform to brokers which don’t specialize in forex. Given the surging volume and healthy spreads in forex, its probably not difficult to sell its appeal. Online brokers have also acknowledged that the majority of its profits are generated by a minority of its customers. Given that most currency traders tend towards being extremely active, it won’t be long before they are courted by traditional brokers.

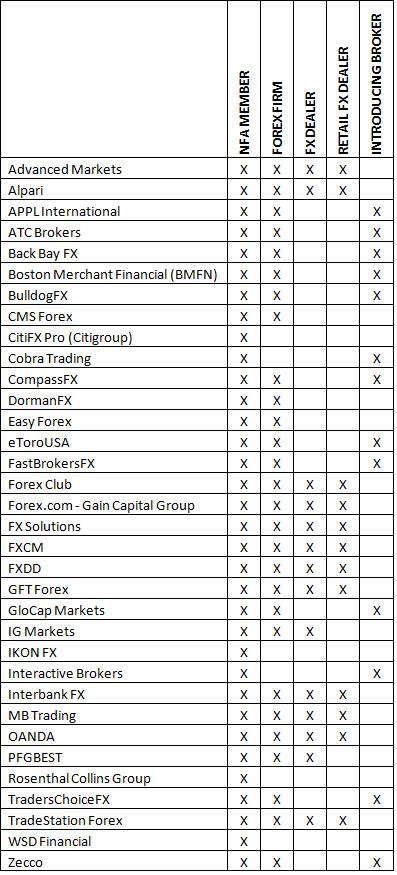

As LeapRate pointed out in a recent report, what we are witnessing is a consolidation and mainstreaming of retail forex.In 2010, the US Commodity Future Trading Commission (CFTC) moved to bring retail forex out of the shadows and under its regulatory umbrella. New rules raised registered capital requirements, lowered leverage ratios, and generally increased the amount of scrutiny applied to brokers. This forced smaller players to either merge, move overseas, or quit the retail forex business. It also galvanized the major brokers, in the form of two Initial Public Offerings (IPOs), capital infusions, and a blitz of advertising. This week, CitiFX introduced a new forex pricing structure, major currency spreads to under 2 pips for its favored customers. TradeStation Forex also announced plans “to launch and offer exclusively the company’s new forex brokerage offering beginning later this quarter.”

In the next few years, I think we will witness further consolidation, with ~10 brokers accounting for the majority of retail forex trading volume. Online discount brokers may also establish themselves as a major force, luring customers through the strength of their brands and the accompanying guarantee of transparency, as well the ability to trade different types of securities using a single, integrated platform. Spreads will continue to fall for the major currencies, and even for some of the exotics. In fact, it probably won’t be long before retail forex becomes completely commoditized, and it loses its novelty.