Dubai and the Dollar

The big story of the week was the announcement by Dubai World, the investment arm of Dubai, that it is having trouble making payments on nearly $60 Billion. The funds were borrowed for various large-scale projects, ranging from man-made islands to massive hotels and skyscrapers, many of which are hemorrhaging money in the wake of the real estate crisis.

This announcement has implications both for the direct stakeholders in Dubai as well as for investors, generally. Dubai World’s bondholders were taken aback by its financial troubles, as well as by the suggestion of the United Arab Emirates that it would not come to the rescue. Apparently, it had always been assumed that oil-poor Dubai would be bailed out by its oil-rich neighbors in the event of insolvency. While it’s possible that this still applies, at the very least, investors will have to squirm/suffer a bit in the short-term. “Moody’s Investors Service and Standard & Poor’s cut the ratings on Dubai state companies yesterday, saying they may consider state-controlled Dubai World’s plan to delay debt payments a default.”

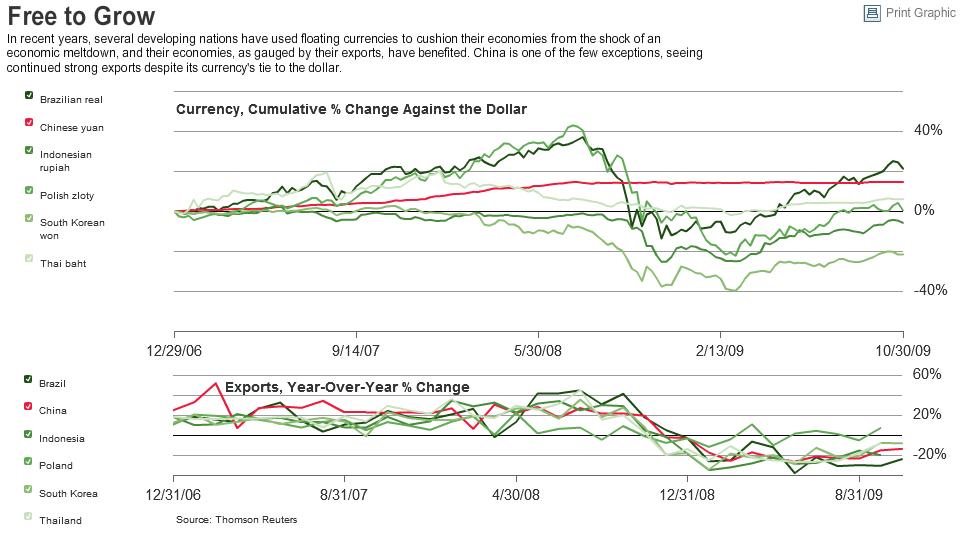

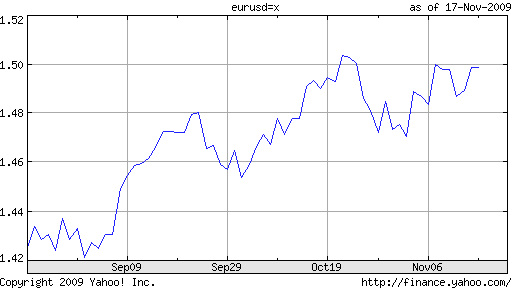

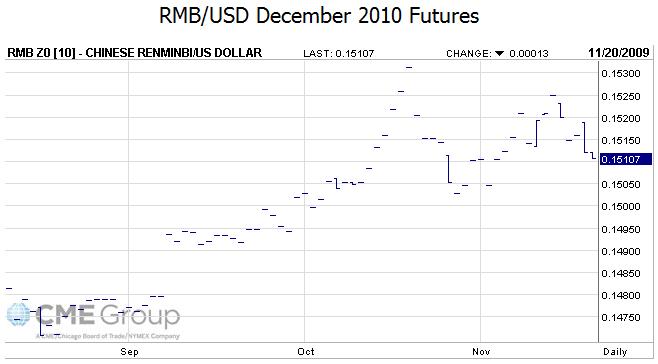

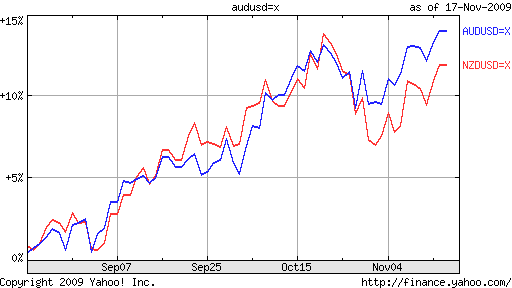

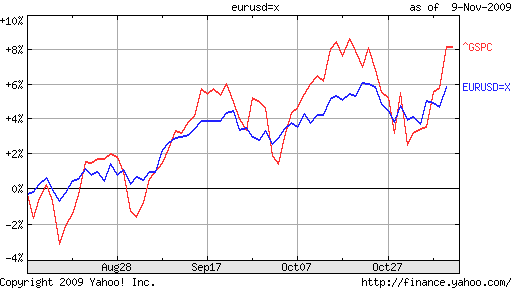

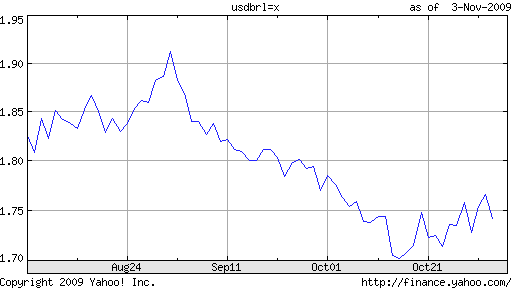

The news rattled forex markets, predictably sending “safe-haven” currencies (is anybody actually still using this term?) like the Dollar and Yen up, while sending everything else down. The reasoning is that the Dubai debt bomb could easily spread to other emerging market economies, triggering a wave of sovereign defaults and even a second credit crisis. Credit default swaps (which function as insurance against default) on emerging market bonds soared on the news, by 60% for Dubai bonds and 16% for Greece, for example. The situation has been likened to the defaults of Russia in 1998 of Argentina in 2002, both of which massively destabilized global capital markets at the time. Despite the recent gains, financial markets remain shaky and a sovereign default would likely reverberate around the financial world. “It will tarnish the reputation of the Gulf region a bit, and it will certainly make investors more bearish again about emerging markets,” explained one analyst.

At the same time, there are reasons to believe that this incident, should it erupt into a full-blown crisis, can easily be contained. For one thing, the situation in Dubai is unique. While many governments and institutions borrowed heavily during the height of the bubble, few came close to matching the scale and audacity of Dubai. In addition, Dubai doesn’t have any natural resources that it can fall back on during the ongoing recession; its pillar industries of tourism and finance were damaged heavily by the credit crisis, and it will be a while before they recover.

At the same time, some investors have been looking for a chance to “take profits” as the end of the year approaches and concerns mount that new bubbles might be forming in certain sectors of the market. “The news seems to have rattled a market already skeptical about the sharp rise in share prices in recent months. Financial instability in Vietnam and widening bond spreads in Greece and Spain have revived concerns that the global financial system is overleveraged.” Added another market observer: “This may be the trigger to allow for the market to take a rest and pull back. I felt that there would be a significant correction in what is an ongoing bull market.”

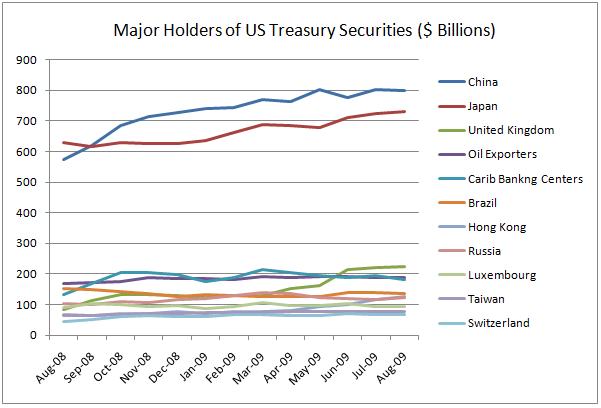

In the end, it’s hard to assess how significant this Dubai crisis actually is. As one analyst pointed out, the exposure of financial institutions to the UAE “is a negligible 0.4 percent of foreign banks’ total cross-border exposure.” Moreover, there’s not much of a connection between Dubai and China and Brazil, the latter of which largely escaped the economic downturn and have been two of the hottest performing economies over the last year. Still, with the end of the year approaching, investors will probably take this opportunity to book some of their profits so they can make a fresh start in 2010, which means December could see a small rally in the Dollar. For what it’s worth, that’s where my money is.