British Pound “Pauses for Breath” [Part 2 of 2]

By coincidence, today’s release of final GDP data confirms – rather than negates – the economic picture that I painted yesterday. “The economy slumped a downwardly revised 2.4% in the first quarter, which was narrowly the largest decline since the second quarter of 1958. The annual decline in output was 4.9%, the largest since records began in 1948.” The news didn’t affect the Pound, given that it refers to a period that ended a few months ago. At the same time, it revealed the seriousness of UK economic troubles and the depth of the hole that it must climb out of in order to achieve recovery.

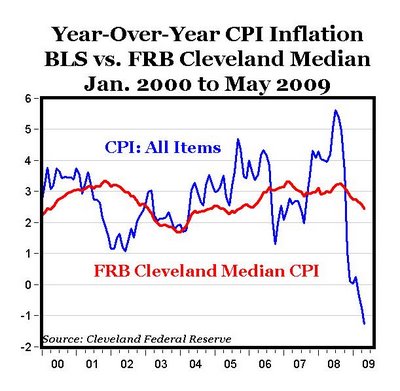

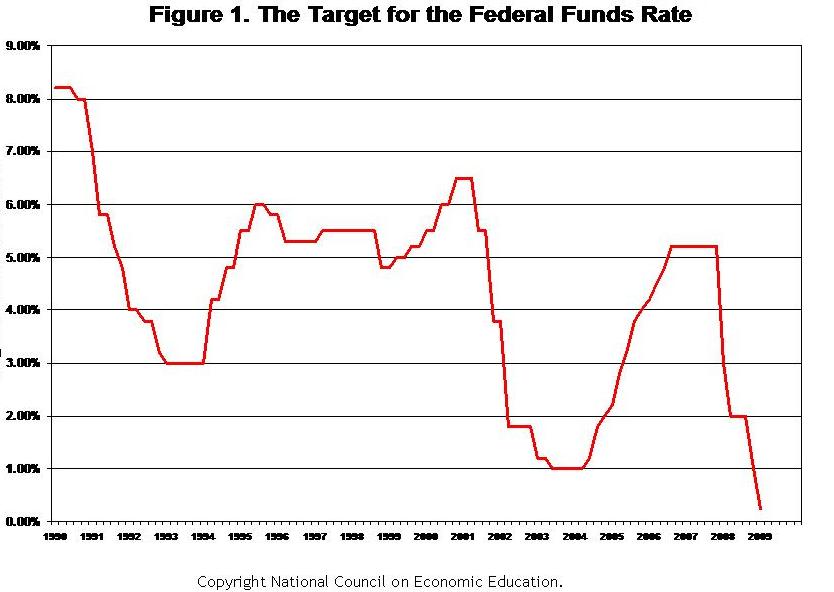

Of course, the Bank of England is doing its part to try to help the economy along: The minutes from its last meeting showed that the BOE “voted unanimously to keep interest rates at a record low of 0.5 percent and maintain its 125 billion pound quantitative easing programme, minutes showed on Wednesday.” Experts reckon that the BOE will probably continue to keep rates low. Unemployment remains high and output will likely remain well below its potential well into any economic recovery. One analyst argues, “Even if the recession is now over, inflation could keep falling until mid-2011. Which means that it should be below its 2 per cent target in late 2011 and early 2012. Because Bank rate is set with regard to where inflation will be in two years time – as it takes that long for monetary policy to significantly affect prices – this points to rates staying low for at least a few more months.”

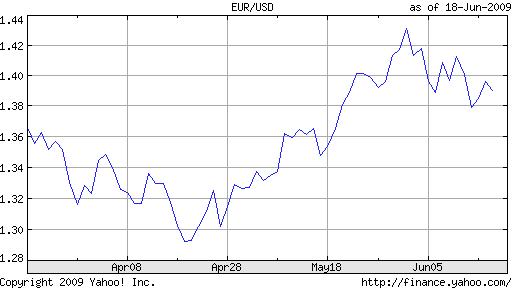

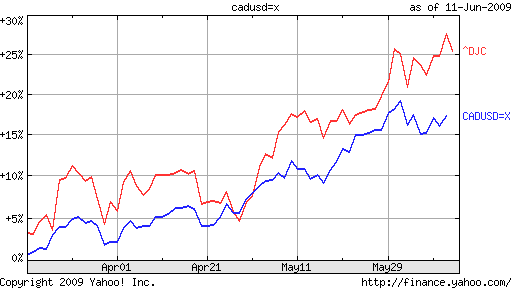

But the Bank’s rate cuts are being offset by the Pound’s recent 15% rise- its strongest quarterly performance in over 20 years. Based on some models, such a dramatic rise is equivalent in force to a 4% hike in interest rates. The quantitative easing program is also beset with problems, namely that 50% of the newly printed money has been used to purchase assets/bonds from foreign investors, which are more likely to take the money out of the British economy.

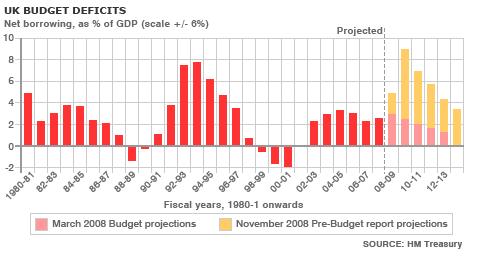

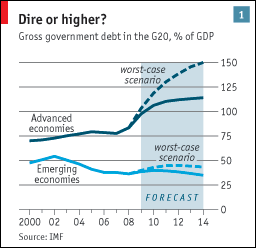

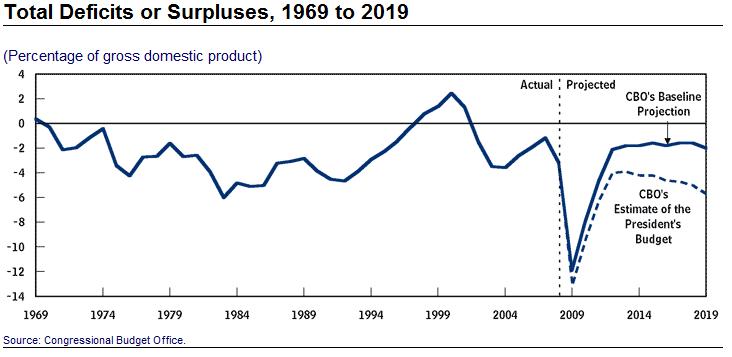

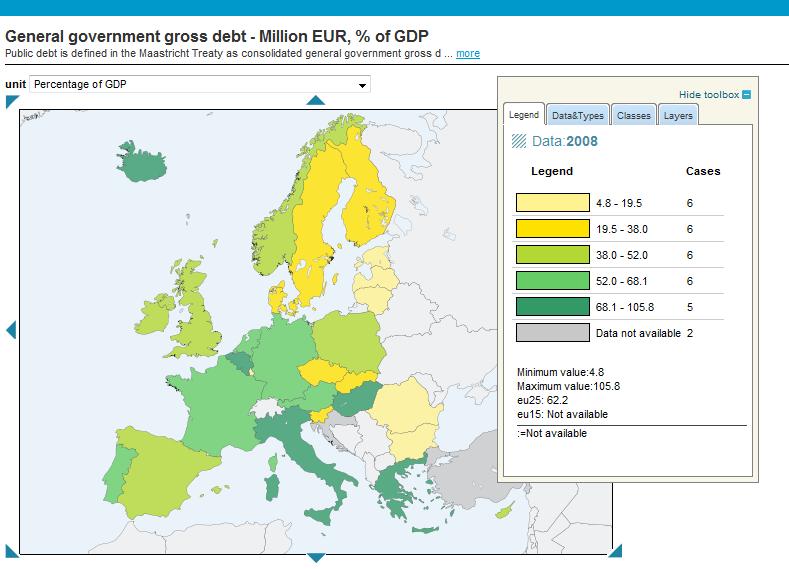

The government, meanwhile, is probably out of options, and may have to even unwind some of its fiscal stimulus due to lack of funds. In fact, the “deterioration in the U.K.’s public finances…prompted Standard & Poor’s to warn on May 21 that the country could lose its AAA debt rating. The firm estimated the cost of propping up Britain’s banks at 100 billion pounds ($166 billion) to 145 billion pounds and said government debts could double to almost 100 percent of gross domestic product by 2013.” The budget deficit in 2009 alone could surpass 15%.

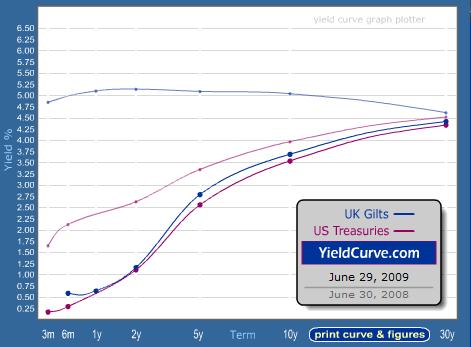

In short, there is potentially more downside than upside to these efforts, especially as far as the Pound is concerned. The BOE’s easy money policy makes the Pound an unattractive buy in the short term, while its QE program could stoke inflation in the long-term, without much benefit to the economy. Furthermore, it will be difficult to rein in this program because of the perennial budget deficits of the government, which “must sell about 900 billion pounds of gilts over five years…The Bank of England will buy a third of these gilts.” The recent rise in government bond yields as well as the rising cost of bond insurance (i.e. credit default swap premiums) confirm that investors are growing increasingly nervous. According to a Harvard University historian, “The probability of a real sterling crisis is around one in three.”

In short, there is potentially more downside than upside to these efforts, especially as far as the Pound is concerned. The BOE’s easy money policy makes the Pound an unattractive buy in the short term, while its QE program could stoke inflation in the long-term, without much benefit to the economy. Furthermore, it will be difficult to rein in this program because of the perennial budget deficits of the government, which “must sell about 900 billion pounds of gilts over five years…The Bank of England will buy a third of these gilts.” The recent rise in government bond yields as well as the rising cost of bond insurance (i.e. credit default swap premiums) confirm that investors are growing increasingly nervous. According to a Harvard University historian, “The probability of a real sterling crisis is around one in three.”

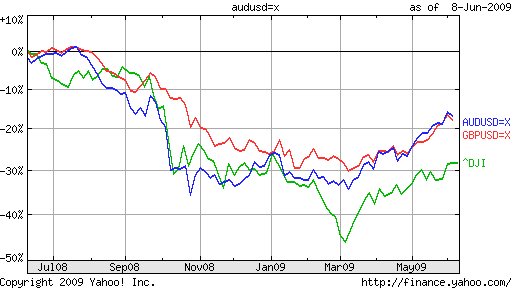

Still, there are optimists. Says one analyst, “The U.K. economy’s heavy dependence on the finance sector, recently seen as a big flaw, has also turned into a benefit. ‘Sterling is basically a bet on global financial well-being.’ ” Also, “Foreign demand for gilts rose to an all-time high in the first quarter of this year as concern the world economy would stay mired in a recession drove investors to the relative safety of government securities.” But these notions are somewhat contradictory. When you map these ideas against the backdrop of the Pound, you can see that is benefited primarily from the perception of recovery- not from the safe-haven perception.

These optimists believe the Pound will rise as high as $1.80 against the USD and €1.40 against the Euro. Under the best-case scenario, quantitative easing and government spending will trickle down to the bedrock of the economy, and will be unwound immediately after the economy enters a recovery period so as not to spur inflation. Under the worst-case scenario, though, the government will continue to run large budget deficits and fail to find enough buyers for its debt. The resulting stagflation would cause investors to rush for the exits and for the currency to collapse. In all likelihood, the actual outcome will fall somewhere in between.

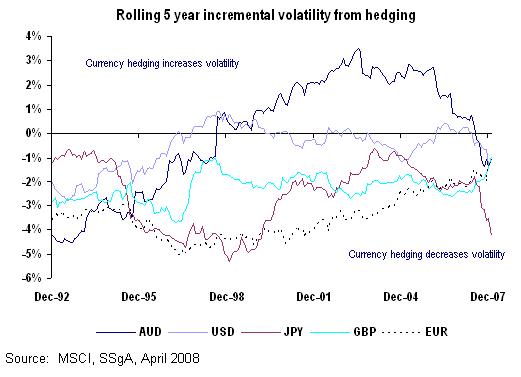

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased

Generally speaking, there are a few situations in which currency hedging is useful: international equity/bond investing, currency investing/trading, and inflation hedging. The latter typically involves using commodities/metals to hedge against inflation, which is typically proxied by the Dollar. In other words, inflation hawks might buy gold/oil to offset a declining Dollar. This dynamic is currently on display in commodities markets, where “Speculative money has increased

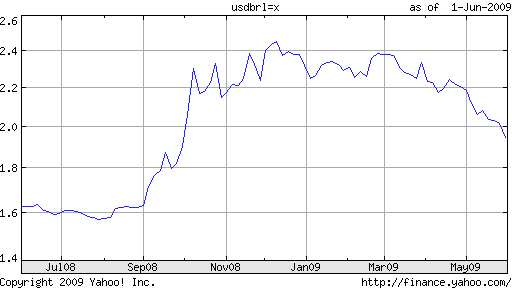

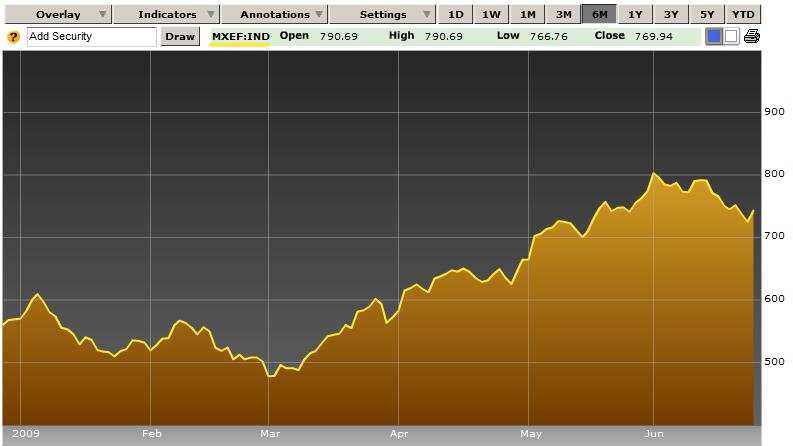

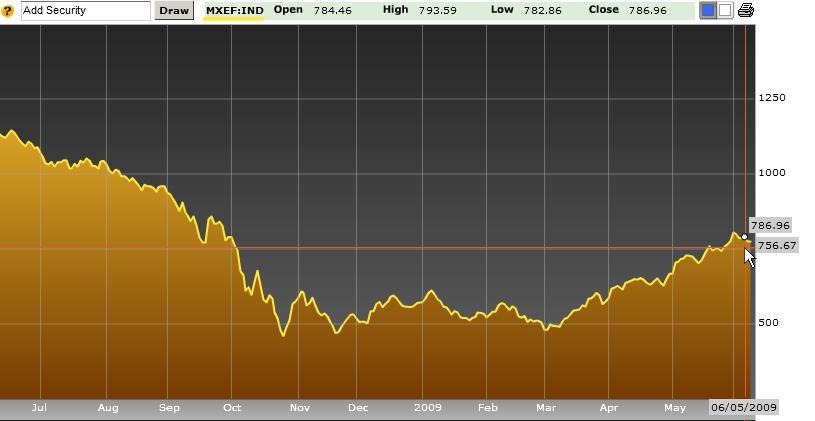

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge

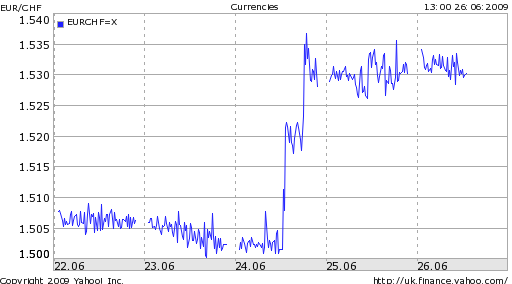

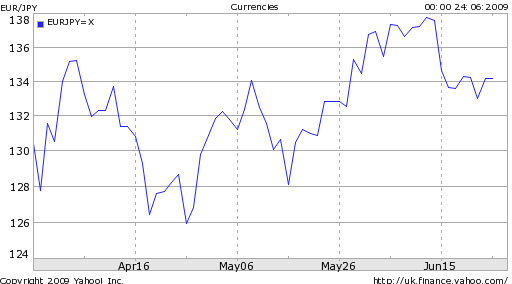

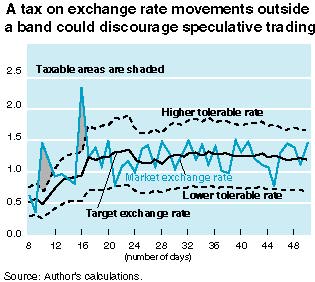

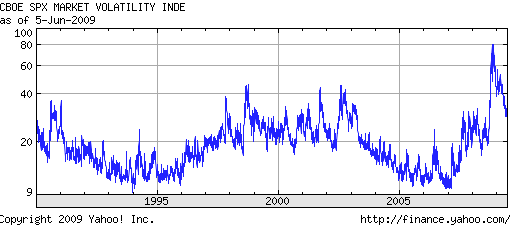

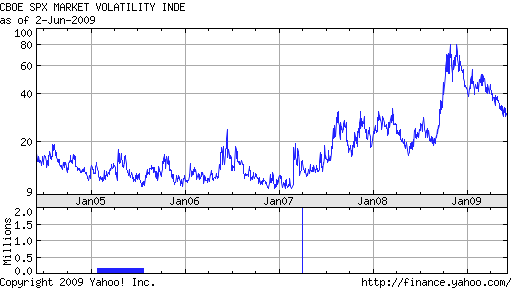

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations.

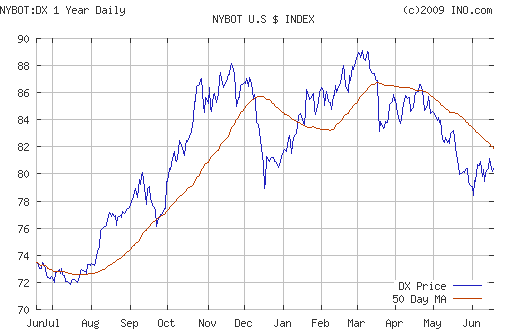

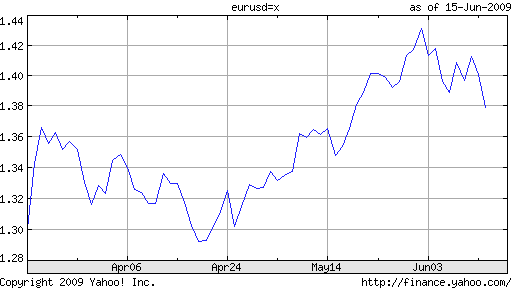

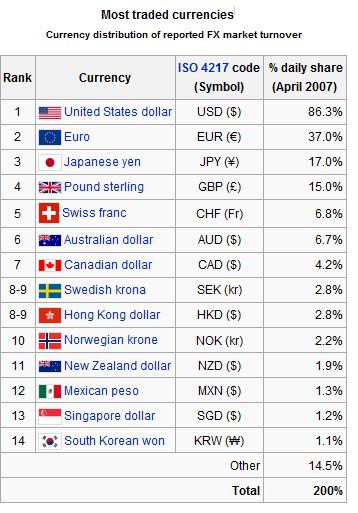

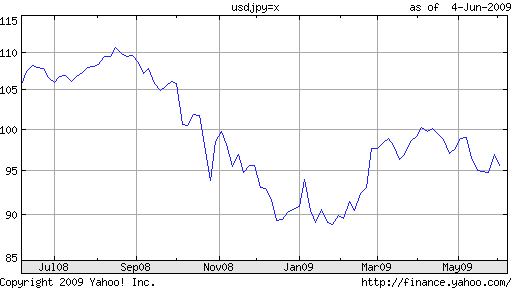

While still a fringe idea, the tax initially gained momentum following the 1997 Southeast Asian economic crisis, and has found new followers in the wake of the ongoing credit crisis. Consider the unprecedented volatility in currency markets of late, manifested in wild daily fluctuations. Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility.

Even the US Dollar, the world’s reserve currency, has been on a veritable roller coaster of late, rising and falling by 10% in a matter of months. Prior to the rise of forex speculation (already a $1 Quadrillion/year market!), it was rare for a currency to move that much in a year. Given that such speculation probably accounts for 90% of daily turnover, it seems obvious as to who is causing this volatility. Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.)

Don’t get me wrong; there’s a role for speculation in the forex markets, just like there’s a role for speculation in all securities markets. When markets function efficiently and players act rationally, currences should and will reflect economic fundamentals and act to minimize global imbalances. Due to the rise of the carry trade and the herd mentality, however, the oppose often obtains in practice. This can cause currency runs and or artificially inflated currencies that compel Central Banks to act counter to the way they otherwise would (i.e. by raising interest rates rapidly to deter capital flight, crimping economic growth.)

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.

If the current rally is to be seen as “legitimate,” then perhaps the worst of the 2008-2009 recession is truly behind us, and the global financial system has been given a reprieve from a meltdown. The concern going forward then will naturally shift past the steps that governments and Central Banks are taking to fight the crisis, towards the long-term economic impact of those measures.