June 15th 2009

Politics Weigh on the Euro, but Overshadowed by Other Factors

With interest rate differentials, growth trajectories, and risk aversion weighing on (forex) markets, there’s no room in the picture for politics. I preface this post accordingly because current market dynamics are such that even the most dramatic political developments (short of the breakup of the EU) would probably be brushed aside. The long-term, however, is a different story, and investors ignore politics at their peril.

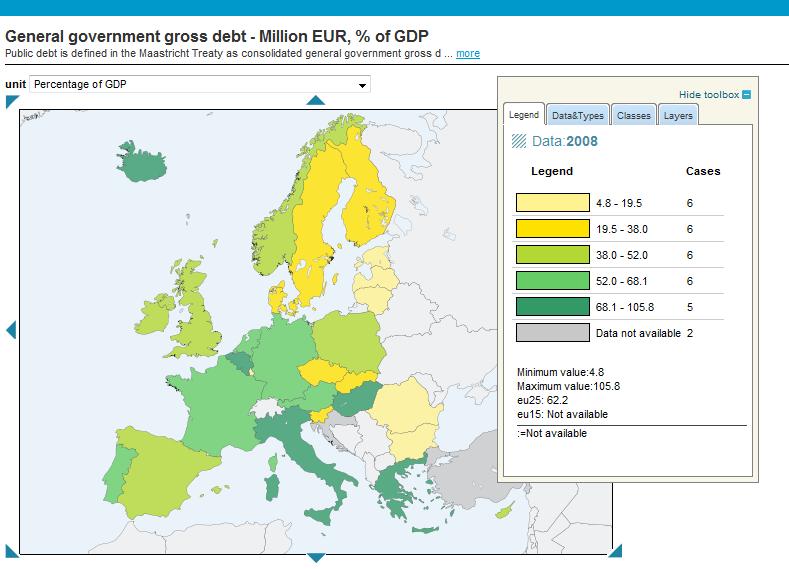

By its very nature, the Euro is perhaps most vulnerable to the vicissitudes of politics. The last week alone brought two significant developments: the downgrading of Ireland’s debt, and a crisis in Latvia. The former weighed directly in the Euro, while the latter probably didn’t have much of an effect. The reason being is that investors viewed the Irish downgrade as a possible precursor to downgrades in other EU economies. Spain and Italy, for example, are in equally precarious positions, and a 6% decline in GDP means German probably isn’t that far behind. In other words, investors may have to rethink their implicit assumption that the EU is currently less risky than the US.

But how do you square fiscal instability against monetary instability? The US is printing money, but EU member states are (marginally) more likely to go broke. Is inflation more conducive to currency devaluation that sovereign bankruptcy? Perhaps the logic is that inflation is acceptable (albeit undesirable) whereas a large-scale default would shake the global financial system to its core; this being the case, it’s probably more practical to bet on the former.

The crisis in Latvia, meanwhile, came in the form of sudden pressure on currency to devalue its currency (known as the Lats), which is pegged to the Euro. The crisis only affects the Euro indirectly vis-a-vis the currency peg and any exposure that European investors have to Latvia. Thus, the Euro wouldn’t drop much as a result of a Latvian currency devaluation, even though the consensus is that such would be “bad” for everyone. For example, it would “trigger a wave of bankruptcies because 80 percent of private borrowing is in euros.”

The crisis is mainly relevant in that it has turned into a framing point for the future of the Euro, which Latvia is slated to join in 2012. “Euro zone entry would recede since the country would have to restart from scratch in the EU’s Exchange Rate Mechanism (ERM) with higher inflation and a bigger budget deficit.” Given that the EU is already slightly unstable (see above for example), why would it want to bring even more unstable economies into the fold of the Euro?

“There is some suspicion that Germany, the EU’s central economy, may want to slow down euro zone enlargement to preserve stability for existing members and perpetuate its orthodox influence over European Central Bank decision-making.” Still, “The EU is a community of law. Treaty rules for joining the single currency cannot simply be torn up in a crisis to admit countries in distress.” In short, there are compelling arguments for both sides. Analysts should watch closely, as the treatment of Latvia (i.e. whether the ECB bends over backwards to help it stay on track) will show how serious the EU is about spreading membership to the rest of Europe.

June 18th, 2009 at 5:50 am

To my mind EU is not very strong community, that can break in a moment because of different self-contradictions. But at the same time you see, Euro is now moving upward…