Bank of Canada Still Mulling FX Intervention

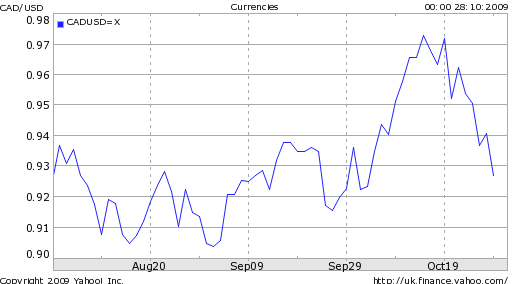

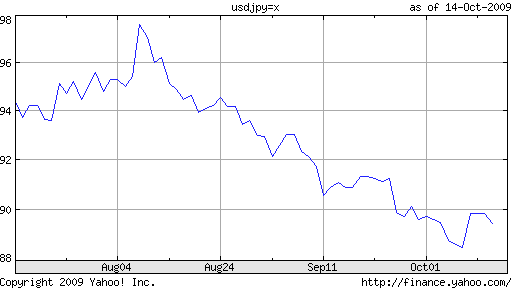

The Canadian Dollar fell from parity with the US Dollar in July 2008. For a minute, it looked as though it would return to that mark in October 2009. Alas, it was not to be, as the currency that had risen 20% since March wasn’t able to rise another 3% to close the elusive gap that would once again bring it face-to-face with the Greenback.

The Loonie’s rise was not difficult to understand. Soaring commodity prices and the fact that the economic recession was milder in Canada than in other economies drove the perception that Canada was a good place to invest. Despite a surging budget deficit and weak domestic consumption, investors bought into this notion. The weak Dollar and rising risk aversion reinforced this perception, and as investors accepted that parity was inevitable, hot money poured in and the Loonie’s rise became self-fulfilling.

That was until Mark Carney, head of the Bank of Canada, used the strongest rhetoric to-date in discussing the possibility of intervention. For the first time in this cycle, the markets took the hint, and sent the Canadian Dollar down by the largest single-day margin in months. “Markets should take seriously our determination to set policy to achieve the inflation target. Markets sometimes lose their focus, we don’t lose our focus,” he said firmly, adding that forex intervention is “always an option.”

Intervention is supported both by economic data, and other Canadian institutions. According to one estimate, every 1 cent increase in the Loonie against the Greenback costs the county $2 Billion in export revenue and 25,000 jobs. The chief economist for CIBC, meanwhile, has warned that many companies are in the process of making long-term direct investment decisions, and could be discouraged from locating in Canada because of perceptions that its currency will remain strong for the immediate future: “If the loonie is overvalued for a few years, we may be sacrificing business plant and equipment on the altar of a strong currency.” He also compared the predicament facing the Bank of Canada to that facing the Royal Bank of Switzerland, which ultimately and successfully intervened on behalf of the Franc. Intervention on behalf of the Loonie, he argued, could be undertaken under the umbrella of fighting speculation and irrational movements in currency markets.

In fact, it seems investors still are no convinced that the BOC (via Carney) means what it says. “Mark Carney has raised the prospect of intervening in currency markets, but seems reluctant to actually do so,” argued one analyst. “I don’t think they would really like to intervene at all, and they would prefer avoiding it. If they can intervene by jaw boning, they would much rather do that,” added another.

Why did the Loonie fall suddenly then, if the markets still aren’t concerned about intervention? The answer is that they have seen the concrete impact of the expensive Loonie on the Canadian economy. In the words of one analyst, it has moved from being a threat to a bona fide impediment. Especially given the stall in the commodity price rally, investors apparently are willing to acknowledge that they may have gotten ahead of themselves and that parity with the Dollar is not yet justified by fundamentals. Meanwhile, Canadian interest rates are at a comparable level with US rates, which means foreign investors can’t earn a yield spread from investing in Canada. This is likely to be the case for a while, as the valuable Loonie has kept inflation in check and given the BOC some flexibility in tightening its monetary policy.

Personally, I don’t think the BOC will ultimately intervene. Investors have shown that they aren’t afraid of the BOC, which would make any intervention both expensive and unfruitful. In addition, I think investors have accepted their own accesses, and will hesitate to push the Loonie much higher (or past parity, for that matter) until there is more evidence that such is justified. In the meantime, expect the Loonie to hover in the 90’s and perhaps even test parity, before smashing through when the time is right. And this, I do believe, is inevitable.

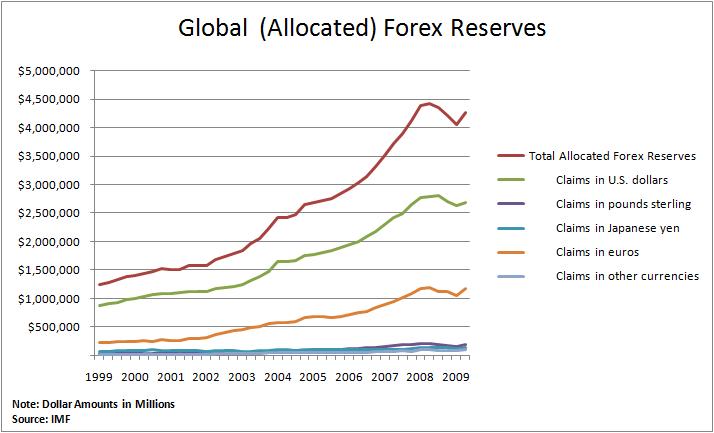

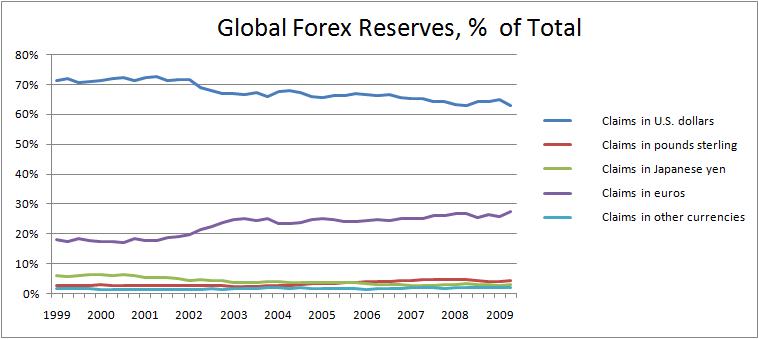

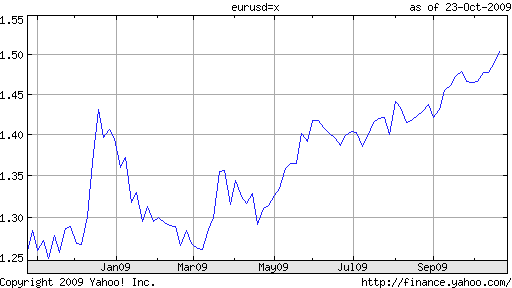

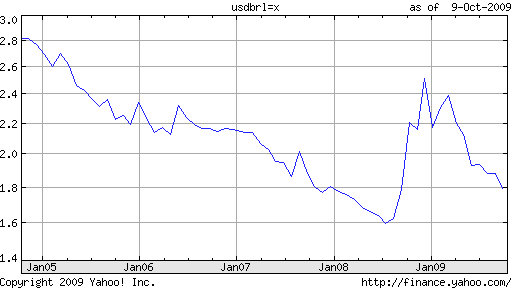

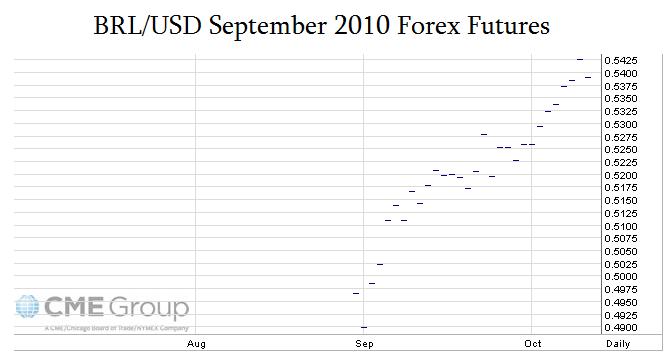

A theme in forex markets (as well as on the Forex Blog) is that as the Dollar has declined, virtually every other asset/currency has risen. The rationale for this phenomenon is that the global economic recovery is boosting risk appetite, such that investors are now comfortable looking outside the US for yield. However, this market snapshot may have to be tweaked slightly, in accordance with a recent WSJ article (

A theme in forex markets (as well as on the Forex Blog) is that as the Dollar has declined, virtually every other asset/currency has risen. The rationale for this phenomenon is that the global economic recovery is boosting risk appetite, such that investors are now comfortable looking outside the US for yield. However, this market snapshot may have to be tweaked slightly, in accordance with a recent WSJ article (