Aussie is Breaking Away from Kiwi

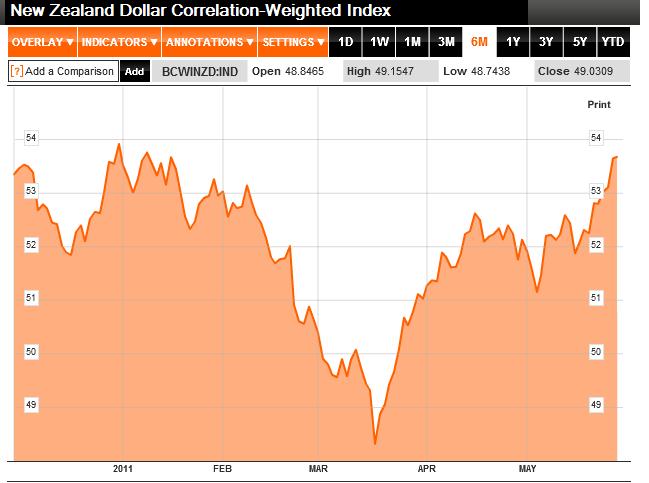

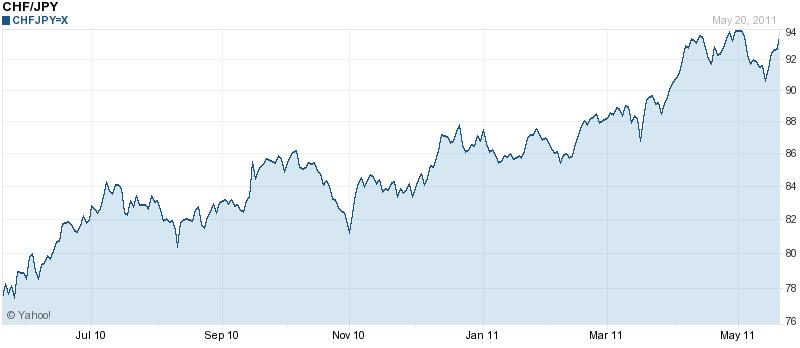

The correlation between the Australian Dollar and New Zealand Dollar is among the strongest that exists between two currencies. Given their regional bond and similar dependence on commodities to drive economic growth, perhaps this is no wonder. Over the last year, however, the Aussie has slowly broken away from the Kiwi. While the correlation between the two remains strong, the emergence of distinct narratives has given rise to a clear chasm, which can be seen in the chart below. Given that the NZD is evidently among the most overvalued currencies in the world, does that mean the same can be said about the AUD?

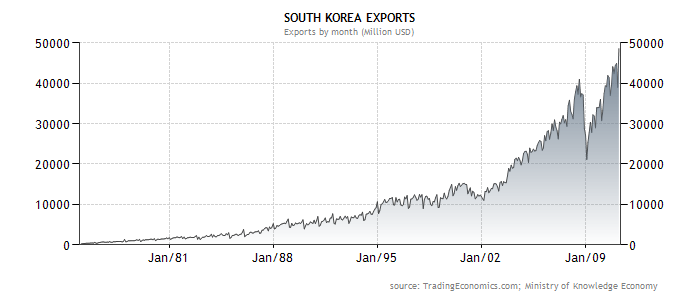

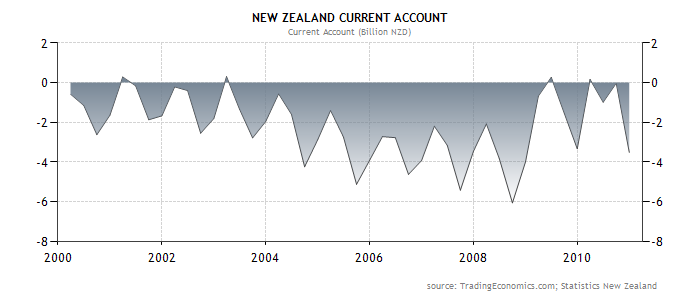

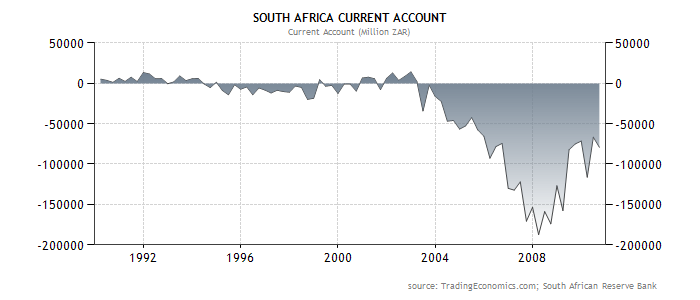

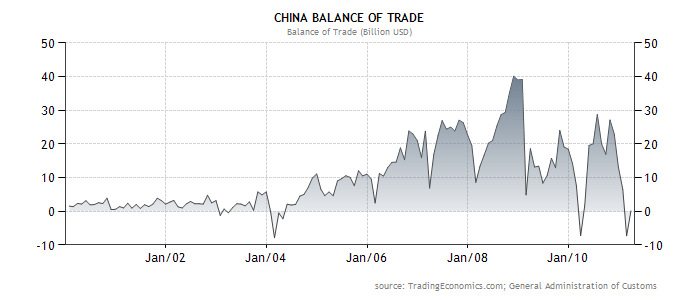

Alas, geographic proximity aside, the two economies have very little in common. Australia is rich in coal, precious metals and other natural resources , while New Zealand produces and export primarily agricultural products. Granted, the prices for both types of commodities have exploded over the last decade (and especially the last year), but let’s be clear about the distinction. This has enabled both economies to achieve trade surpluses, but oddly current account deficits. Australia’s economy is projected to grow by more than 4% in 2011, compared to 2% in New Zealand. Australia’s benchmark interest rate is also higher, its capital markets are deeper, and the supply of its currency necessarily exceeds that of New Zealand.

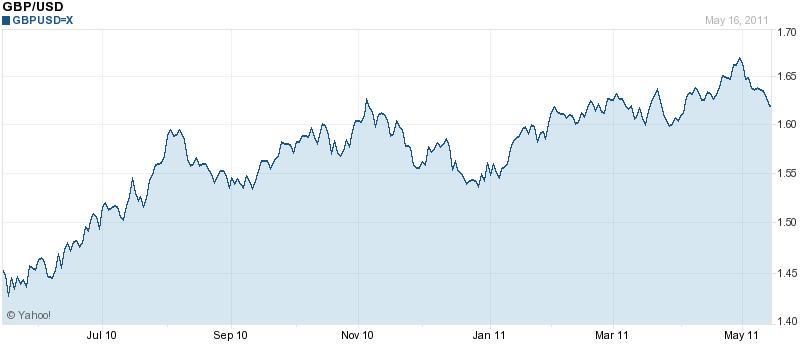

Taken at face value, then, it would seem commonsensical that the Aussie should rise both against the Kiwi and the US Dollar. Indeed, it recently touched an all-time high against the latter, and is now firmly entrenched above parity. On a trade-weighted basis, it has been among the world’s best performers over the last two years.

In fact, some are wondering (myself included), whether the Australian Dollar might have risen too much for its own good. According to OECD valuations based on purchasing power parity (ppp), the Aussie is now 38% overvalued against the dollar, behind only the Swiss Franc and Norwegian Krone. In fact, exporters of non-commodity products (i.e. those whose customers are actually price-sensitive) have warned of mounting competitive pressures, declining sales, and inevitable price cuts. In other words, the portion of the Australian economy that doesn’t deal in commodities is actually in quite fragile shape. Given that China’s economy is projected to slow over the next two years and that booming investment in Australia’s mining sector should boost output, the commodity sector of the economy might soon face similar pressures.

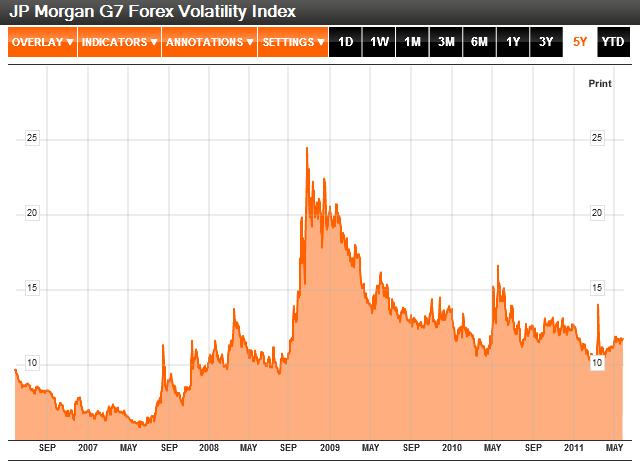

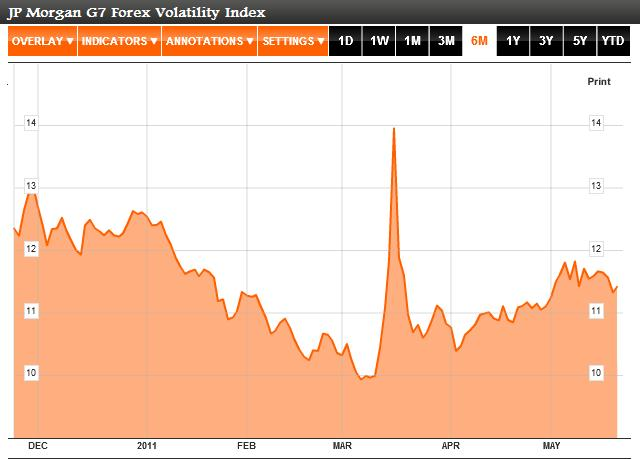

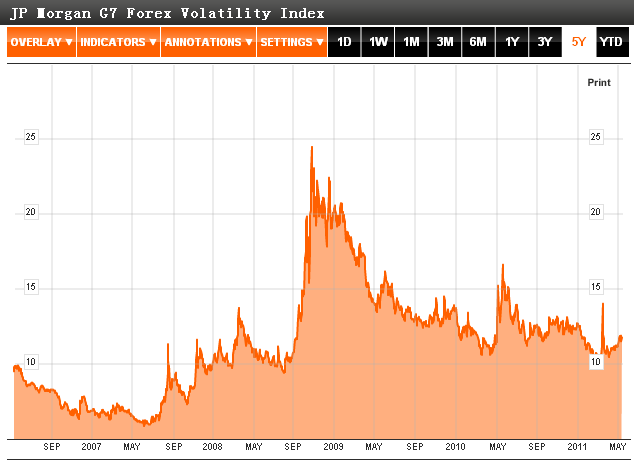

For that reason, the Reserve Bank of Australia (RBA) has avoided raising its benchmark interest rate is fast as some analysts had expected, and inflation hawks had hoped. There is a chance for a 25 basis point hike as soon as June – bring the base rate to an even 5% – but the RBA’s own statements indicate that it probably won’t be until June and July. Regardless of when the RBA tightens, Australian interest rate differentials will remain strong for the foreseeable future, and likely continue to attract speculative inflows for as long as risk appetite remains strong.

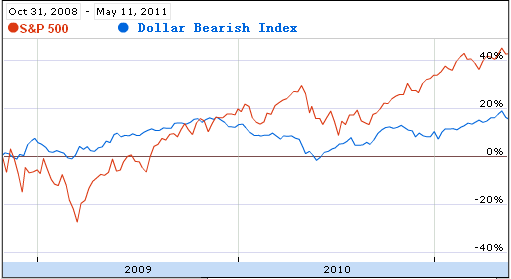

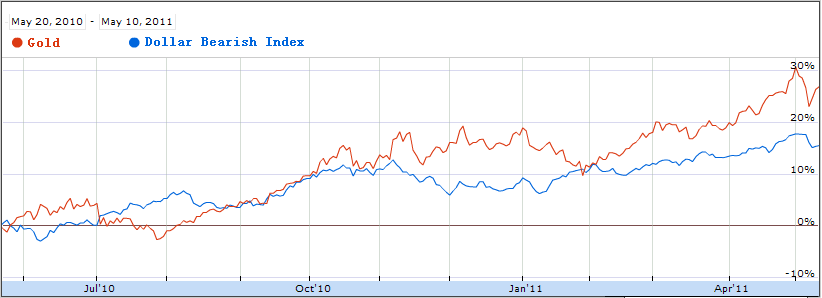

So why does the Australian dollar continue to rise? It might have something to do with gold. As you can see from the chart above, the correlation between the Aussie and gold prices is almost just as strong as the relationship between the Aussie and the Kiwi. Given that Australia is the world’s second largest gold exporter, it is perhaps unsurprising that investors would see rising gold prices as a reason for buying the Australian dollar. However, it seems equally possible that demand for both is being driven by the pickup in risk appetite. While some gold buyers might counter that gold is best suited for those who are averse to risk (i.e. afraid that the financial system will collapse), the performance of gold over the last five years suggests that in fact the opposite is true. When risk appetite is high, speculators have bought gold and the Australian dollar (among other assets).

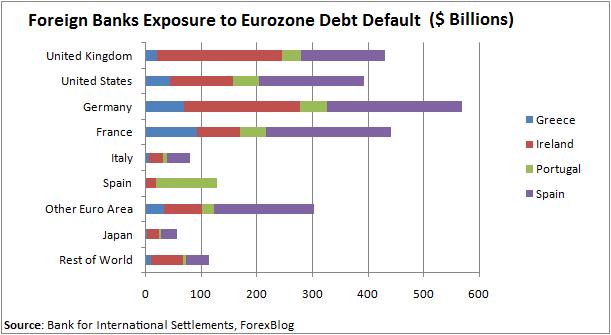

It’s unclear whether this will remain the case going forward. The Wall Street Journal recently reported that gold is increasing attracting risk-averse investment, as buyers fret about the eurozone sovereign debt crisis and other threats to the system. However, the same cannot be said about the Australian Dollar. For as long as risk is “on,” demand for the Aussie will remain intact. And if the Aussie Dollar Barometer survey – which found that “exporters expect the Australian dollar to reach a post-float record of $US1.16 by September and to remain above parity well into next year” – is any indication, risk appetite will indeed remain strong for the foreseeable future.

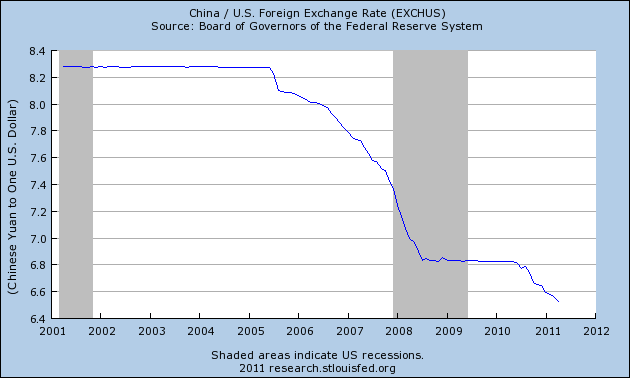

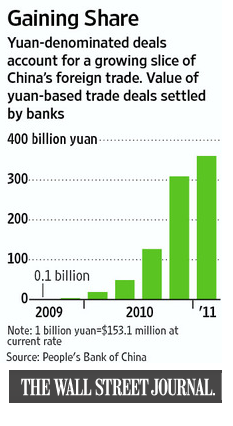

For the record, I think that the Chinese yuan is pretty close to being fairly valued. That might seem like a ridiculous claim to make when Chinese wages and prices are still well below the global average. Consider, however, that the same is true for the majority of emerging market economies, including those that don’t peg their currencies to the dollar. That doesn’t mean that the yuan won’t – or that it shouldn’t – continue to rise. In fact, the PBOC needs to do more to ensure that the Yuan appreciates evenly against all currencies, since most of the yuan’s rise to-date has taken place relative to the US Dollar. It’s merely a commentary that the PBOC is close to fulfilling the promises it has made regarding the yuan, and going forward, I think that observers should expect that its forex policy will be reconfigured to promote domestic macroeconomic policy objectives.

For the record, I think that the Chinese yuan is pretty close to being fairly valued. That might seem like a ridiculous claim to make when Chinese wages and prices are still well below the global average. Consider, however, that the same is true for the majority of emerging market economies, including those that don’t peg their currencies to the dollar. That doesn’t mean that the yuan won’t – or that it shouldn’t – continue to rise. In fact, the PBOC needs to do more to ensure that the Yuan appreciates evenly against all currencies, since most of the yuan’s rise to-date has taken place relative to the US Dollar. It’s merely a commentary that the PBOC is close to fulfilling the promises it has made regarding the yuan, and going forward, I think that observers should expect that its forex policy will be reconfigured to promote domestic macroeconomic policy objectives.