November 2nd 2010

Currency Wars: Will Everyone Please Stop Whining!

I read a provocative piece the other day by Michael Hudson (“Why the U.S. Has Launched a New Financial World War — and How the Rest of the World Will Fight Back“), in which he argued that the ongoing currency wars are the fault of the US. Below, I’ll explain why he’s both right and wrong, and why he (and everyone else) should shut up and stop complaining.

It has become almost cliche to argue that the US, as the world’s lone hegemonic power, is also the world’s military bully. Hudson takes this argument one step further by accusing the US of using the Dollar as a basis for conducting “financial warfare.” Basically, the US Federal Reserve Bank’s Quantitative Easing and related monetary expansion programs create massive amounts of currency, the majority of which are exported to emerging market countries in the form of loans and investments. This puts upward pressure on their currencies, and rewards foreign speculators at the expense of domestic exporters.

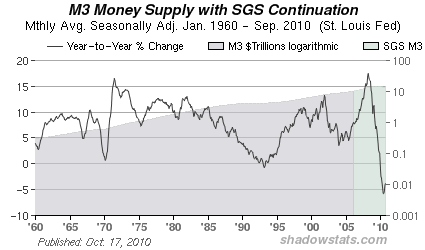

Hudson is right that the majority of newly printed money has indeed been shifted to emerging markets, where the best returns and greatest potential for appreciation lies. Simply, the current economic and investing climate in the US is not as strong as in emerging markets. Indeed, this is why the (first) Quantitative Easing (QE) program was not very successful, and why the Fed has proposed a second round. While there is a bit of a chicken-and-egg conundrum (does economic growth drive investing, or do investors drive economic growth?) here, current capital flow trends suggest that any additional quantitative easing will also be felt primarily in emerging markets, rather than in the US. Not to mention that the US money supply has expanded at the same pace (or even slower) as the US economy over the long-term.

While the point about QE being ineffective is well-taken, Hudson completely ignores the strong case to be made for investing in emerging markets. He dismissively refers to all such investing as “extractive, not productive,” without bothering to contemplate why investors have instinctively started to prefer emerging markets to industrialized markets. As I said, emerging market economies are individually and collectively more robust, with faster growth and lower-debt than their industrialized counterparts. Calling such investing predatory represents a lack of understanding of the forces behind it.

Hudson also overlooks the role that emerging markets play in this system. The fact that speculative capital continues to pour into emerging markets despite the 30% currency appreciation that has already taken place and the asset bubbles that may be forming in their financial markets suggests that their assets and currencies are still undervalued. That’s not to say that the markets are perfect (the financial crisis proved the contrary), but rather that speculators believe that there is still money to be made. On the other side of the table, those that exchange emerging market currency for Dollars (and Euros and Pounds and Yen) must necessarily accept the exchange rate they are offered. In other words, the exchange rate is reasonable because it is palatable to all parties.

You can argue that this system unfairly penalizes emerging market countries, whose economies are dependent on the export sector to drive growth. What this really proves, however, is that these economies actually have no comparative advantage in the production and export of whatever goods they happen to be producing and exporting. If they can offer more than low costs and loose laws, then their export sectors will thrive in spite of currency appreciation. Look at Germany and Japan: both economies have recorded near-continuous trade surpluses for many decades in spite of the rising Euro and Yen.

The problem is that everyone benefits (in the short term) from the fundamental misalignments in currency markets. Traders like to mock purchasing power parity, but over the long-term, this is what drives exchange rates. Adjusting for taxes, laws, and other peculiarities which distinguish one economy from another, prices in countries at comparable stages of development should converge over the long-term. You can see from The Economist’s Big Mac Index that this is largely the case. As emerging market economies develop, their prices will gradually rise both absolutely (due to inflation) and relatively (when measured against other currencies).

Ultimately, the global economy (of which currency markets and exchange rates represent only one part) always operates in equilibrium. The US imports goods from China, which sterilizes the inflows in order to avoid RMB appreciation by building up a stash of US Dollars, and holding them in US Treasury Bonds. Of course, everything would be easier if China allowed the RMB to appreciate AND the US government stopped running budget deficits, but neither side is willing to make such a change. In reality, the two will probably happen simultaneously: China will gradually let the RMB rise, which will cause US interest rates to rise, which will make it more expensive and less palatable to add $1 Trillion to the National Debt every year, and will simultaneously make it more attractive to produce in the US.

Until then, politicians from every country and hack economists with their napkin drawings will continue to whine about injustice and impending economic doom.

November 3rd, 2010 at 8:32 pm

Very interesting article ! Thanks,

It reminds me an article I read in the FTfm the other day about a currency index using PPP. What are your thoughts about it? Do you think it could be a good tool to protect one from the so called currency war ? Sebgati

Link to the FT article:

http://www.ft.com/cms/s/0/e80e10c6-ddff-11df-88cc-00144feabdc0.html