May 20th 2011

G7 Leads Shift in Forex Reserves

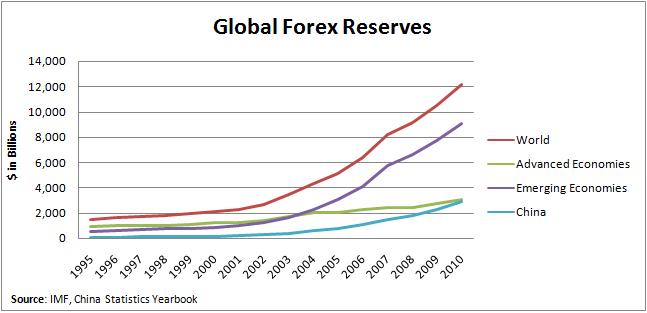

As you can see from the chart below, the world’s foreign exchange reserves (held by central banks) have undergone a veritable explosion over the last decade. While emerging markets (especially China!) have accounted for the majority of this growth, there are indications that this could soon change. China’s reserve accumulation is set to slow, while advanced economies’ reserves are set to increase.

In the past, central banks from advanced economies have accumulated reserves only sparingly, and in fact, much of this growth can be claimed by Japan. This is no mystery. While held by emerging economy central banks, most of the reserves are denominated in advanced economy currencies. This has ensured a plentiful supply of cheap capital, to support both economic expansion and perennial current account deficits (namely in the US!). In addition, advanced economy central bankers tend to hew towards economic orthodoxy, which precludes them from intervening in forex markets, and obviates the need to accumulate forex reserves. Emerging economies, on the other hand, depend principally on exports to drive growth. As a result, many are driven towards holding down their currencies in order to maintain competitiveness. China has taken this to an extreme, by exercising rigid control over the value of the Yuan, and necessitating the accumulation of $3 trillion in foreign exchange reserves.

This trend accelerated in 2010 with the inception of the so-called currency wars (which have not yet abated). Competing primarily with each other, emerging economies bought vast sums of foreign currency in order to promote economic recovery. Many countries from South America and Asia which don’t normally intervene were also drawn in. The result was a tremendous accumulation of foreign exchange reserves, which is reflected in the chart above.

There is already evidence that this phenomenon is starting to reverse itself. Consider first that advanced economies have participated in the currency wars as well. Japan’s reserves have swelled to more than $1.1 Trillion. Switzerland spent $200 Billion defending the Franc, and South Korea has spent more than $300 Billion over the last five years trying to hold down the Won. The Bank of England (BOE) recently announced plans to rebuild its reserves (the majority of which were redeployed towards gilt purchases). The European Central Bank (ECB) has announced similar plans, and may be joined by the Bank of Canada and US Federal Reserve Bank.

Advanced economies need currency reserves for a couple reasons. First of all, they can no longer rely on monetary easing to reduce their exchange rates because of the inflationary side-effects. Second, the recent coordinated intervention on Japan’s behalf showed that the G7 will move to protect its members when need be. Finally, political forces are compelling advanced economies to slow the outflow of jobs and production, and this requires more competitive exchange rates.

Emerging economies, meanwhile, are starting to recognize that unchecked reserve accumulation is neither sustainable nor desirable. First of all, managing those reserves can be tricky. Intervention is not free, and exchange rate and investment losses must be accounted for somewhere. Second, continued intervention has several detrimental byproducts, namely inflation and the handicapping of domestic industry. Finally, emerging economy currency appreciation is inevitable. Constant intervention merely forestalls the inevitable and invites unending speculation and inflows of hot-money.

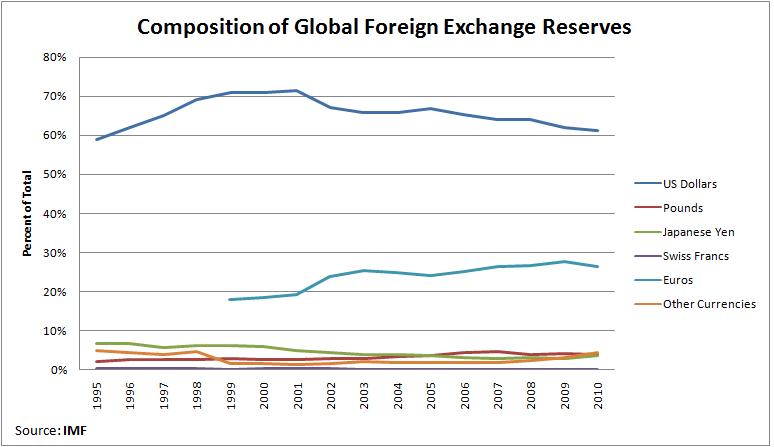

There are a few of ways that currency investors can position themselves for this change. As emerging market economies stop the accumulation of (or worse, sell off) their reserves, a major source of demand for advanced economy currency will be curtailed. This will accelerate the broad-based appreciation of emerging market currencies against their advanced economy counterparts. At the same time, I’m not sure how much reshuffling we will say in the composition of reserves. The euro is plagued by existential uncertainty, while the yen and pound have serious fiscal problems. In the short-term, the Chinese Yuan is prevented by several factors from becoming a legitimate reserve currency, namely that it is too difficult to obtain. (As soon as this changes, you can bet that emerging economy central banks will begin accumulating it. After all, they are competing with China – not with the US). The dollar is certainly also an “ugly” currency, but given the size of the US economy, the depth of its capital markets, and the liquidity with which the dollar can be traded, it will remain the go-to choice for the immediate future.

In the short-term, traders that wish to short advanced economy currencies (namely the Japanese yen) can do so in the secure knowledge that they are backstopped by the G7 central banks. It’s like you have an automatic put option that limits downside losses. If the Yen falls, you win! If the yen rises, the BOJ & G7 should step in, and at least you won’t lose!