Tide is Turning for the Aussie

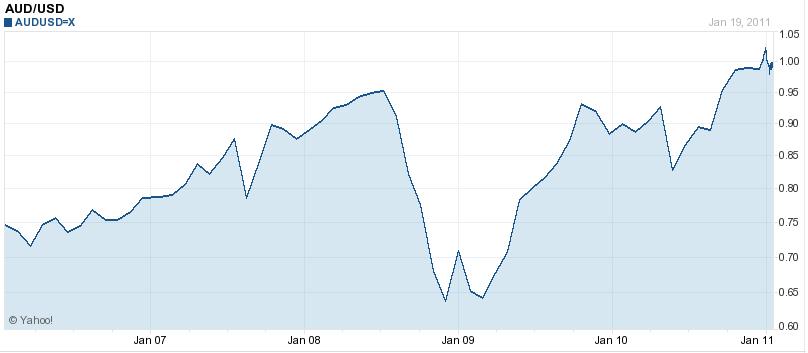

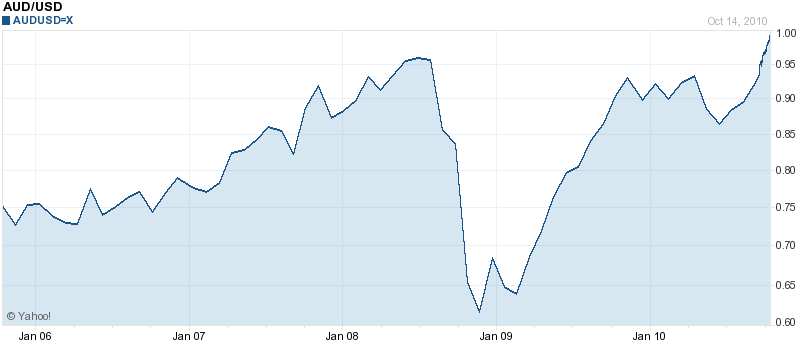

“Australia is about to enter a boom that should last decades…The Australian dollar is unlikely to go back to where it was, and manufacturing will shrink in importance to the economy, perhaps even faster than it has been.” This, according to Martin Parkinson, Treasury Minister of Australia. While 30 years from now, Mr. Parkinson’s prognosis might probe to be accurate, I’m not so sure it applies to the period 3 months from now. Here’s why:

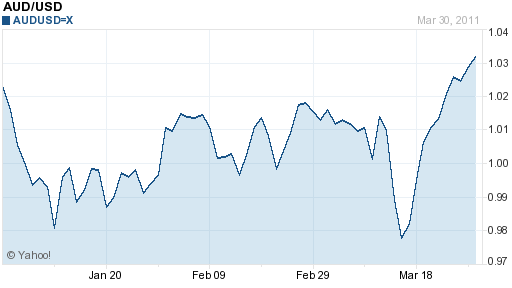

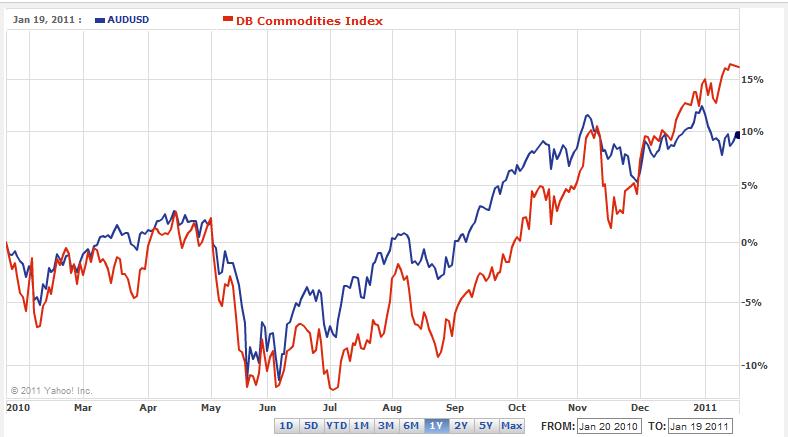

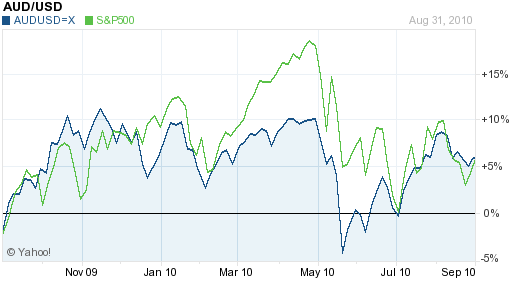

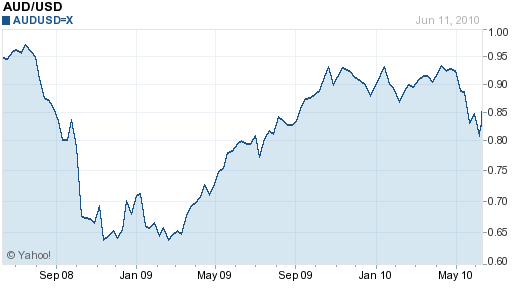

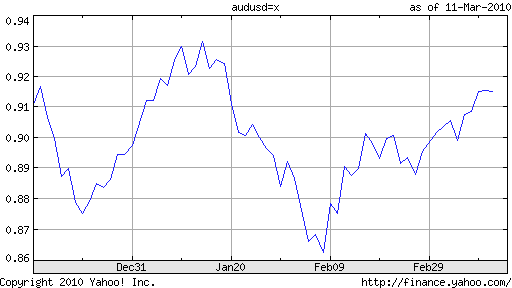

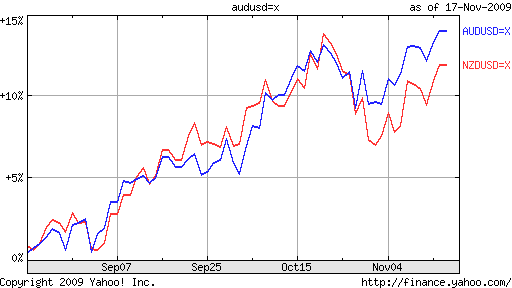

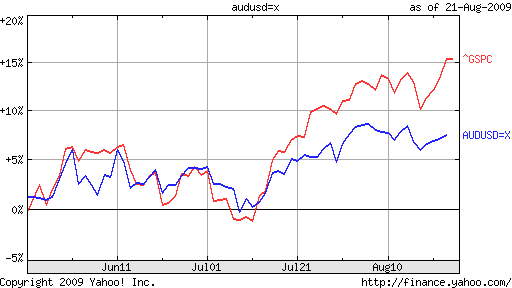

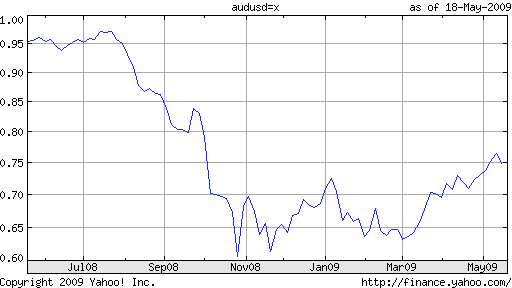

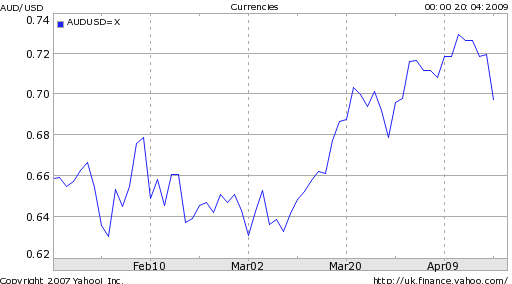

First of all, the putative economic boom that is taking place in Australia is being driven entirely by high commodity prices and surging production and exports. Since peaking at the end of April, commodity prices have fallen mightily. You can see from the chart above that there continues to exist a tight correlation between the AUD/USD and commodities prices. As commodities prices have fallen over the last two months, so has the Australian Dollar.

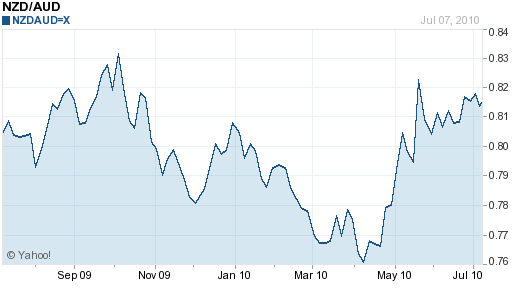

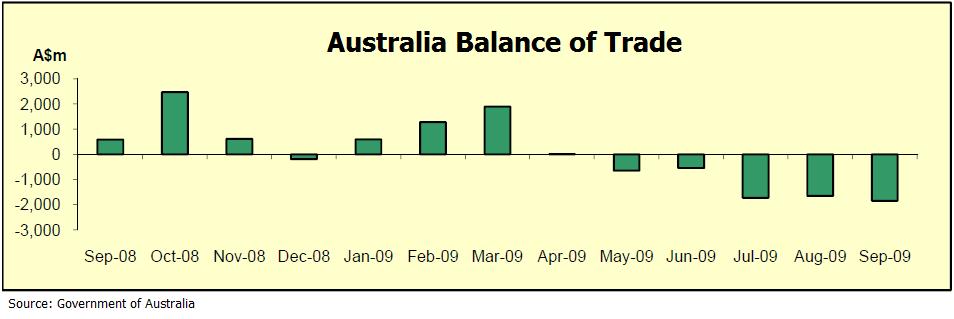

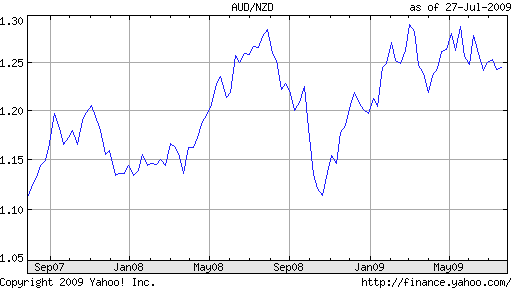

In addition, while demand will probably remain strong over the long-term, it may very well slacken over the short-term, due to declining economic growth across the industrialized world. Consider also that Australia’s largest market for commodity exports – China – may have difficulty sustaining a GDP growth rate of 10%, and at the very least, new fixed-asset investment (which necessitates demand for raw materials) will temporarily peak in the immediate future.

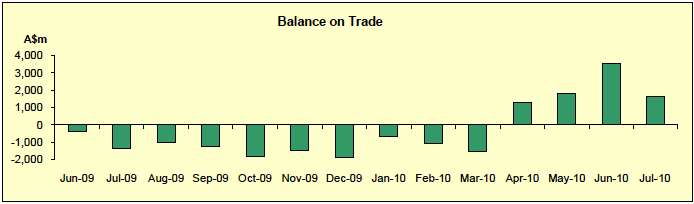

Finally, the mining sector directly accounts for only 8% of Australia’s economy, which means that only to a limited extent to high commodities prices contribute to the bottom line of Australian GDP. This notion is reinforced by the 1.2% economic contraction in the second quarter – the biggest decline in 20 years – and the fact that GDP is basically flat over the last three quarters. Many non-mining economic indicators are sagging, and the number of corporate bankruptcies is 10% higher than in 2010. In the end, then, the ebb and flow of Australia’s fortune depends less on commodities, and more on other sectors.

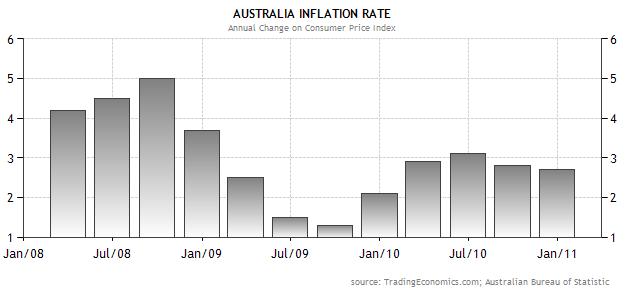

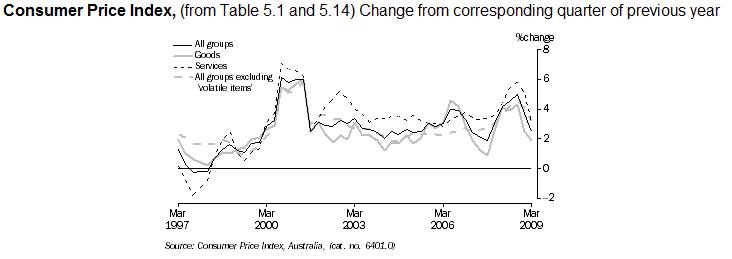

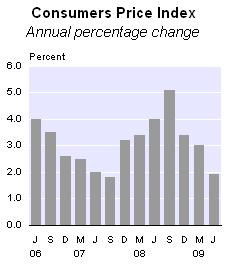

Mr. Parkinson’s optimistic forecasts might also be undermined in the short-term by a looser-than-expected monetary policy. The Reserve Bank of Australia last hiked its benchmark interest rate in November 2010, and may not hike again for a few more months due to moderating economic growth and proportionally moderate inflation. Given that an attractive interest rate differential may be driving some of the speculative activity that has girded the Aussie’s rise, a decline in this differential could likewise propel it downward.

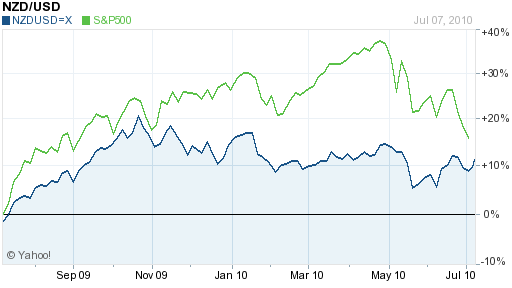

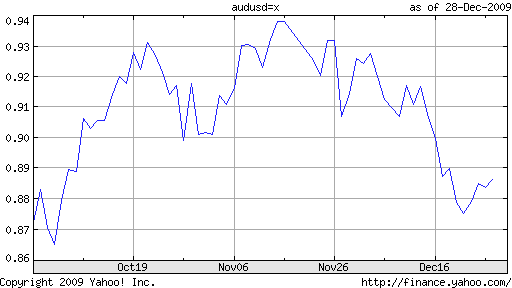

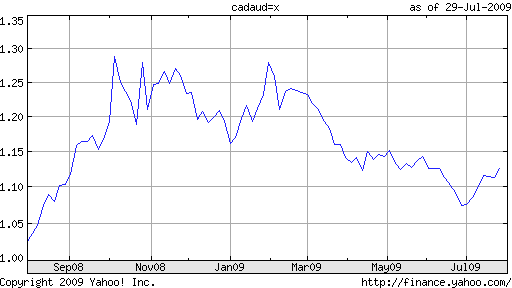

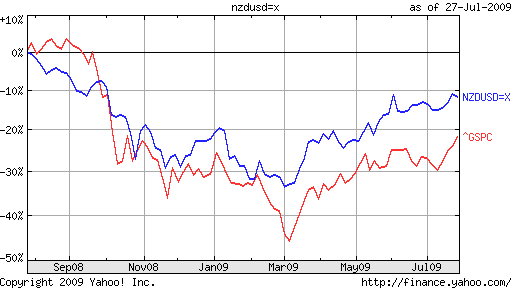

That’s because anecdotal reports suggest that the Australian Dollar remains a popular long currency for carry traders, funded by shorting the US Dollar, and to a lesser extent, Japanese Yen. Given that many of these carry trades are heavily leveraged, it wouldn’t take much to trigger a short squeeze and a rapid decline in the AUD/USD. For evidence of this phenomenon, one has to look no further back than May 2010, when the Aussie fell 10-15% in only three weeks.

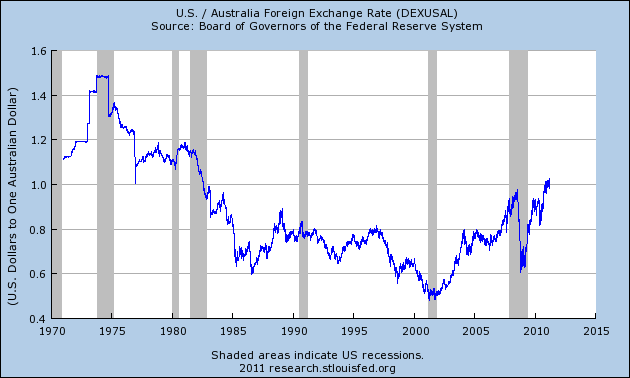

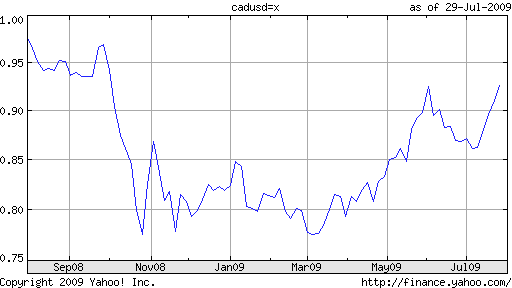

Ultimately, as one commentator recently pointed out, the Aussie’s 70% rise since 2008 might better be seen as US Dollar weakness (which also catalyzed the rise in commodity prices). The apparent stabilizing of the dollar, then, might let some air out of the currency down under.