March 14th 2010

Australia Hikes Rates; How about the Carry Trade?

Following up on my last post, I want to use this post to write about the long side of the carry trade- specifically the Australian Dollar. The Bank of International Settlements (BIS) observed in a recent report that, “The role of short-term interest rate differentials in both the deprecations and their reversal has grown over time.” When you consider that the benchmark interest rate in Australia is now 4% and that interest rates in every other industrialized country (including Japan) are close to 0%, it’s not hard to connect the dots.

Earlier this month, the Reserve Bank of Australia (RBA) raised the benchmark by .25% for the fourth time since it began tightening. In an accompanying press release, the RBA stated that “The board judges that with growth likely to be close to trend and inflation close to target over the coming year, it is appropriate for interest rates to be closer to average. Today’s decision is a further step in that process. It’s worth noting that the Australian Dollar barely budged, because investors had expected the move. The larger question was, and still is, the ultimate extent of RBA rate hikes and how soon it will get there.

Glen Stevens, Governor of the RBA, has himself indicated that “rates are still 50 to 100 basis points, or hundredths of a percentage point, below normal.” If you do that math, that means that the RBA will hike rates to 4.5-5% before stopping. Other more bullish analysts think 5-6% is a more realistic expectation because it is closer to the long-term average of Australian rate hikes.

As to when the benchmark will reach that point, it’s anyone’s guess. Going forward, analysts have pegged the liklihood of an April rate hike at 40%. Said one analyst, “It’s now a line-ball call; indeed, if you put a gun to my head . . . I’d guess that the RBA is going to hike again by 25 basis points in April.” Still, most think that the RBA won’t hike again until May. Added another analyst, “They are not indicating any urgency. We think they will go again in a couple of months. It could be three months, it could be two, our formal view is two, that may depend on how the inflation numbers look.” It’s too early to project when the next next (after the next one) hike will take place, because it depends on the timing of the first one.

At this point, most Australian economic data is trending steadily in the right direction. “Australia’s economy is starting a new upswing…Unemployment fell to 5.3% in January, not far above levels considered full employment for the economy…A rebound in construction and an investment splurge in the mining sector are expected to restore growth in the economy back to historic averages by the end of 2010. The RBA has indicated it expects inflation to remain within its 2%-3% target band.” Without drilling too deeply into any of the other numbers, there’s very little reason to doubt that the Australian economic recovery is genuine, which reinforces the notion that it is only a question of when – not if – the RBA further hikes rates.

In fact, the picture surrounding the Australian Dollar is almost a mirror image of the Japanese Yen. While the Yen looks destined to fall irrespective of the carry trade, the Australian Dollar looks destined to fall. While further monetary easing in Japan will give the Yen a second life as a funding currency, higher rates in Australia will once again make it a popular long currency. In short, “With commodity prices likely to remain strong and the spread between Australian and US interest rates likely to widen further its only a matter of time before the Australian dollar breaches parity against the US dollar.”

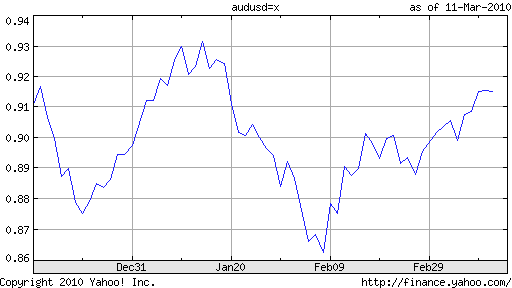

In fact, the Australian Dollar just touched a 13-year high against the Euro – though that is as much due to the Greek debt crisis and Euro problems as it is with Aussie strength. Meanwhile, the Australian Dollar has zig-zagged against the US Dollar, and is now in a rising trend following a recovery in risk sentiment. Whether it sustains this momentum depends largely on whether the RBA hikes rates next month.