October 16th 2010

Betting on China Via Australia

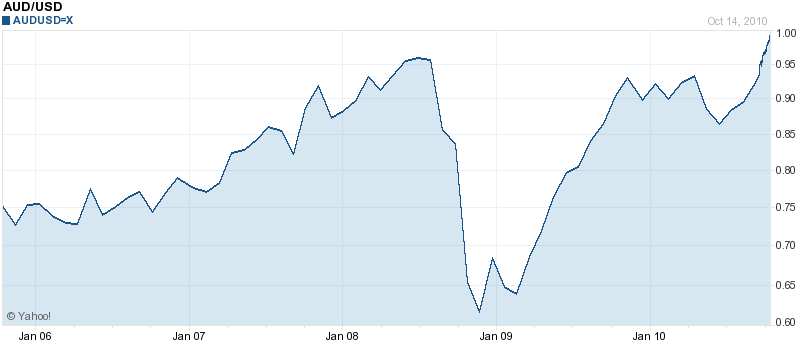

There are plenty of investors that think betting on China is as close to a sure thing as there could possibly be. The only problem is that investing directly in China’s economic freight train is complicated, opaque, and sometimes impossible. The Chinese government maintains strict capital controls, prohibits foreigners from directly owning certain types of investment vehicles, and prevents the Chinese Yuan from appreciating too quickly, if at all. For those that want exposure to China without all of the attendant risks, there is a neat alternative: the Australian Dollar (AUD).

Those of you that regularly read my posts and/or follow the forex markets closely should be aware of the many correlations that exist between currencies and other financial markets, as well as between currencies. In this case, there would appear to be a strong correlation between Chinese economic growth and the Australian Dollar. If the Chinese Yuan were able to float freely, it might rise and fall in line with the AUD. Since the Yuan is fixed to the US Dollar, however, we must look for a more roundabout connection. HSBC research analysts used Chinese electricity consumption as a proxy for Chinese economic activity (why they didn’t just use GDP is still unclear to me), and discovered that it fluctuated in perfect accordance with the Australian Dollar.

Before I get ahead of myself, I want to explain why one would even posit a connection between China and the Aussie in the first place. There are actually a few reasons. First, Australia is economically part of Asia: “Today, 43 per cent of Australia’s total merchandise trade is with north Asia. A further 15 per cent is with Southeast Asia.” Second, Australia’s economy is driven by the extraction and sale of natural resources, of which China is a major buyer and investor: “In 2008-9, China was the biggest investor in the key resource sector with $26.3bn involvements approved, 30 per cent of the total.” Third, Chinese demand has come to dictate the prices of many such resources, causing them to rise continuously. Thus, Australia’s natural resource exports to countries other than China still draw strength (via high commodity prices) from Chinese demand.

As one analyst summarized, “China is buying raw materials from Australia in leaps and bounds, and that’s what’s driving that currency’s growth.” Sounds like an Open and Shut case. In fact, this presumed correlation has become so entrenched that any indication that China is trying to cool its own economy almost always prompts a reaction in the Aussie. To be sure, warnings that China’s annual legislative conference (scheduled for October 17) would produce a consensus call for a tightening of economic policy have made some forecasters more conservative. Still, as long as the Chinese economy remains strong, the Australian Dollar should follow.

It’s worth pointing out that the correlation between the Aussie and the Chinese economy doesn’t exist in a vacuum. For example, the Australian Dollar has also closely mirrored the S&P 500 over the last decade, which suggests that global economic growth (and higher commodity prices) are as much of a factor in the Aussie’s appreciation as is Chinese economic activity. The Aussie is also vulnerable to a decline in risk appetite, like the kind that took place during the financial crisis and flared up again as a result of the EU Sovereign debt crisis. During such periods, Chinese demand for commodities becomes irrelevant.

On the other hand, part of the reason the Australian Dollar has surged 10% since September and 20% since June is because other countries’ Central Banks (such as China) have increased their interventions on behalf of their respective currencies. Australia is one of a handful of countries whose Central Bank not only hasn’t actively tried to depress its currency, but whose monetary policy (via interest rate hikes) actually invites further appreciation. As the Aussie closes in on parity and Australian exporters and tourism operators become more vocal about the impact on business, however, the Reserve Bank of Australia (RBA) might be forced to act.

December 17th, 2010 at 10:35 am

Great post. The reason why Aud tracks the Yuan is because Australia is a huge exporter of natural resources and China is such a such consumer of natural resources. A strong China means strong demand.

January 6th, 2011 at 4:32 pm

Thanks, I have found this a great read a few months on , and veyr interesting perspective to see how things pan out- especially given that the Chinese are now raising interest rates. Cheers

February 1st, 2011 at 4:55 pm

Hi, I agree , a great analysis of the fotunes of the AUD. Whilst a slow down in China is on the wish list of its authorities, its is going to prove to be hard to achieve in an orderly fashion in my view because of the enthusiastic nature of the Chinese consumer/investor. So while a sharp correction does not seem imminent, it has to remain a potential risk.

The other theme that I believe will continue to be a force over the medium term is the conscious diversification away from from the USD and its assets by central banks around the globe. The “co-ordinated” attitude of some of them of late has vertainly help reduce fears in the market about European debt, and I think these timely and well thought out strategies will help maintain the upside bias of the AUD over the medium term