Boom Time for Forex

It has been three years since the Bank of International Settlements’ last report on foreign exchange was released. Since then, analysts could only speculate about how the forex market has evolved and changed.

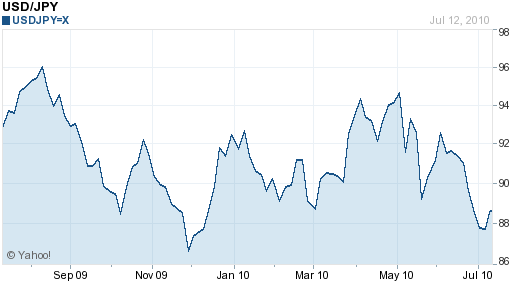

The wait is now over, thanks to a huge data release by the world’s Central Bank, which showed that daily trading volume currently averages $4.1 Trillion, a 28% jump since 2007. Trading in London accounted for 44% of the total, with the US – in a distant second – claiming nearly 19%. Japan and Australia accounted for 7% and 5%, respectively, with an assortment of other financial centers splitting the remainder.

This data is consistent with a recent survey of fund managers, which indicated a growing preference for investing in currencies: “Thirty-eight per cent of fund managers said they were likely to increase their allocations to foreign exchange, while 37 per cent named equities and 35 per cent commodities. Currency was most popular even though this was the asset class where managers felt risks had risen most over the past 12 months.” In short, the zenith of forex has yet to arrive.

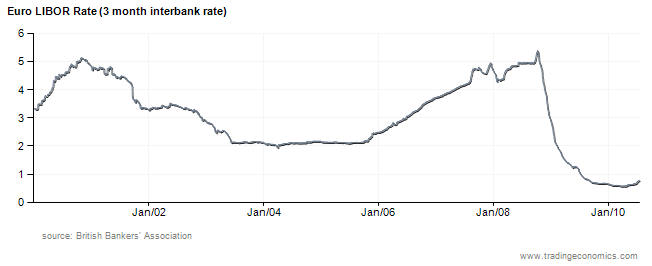

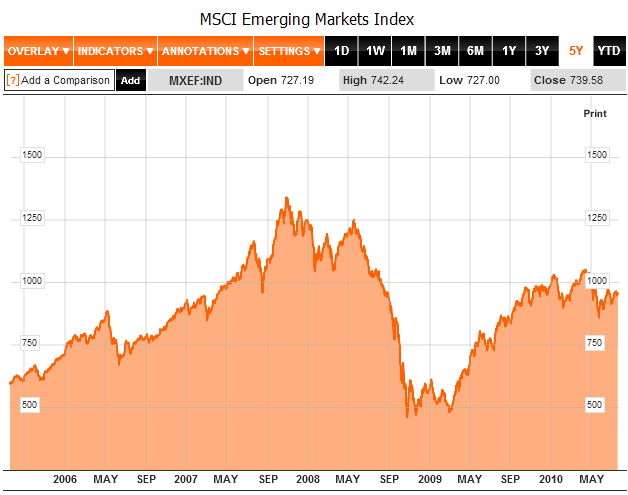

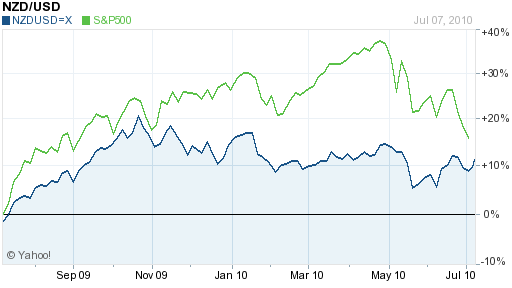

There are a few of explanations for this growth. First, there are the inherent draws of trading forex: liquidity, simplicity, and convenience. Second, investors are in the process of diversifying their portfolios away from stocks and bonds, which have underperformed in the last few years (on a comparative historical basis). As investors brace for a long-term bear market in stocks and low yields on bonds for the near future (thanks to low interest rates), they are turning to forex, with its zero-sum nature and the implication of a permanent bull market. Additionally, programmatic trading and risk-based investing strategies are causing correlations in the other financial markets to converge to 1. While there are occasional correlations between certain currencies and other securities/commodities markets, the forex markets tend to trade independently, and hence, represent an excellent vehicle for increasing diversification in one’s portfolio.

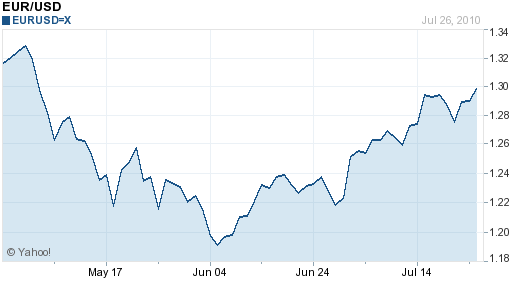

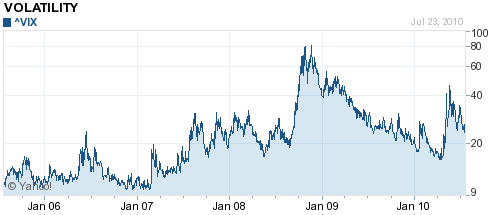

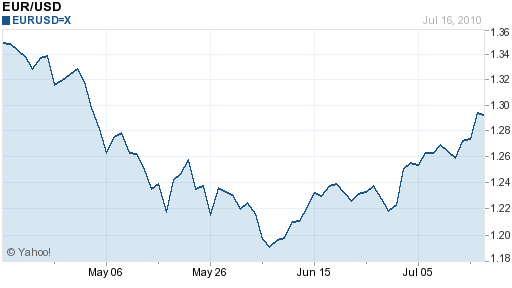

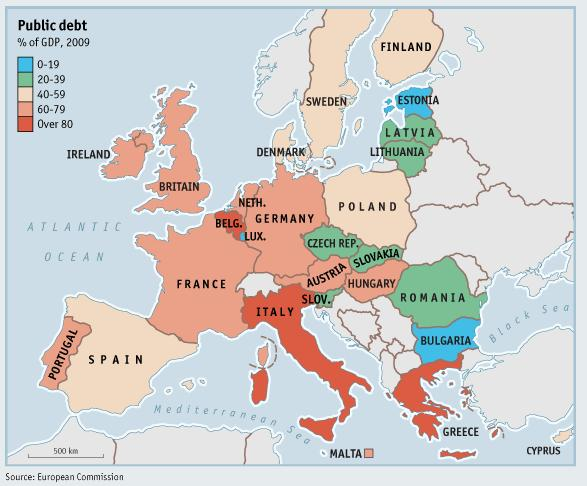

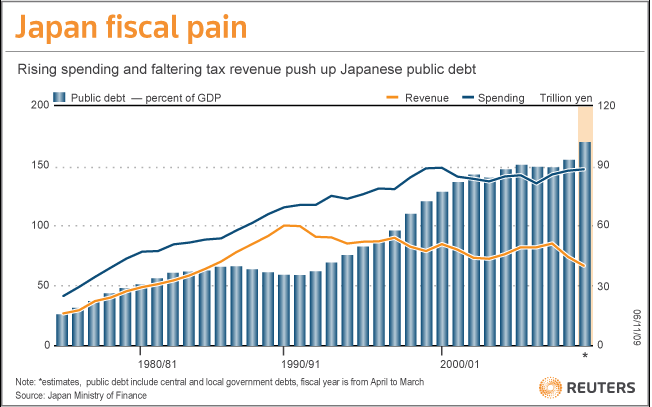

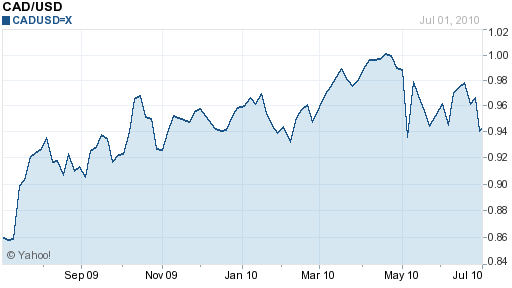

There is also a more circumstantial explanation for the rapid growth in forex: the credit crisis. In the last two years, volatility in forex markets reached unprecedented levels, with most currencies falling (and then rising) by 20% or more. As a result, many fund managers were quite active in adjusting their portfolios to reduce their exposure to volatile currencies: “The volume growth was really a result of the volatility and the fact that you had real end users actively hedging their exposures.” Another contingent of “event-driven” investors moved to increase their exposure to forex, as the volatility simultaneously increased opportunities to profit. Moreover, these adjustments were not executed once. With a succession of mini-crises in 2009 and 2010 (Dubai debt crisis, EU sovereign debt crisis) and the possibility of even larger crises in the near future, investors have had to monitor and rejigger their portfolios on a sometimes daily basis: “If you have a big piece of news, such as the Greek debt crisis, there’s more incentive to change your position,” summarized one strategist.

What are the implications of this explosion? It’s difficult to say since there is a chicken-and-egg interplay between the growth in the forex market and volatility in currencies. [In theory, it should be that greater liquidity should reduce volatility, but if we learned anything from 2008, it is that the opposite can also be the case]. As I wrote last week, I think it means that volatility will probably remain high. Investors will continue to adjust their exposure for hedging purposes, and traders will churn their portfolios in the search for quick profits.

It will also make it more difficult for amateur traders to turn profits trading forex. There are now millions of professional eyes and computers, trained on even the most obscure currencies. As if it needed to be said, forex is no longer an alternative asset.