July 13th 2010

Japanese Yen and the Irony of Debt

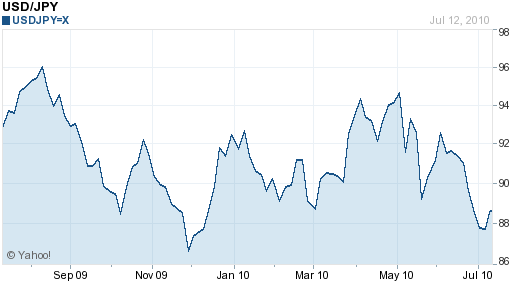

Since my last update in June, the Japanese Yen has continued to creep up. It has risen a solid 5% in the year-to-date against the Dollar, 12% against the Pound, and an earth-shattering 20% against the Euro. It is closing in on a 15-year high of 85 Yen/Dollar, and beyond that, the all-time high of 79. According to the Chicago Mercantile Exchange, “Long positions in the yen stand at $5.4bn. This is the highest level since December 2009 and represents the biggest bet against the dollar versus any currency in the market.”

As to what’s propelling the Yen higher, there is very little mystery. Two words: Safe Haven. “The yen’s attractions lie in its status as a haven from the turmoil that has engulfed financial markets as, first, the eurozone debt crisis unfolded and, then, fears about a double-dip recession have intensified.” To be sure, there are a handful of currencies that are arguably more secure and less risky than the Yen. The problem is that with the exception of the Dollar, none of them can compete with the Yen on the basis of liquidity. In addition, thanks to non-existent inflation in Japan and low interest rates in other countries, there is very little opportunity cost in simply holding Yen and simply taking a wait-and-see approach.

According to some analysts, interest rate differentials will probably remain narrow for the foreseeable future: “Global bond yields will fall, reducing the incentive of yen-based investors to place funds abroad.” In fact, thanks to low interest rate differentials, the Yen is not even the target funding currency for carry traders. Suffice it to say that investors are not bothered by the fact that Japanese monetary policy is extraordinarily accommodative and that Japanese long-term interest rates are the lowest in the world. For those who are concerned about rising interest rate differentials, consider that this probably won’t become a factor until the medium-term.

On the fundamental front, there are a couple of risks for the Yen. First of all, there is the stalled Japanese economic recovery and the possibility that the strong Yen could further erode the competitiveness of Japan’s export sector, the mainstay of its economy. Yen bulls respond to this by noting both that Japan’s economic recovery has already stalled for 25 years and that should the Yen’s rise actually crimp economic growth, the Central Bank would probably intervene. By all accounts, “The government will continue to keep a close eye on the yen.”

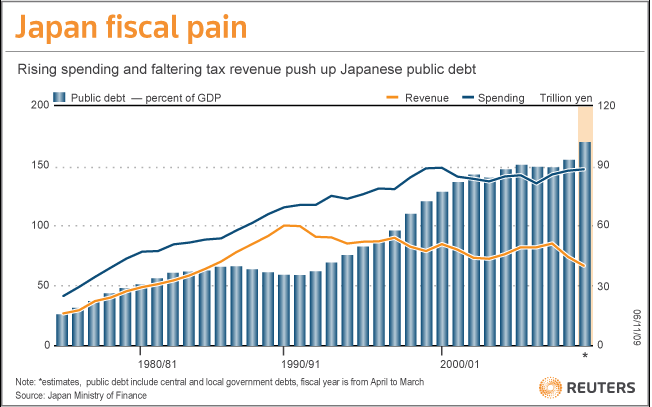

A greater concern, perhaps, is Japan’s massive debt. Near $10 Trillion, public debt is already 180% of GDP, and is projected to grow to 200% over the next few years. Total public and private debt, meanwhile, is by far the highest in the world, at 380% of GDP. The Japanese government is planning to implement “austerity measures,” but political stalemate and election pressures will make this difficult to achieve. All three of the rating agencies have issued stern warnings, and downgrades could soon follow. Here, Yen bulls retort that as unsustainable as this debt might appear, the majority (90%) of it is financed domestically, through the massive pool of savings. The remaining 10% is eagerly soaked up by foreign investors, who view the debt as a more attractive alternative to cash and stocks. [This is the great irony that I alluded to in the title of this post – that more debt is viewed positively as “liquidity” and does nothing to hurt the Yen].

Speaking of which, the Japanese stock market has risen by only 5% this year, and some analysts are predicting that a long bull market is inevitable. Adding to the fervor, Central Banks have begun to build their positions in the Yen, for the first time in 10 years. It seems everyone is excited about the Yen, even economists: “Within the developed economy space, Japan looks relatively good as an economy that’s likely to be growing faster than Europe or America, and it’s generally considered to have low risk of capital flight.” In other words, the consensus is that there is a very low chance of a “Greek-like debt crisis.”

At this point, the Yen can only be toppled by Central Banks: either foreign Central Banks will hike interest rates and make the Yen unattractive in contrast, or the Bank of Japan will intervene directly to prevent it from rising further.

July 16th, 2010 at 3:49 pm

Hi I have been following your analysis on the JPY for a few months now and would just like to state that I believe you do an exceptional job!

With the Yen getting stronger @ 86 against the dollar today and very close to the levels from November do you think that the BOJ is going to start intervening? Of course they have made it no secret that they would rather see the Yen above 90 against the dollar.

July 17th, 2010 at 5:21 am

Who are the best Forex player around?

October 19th, 2010 at 12:46 pm

Thanks, finally someone addresses directly the elephant in the room (ie: how can the yen be so strong when the country is so deep in debt). The explanation is great, but I am reminded of the phrase “what can’t go on forever, won’t”.

I only wonder just WHEN will the Yen be toppled by the central banks, as it sounds inevitable. What will be the inflection point? The Japan miracle is over, the population is aging rapidly. Its nice that you owe most of the money to your own citizens, but eventually you just cant service the debt, and just like what happened in the US mortgage crisis, what happens then? All hell breaks loose, and it comes suddenly and to the surprise of the “experts” and their wise and balanced analysis suddenly seems like a nice day dream just like dreaming that your home value will keep rising, while incomes are falling. Surely its not so completely harmless to default on your own citizens; this would surely send the country into depression as the people wake up to finally realize that their savings have been fatally wasted away, and is not coming back. Depressed countries don’t make very strong economies to repay foreign debts or to secure the ultimate value of their currencies.

Isn’t this a perfect example of the odds unreasonably skewed towards the favorite horse so much so that rewards of betting the other way make more sense?

Somebody (Soros like), someday is going to make the mother of all trades, and reap a multi-trillion dollar windfall on the Yen collapse.

I think that the Yen is going to hit the wall hard, when some unexpected crisis somewhere else is going to take the veil off this ugly bride and everyone will stampede for the small Japanese doorway at once, kicking themselves as they do for not looking under the veil sooner.