New “Partition” in Forex Markets

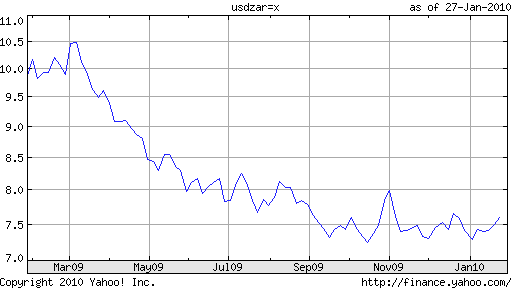

In October, I wrote about a “separation” that had taken place in currency markets between the “sick” currencies and the “healthy” currencies. At the time, I argued that the former category was comprised mainly of the Dollar and the Pound, with most other currencies healthy by comparison. While I still stand by this paradigm, I would like to revise it slightly. Specifically, I would like to add the Euro and the Yen to this list.

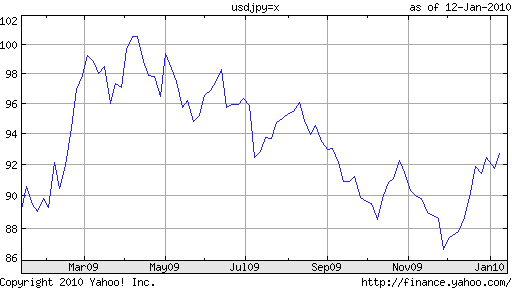

The recent blow-up surrounding the downgrade of Greece’s debt and subsequent explosion in the price of credit default swaps (which insure against default), have shined a spotlight on the fiscal problems of many of the EU’s member states, including Spain, Italy, Portugal, Ireland, and others. The situation in Japan, meanwhile, has been much more gradual, though equally dangerous: “In 1990, Japan’s total national debt load was 390% of GDP. Now it’s 460%. In the interim, the country has suffered sub-par growth and routine recessions.”

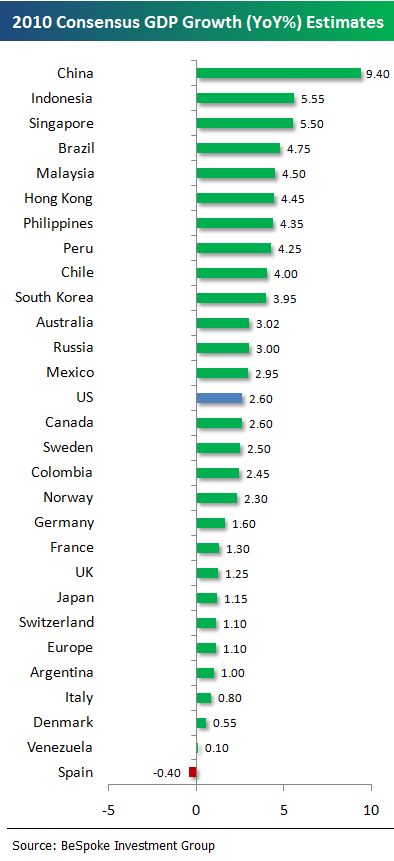

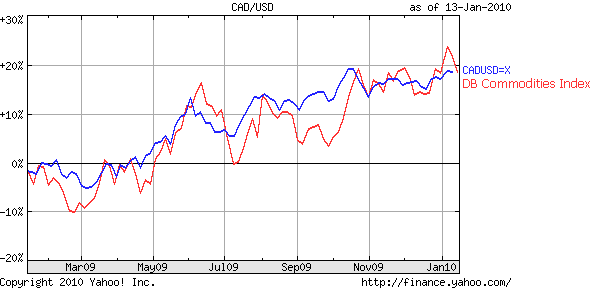

The fiscal problems of the US and UK governments as well as the debts of their citizens and companies have long been famous. For that reason, when the sick/healthy paradigm was first proposed, they were the two most obvious candidates. Having conducted some additional analysis, it’s now patently obvious that the same problems affect the EU and Japan. Given that their economies are also in weak shape, it doesn’t really make sense to group them in with the healthy currencies. Canada (and the Loonie, by extension) is also looking sickly, with its surging national debt and record budget deficits. The only reason it is being spared from the list is because of its richness in natural resources; in other words, it has something tangible that it can use to pay its debts.

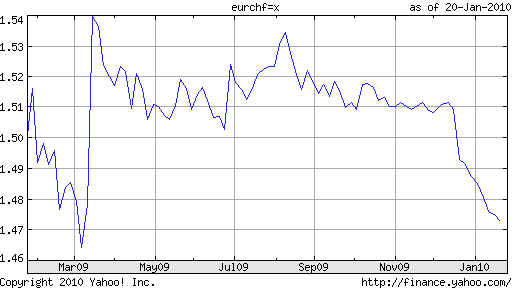

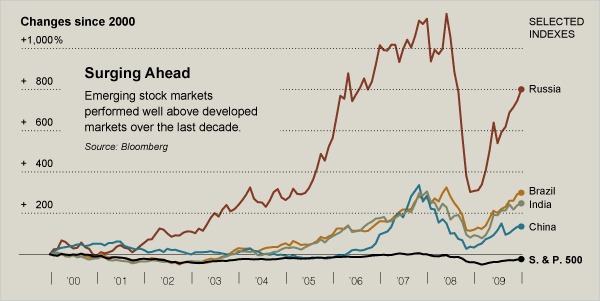

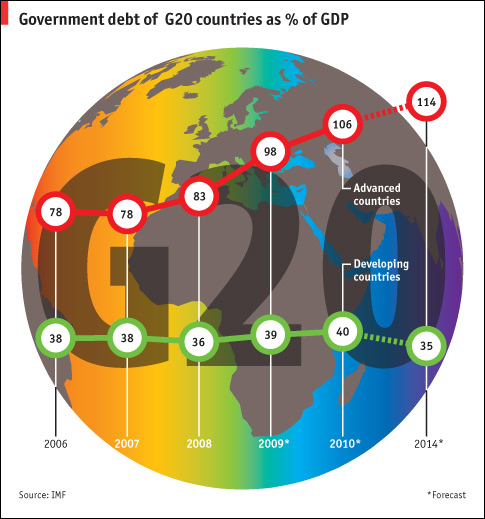

Among the so-called majors, then, only the Swiss Franc, Canadian Loonie, Australian Dollar, and New Zealand Dollar get clean bills of health. A re-casting of the paradigm, then, would put the super-majors (Euro, Yen, Pound, and Dollar account for more than 75% of all foreign exchange activity) on one side, and virtually every other currency on the other. Given that national debt ratios and interest rate differentials diverge across the same boundary, it’s not hard to conjure a basis for this partition. “The IMF forecasts that gross government debt among advanced economies will continue to rise until 2014, reaching 114% of GDP, compared to just 35% for developing nations.” Adds another analyst: “If you look at currencies as a proxy for growth, then you can anticipate that emerging-market currencies will appreciate against the dollar.”

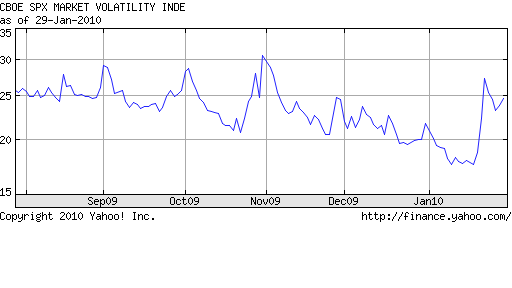

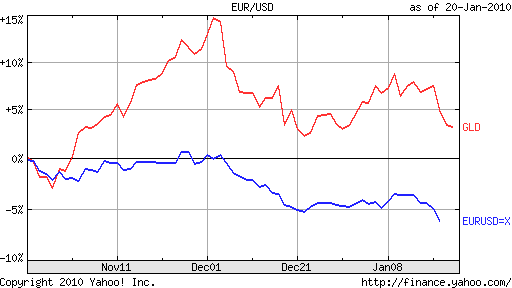

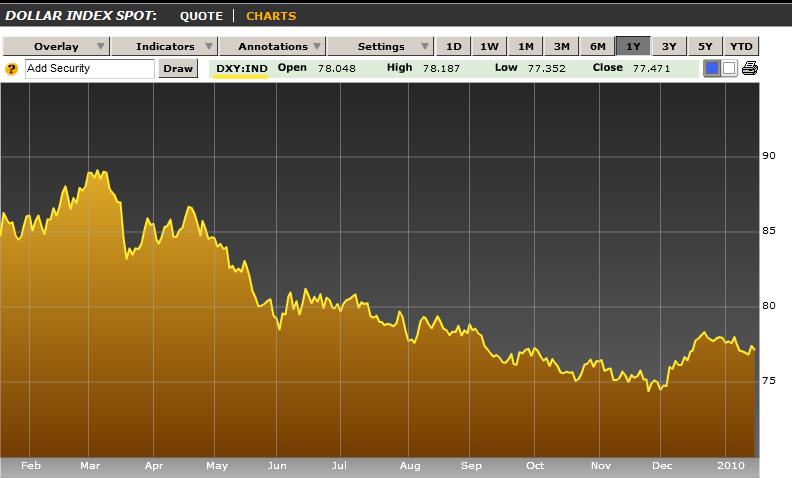

There is also a correction that is taking place within the group of sick currencies. Investors have come to realize belatedly that a Dollar sell-off doesn’t make any sense against the Euro and Yen, whose economic and fiscal situations could hardly be characterized as healthy. “Against the majors, we’re pretty close to the end, if we haven’t already reached the end of a bear market in the dollar,” asserted one analyst. Given that the Dollar’s demise had all but been taken for granted, this reconsideration isn’t coming natural. Volatility has surged to a 3-month high, and investors are responding by moving funds back to the US. Among the majors, then, it looks like the Dollar is still the “least worst” currency.