January 20th 2010

Dollar Carry Trade: Not Dead Yet

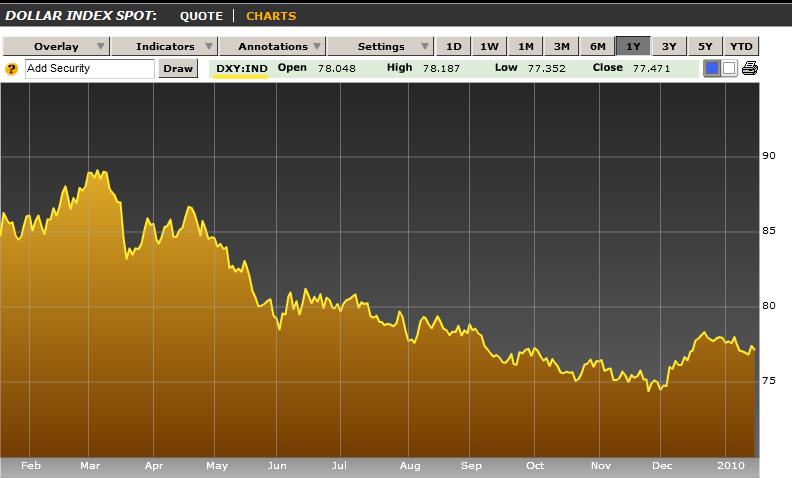

After the impressive rally in the US Dollar at the end of 2009, many market observers predicted that the end was near for the Dollar carry trade. That’s because volatility is the sworn enemy of carry traders; whenever there transpires a sudden change in direction in a funding currency, investors will usually race for the exits, regardless of whether the change was justified by fundamentals.

Alas, 2010 has seen a stabilization – even a modest appreciation – in the Dollar, which means the carry trade is here to stay. For now at least. This is based on two abiding notions. The first is that US short-term interest rates – and, hence, borrowing costs for carry traders – will remain low for the foreseeable future. The second belief is that the most attractive investment opportunities can still be found outside the US, namely in emerging markets. Let’s explore both of these ideas in greater details.

The minutes from its last monetary policy meeting suggest that the Fed is in no hurry to raise rates. On the contrary, it may ease monetary policy even further. According to St. Louis Federal Reserve President James Bullard, U.S. interest rates may remain low for “quite some time.” Added another analyst, “The U.S. economy is chugging along, albeit at a slow pace, and that means the Federal Reserve has no real urgency to raise interest rates.”

In short, investors are rapidly scaling back their expectations for interest rate hikes; futures prices now reflect a mere 20% of a hike by the Fed’s June meeting. If Bullard’s comments carry any weight, investors might turn their attention to the other tools in the Fed’s arsenal- namely quantitative easing. A rise in inflation, portended by many economists, could spur the Fed to draw money out of the markets by selling some of its $1 Trillion in credit securities. Regardless of what it decides on this front (expand, hold steady, rein in), however, the long and short of it as that interest rates aren’t going anywhere anytime soon. And that means funds will remain cheap and available for carry trading.

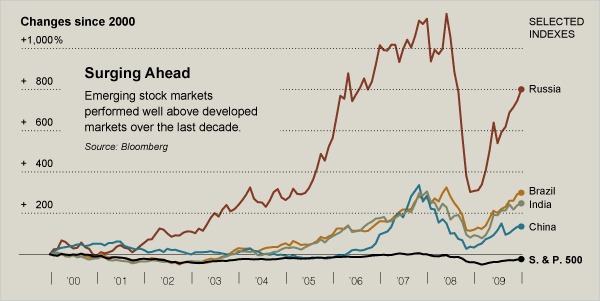

On the other side of the equation is an enduring optimism in emerging markets. The last decade has been very kind to investors that bought emerging market stocks, returning a “modest” 100% in some cases and an incredible 1000% in others. The S&P, in contrast, declined slightly over the same period. In some ways, 2009 was a microcosm for this trend, as the MSCI emerging markets index gained 73%, compared to 25% in the S&P. While investors are cautious about bubbles forming in some of these markets (bubbles seem to form and burst with alarming regularity), they continue to pour money in. $75 Billion was added to emerging market equity funds in 2009, to be precise. They are buoyed by predictions that emerging markets will account for the lion’s share of global GDP growth going forward.

This has facilitated a twist on the carry trade, whereby investors are now commonly using Dollar-funded loans to buy stocks, rather than sit back and earn a modest return investing in comparatively low-risk interest-bearing securities. This “traditional” carry trade is perhaps less popular now because interest rates are at all-time lows in many countries. But this is already starting to change as a healthy recovery in emerging markets has paved the way for rate hikes. While this could put a damper on stocks, it would re-open the bread and butter for carry traders, which is to sit back and earn a simple interest rate spread. Moreover, these carry traders can rest assured that if/when the Fed eventually raises rates, Central Banks in Asia and Latin America will almost certainly be in the same position.

The main threat at this point is uncertainty. “Investors plying the carry trade should tread cautiously — economic data will continue to be volatile, as befits a recovery that will proceed in fits and starts,” summarizes one columnist. In short, while fundamentals continue to support a carry trade strategy, it could be undone (rapidly) by an uptick in volatility.

January 21st, 2010 at 10:16 am

The author makes valid points. The carry trend will emerge whenever there is a sizable interest rate difference. And it will also reverse forcefully, from time to time, as it did in August 2007 and then again in the second half of 2008. It seems to me that carry trades are reversing for now and USD is a good currency to be in for 3-4 months.

January 22nd, 2010 at 5:02 pm

[…] Adam Kritzer declares that the dollar carry trade is not dead. Not yet. […]