Bullish on the Euro?

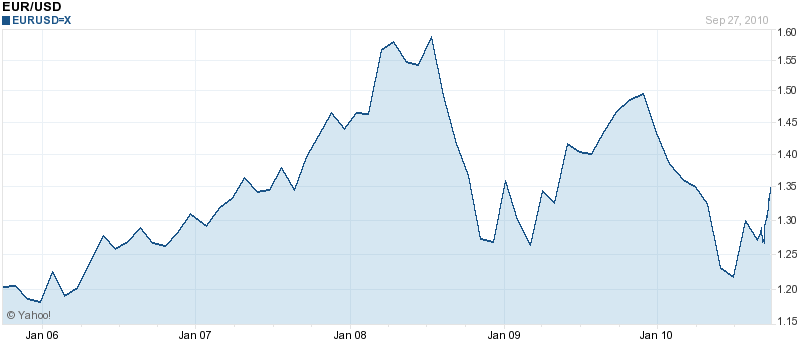

Wouldn’t life just be a little easier if the EUR/USD, the most important forex pair and bellwether of currency markets, could simply pick a direction and stick to it. It dove during the financial crisis, only to surge during the apparent recovery phase, fell during the sovereign debt crisis, and rose during the paradigm shift, then fell as risk appetite waned, only to rise again in September, en route to a 5-month high.

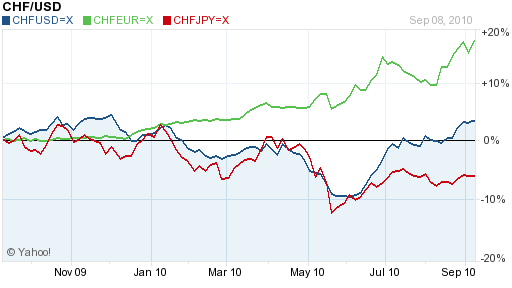

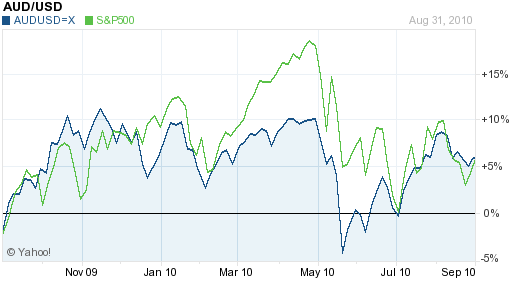

There are a handful of factors which currently underlie the Euro’s strength, which can all generally be explained by the fact that risk is “on” at the moment, and the markets are moving away from so-called safe haven currencies and back towards growth investments. Of course that could change tomorrow (or even 5 minutes from now!), but at the moment, risk appetite is high and the Euro symbolizes risk. Never mind how ironic it is, that growth in the EU is projected at 1.8% for the year while Rest of World (ROW) GDP will probably top 5%. All that matters is compared to the Dollar (and Yen, Pound, Franc to a lesser extent) the Euro is perceived as the currency of risk.

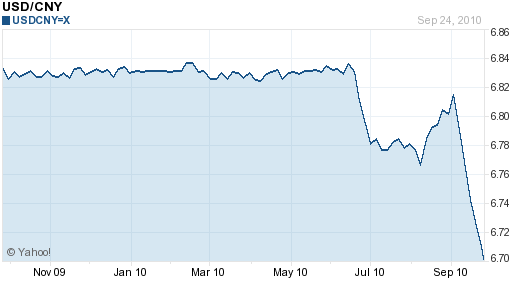

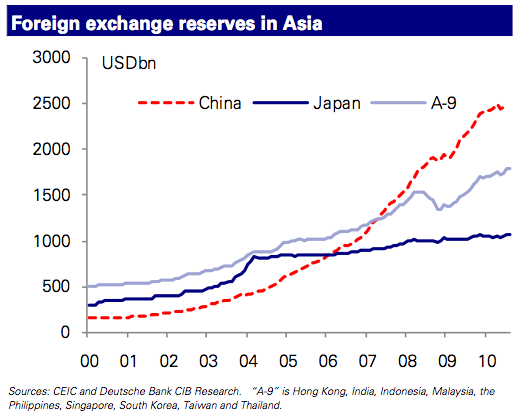

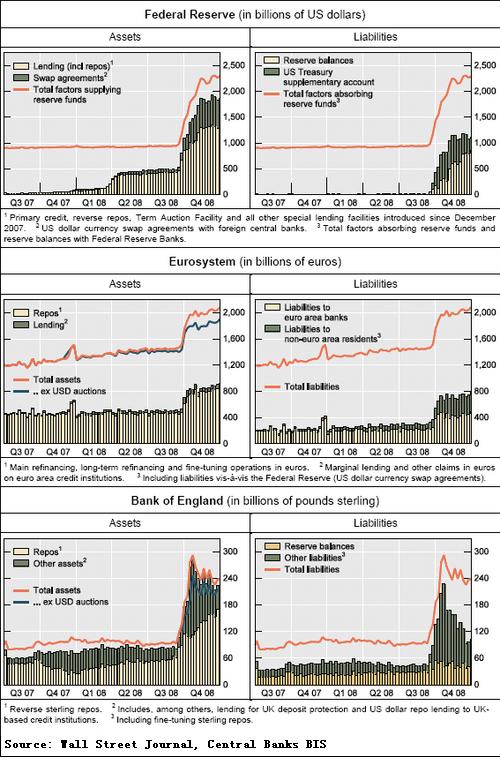

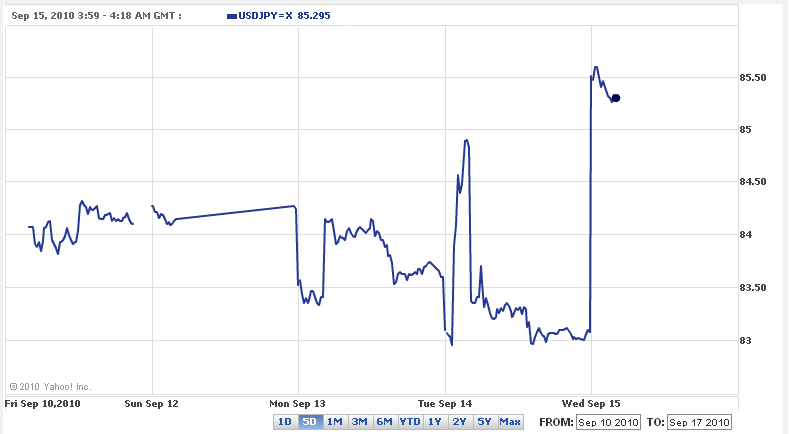

The Euro’s cause is also helped by the ongoing “currency wars,” which heated up last week with Japan’s entry into the game. Basically, Central Banks around the world are now competing with each other to devalue their currencies. In contrast, the European Central Bank (ECB) has decided to remain on the sidelines (in favor of fiscal austerity), which is forcing the Euro up (or rather all other currencies down). To make matters even worse, “The U.S. Federal Reserve indicated this summer that it may ease monetary policy further… often seen as printing money to pump up the economy.” As a result, “The euro looks set to keep on climbing in a trend that looks increasingly entrenched.”

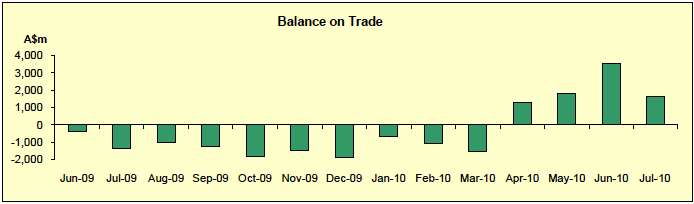

There are certainly those that argue that the Euro’s recent surge reflects renewed confidence in the Eurozone economy and prospects for resolving the EU debt crisis. After all, most Euro members will reduce their budget deficits in 2010 and auctions of new bonds are once again oversubscribed. On the other hand, interest rates for the PIGS (Portugal, Italy, Greece, and Spain) have risen to multi-year highs, as investors are finally trying to make a serious effort at pricing the possibility of default.

In addition, the credit markets in the EU are barely functioning, and large institutions remain dependent on the ECB’s credit facilities for financing. Finally, it shouldn’t be forgotten that the only reason crisis was due to the massive support (€140 Billion) extended to Greece. When this program expires in less than three years, the fiscal problems of Greece (and the other PIGS) will be exposed once again, and a new (stopgap) solution will need to be proposed.

As every analyst has pointed out, none of the EU’s fiscal problems have been solved. EU members have certainly proven adept at resolving acute crises and the ECB certainly deserves credit for keeping credit markets functioning, but none has proposed a viable solution for repairing of member countries’ fiscal and economic health. Currency devaluation is impossible. Sovereign default is being prevented. That leaves wage cuts and increased productivity as the only two paths to equilibrium. The former could be accomplished through inflation, but the ECB seems reluctant to allow this to happen.

For better or worse, the EU seems to have pushed these problems down the road, and if all goes according to plan, they won’t need to be revisited for 2-3 years. For now, then, the Euro is probably safe, and may even thrive. Short positions in the Euro are being unwound with furious speed and data indicate that there is still plenty of scope for further unwinding. Inflation remains subdued, economic growth is stable, and the ECB so far hasn’t voiced any disapproval of the Euro’s rise. While I promote this bullishness with the caveat that “traders have shown a willingness to smack the euro lower from time to time on the slightest news or rumor of downgrades to euro-zone sovereign or bank ratings,” the general Euro trend is now unquestionably UP.

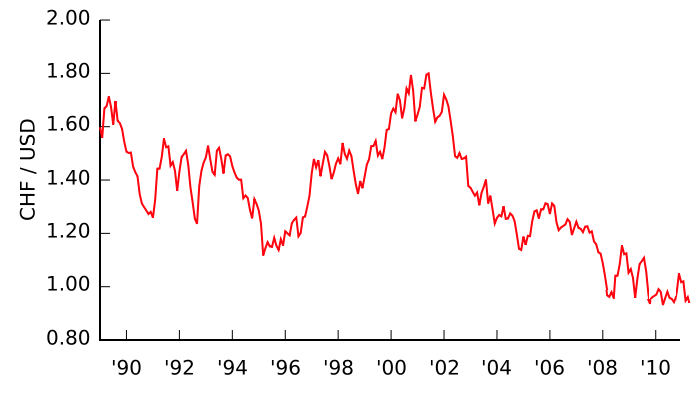

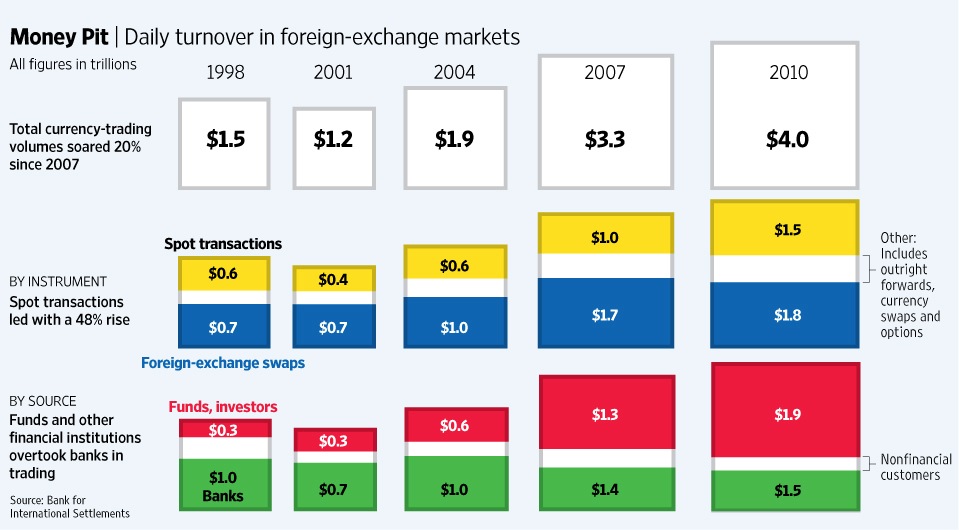

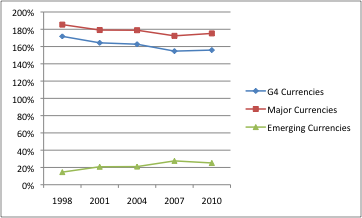

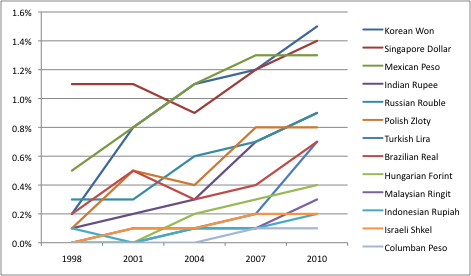

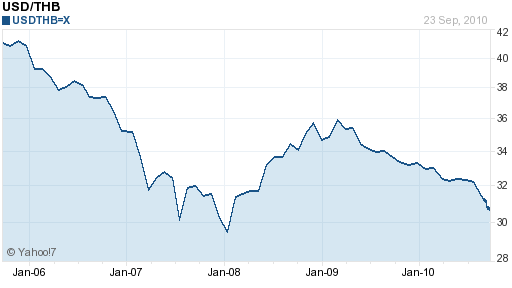

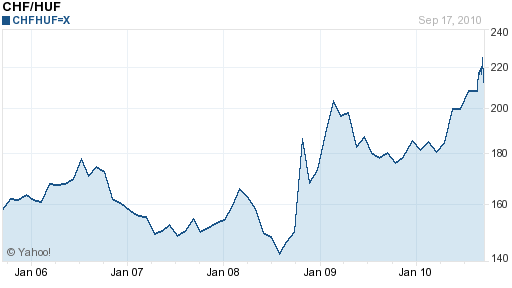

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.