September 27th 2010

RMB Appreciation Accelerates, but Dollar Peg Remains in Place

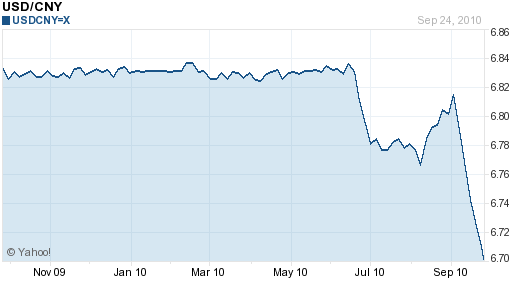

The Chinese Yuan has touched a new high, at 6.69 USD/CNY. Given that the Yuan has still only risen about 2% since the peg was officially loosened in June – with most of that appreciation taking place in the last couple weeks – there still remains intense pressure on China to do more.

Last week’s intervention by the Bank of Japan diverted a tremendous amount of attention towards the Yuan. In fact, many analysts have argued that it is only because of the Yuan-Dollar peg (itself, as well as the Chinese purchases of Yen assets that it engendered) that Japan was forced to act: ” ‘Countries see that getting involved in currency manipulation is a way to give themselves an advantage’…’China, their actions affected Japan, and Japan is affecting us.’ ” The Yen intervention could also force the G20 to re-focus its attention on the Yuan, and at least devote some discussion to it at the next summit.

It should be noted that the two soundbites above both emanated from US Congressmen, which is important because the US government is currently mulling action on the Yuan currency peg. Politicians are growing tired by the Treasury Department’s repeated failure to call China a “Currency Manipulator,” which would require diplomatic talks and even trade sanctions. The Treasury will have an opportunity redeem itself in its next report on foreign exchange, due out on October 15, but it is expected that the report will either be delayed or released without adequately addressing the undervalued Yuan.

In fact, Treasury Secretary Geithner testified before Congress last week, and at least admitted that something needed to be done: “The pace of appreciation has been too slow and the extent of appreciation too limited. We have to figure out ways to change behavior.” However, this was only in response to acerbic criticism – (Senator Schumer told him, “I’m increasingly coming to the view that the only person in this room who believes China is not manipulating its currency is you.”) – and he ultimately failed to outline a timetable/blueprint for action. Despite the consensus among politicians (and President Obama) that the currency peg is harmful to the US economy, Geithner made it clear that the Treasury Department continues to favor unilateral action towards dealing with problem, without Congressional intervention. For now, then, politicians are probably relegated to saber-rattling and name-calling.

China’s response to this charade has been predictable. Trade representatives hinted that China wouldn’t bow to external pressure, and that any attempt at “punishment” would be met with countervailing actions. China also questioned the economics between arguments that the Dollar peg contributes to trade imbalance, calling such claims “groundless.” This position is actually supported by the notion that while the Yuan appreciated by 20% against the Dollar from 2005-2008, the US/China trade deficit actually widened.

In practice, China is likely to stick to its policy of gradual Yuan appreciation, or a few reasons. First of all, while Chinese policymakers know that they don’t need to wholly appease US politicians, they at least need to pretend that they are listening. It’s true that the US is dependent on Chinese products and its purchases of Treasury Bonds. However, it is arguably just as dependent on the US to buy its exports, which promotes employment and social stability, and it is keen to avoid a trade war if possible.

Second, a long-term appreciation of the RMB is actually in China’s best interest. If it wants to spur domestic consumption and promote more value-added manufacturing, it will need a more valuable currency. Outbound M&A, especially involving natural resource companies, will also be more economical if the Yuan is worth more. Also, if China has any serious ambitions of turning the Yuan into a global reserve currency, it will need to create capital markets that are deeper and more liquid, which it is currently unmotivated to do, lest it spur demand for Yuan by foreign institutional investors.

Finally, China should let the Yuan appreciate because it is financially gainful to do so. As I mentioned above, its trade surplus with the US has widened over the last few years as prices for its exports grow along with quantity. Meanwhile, prices for imports and prices paid for commodities and other natural resources have declined in Yuan-terms. For that reason, I think China will probably continue to stick its current policy, and allow the RMB to continue to slowly inch up.