Forex Volatility to Remain High

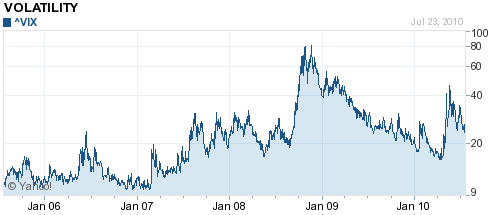

With the onset of the Eurozone sovereign debt crisis this year, volatility levels in forex (as well as in other financial markets), surged to levels not seen since the height of the credit crisis. While volatility has subsided slightly over the last few months, it still remains above its average for the year, and significantly above levels of the last five years.

The spike in volatility was easy enough to understand. Basically, the possibility of a default by a member of the EU or even worse, a breakup of the Euro created massive uncertainty in the markets, spurring the flow of capital from regions and assets perceived as risky to those perceived as safe havens. As you can see from the chart below, this trend has begun to reverse itself, but still remains prone to sudden spikes.

While the crisis in the EU seems to have (temporarily) settled, investors are attuned to the possibility that it could flare up again at any moment. A failed bond issue, a higher-than-forecast budget deficit, political stalemate, labor strikes – all signal a failure to resolve the crisis, and would surely trigger a renewed upswing in volatility and sell-off in risky assets.

The same goes for (unforeseen) crises in other regions, affecting other currencies. Muses one analyst: “Next week? Who knows. One strong candidate is for flight out of the yen as investors start to fear there won’t be enough domestic demand for mountains of Japanese debt and foreign buyers will insist on much higher yields. Another might be that Swiss banking exposure to insolvent east European households causes another banking crisis.” Don’t forget about the UK and US, both of which have hardly put the recession behind them, and whose Trillions in debt represent powder kegs waiting to explode.

It will be months or years before these latent crises even begin to manifest themselves, let alone achieve some kind of resolution. As a result, many analysts predict that volatility will remain high for the foreseeable future: “Big and sudden currency market moves shouldn’t come as a surprise, whatever the direction…Higher market volatility should follow on from greater macroeconomic volatility. Increased economic fluctuations increase uncertainty. And there’s no question macroeconomic volatility has risen.”

In addition, there is no way for governments for Central Banks to alleviate these crises due to the “Trillema of International Finance.” Greg Mankiw, Harvard Economics Professors, explains that in prioritizing an independent monetary policy and open capital markets have forced many countries to forgo exchange rate stability: “Any American can easily invest abroad…and foreigners are free to buy stocks and bonds on domestic exchanges. Moreover, the Federal Reserve sets monetary policy to try to maintain full employment and price stability. But a result of this decision is volatility in the value of the dollar in foreign exchange markets.” While the Euro has eliminated exchange rate fluctuations between members of the Eurozone, meanwhile, there is nothing that the ECB can (or desires to) do to minimize volatility between the Euro and outside currencies.

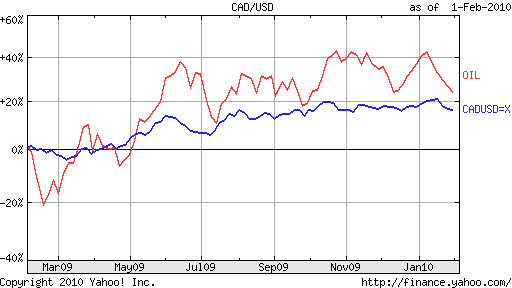

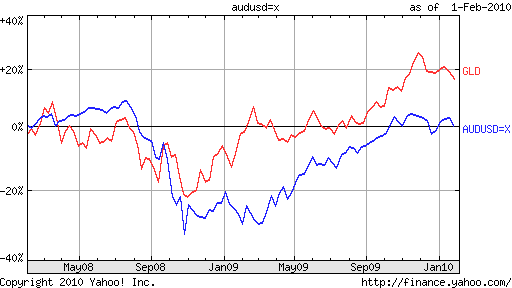

From the standpoint of forex strategy, there are a couple of lessons that can be learned. First of all, the carry trade will remain underground until volatility returns to more attractive levels. Until then, the potential gains from earning a positive yield spread will be offset by the possibility of sudden, irascible currency depreciation. Second, growth currencies – despite boasting strong fundamentals – will remain vulnerable to sudden declines. That doesn’t mean that they should be avoided; rather, you should simply be aware that small corrections could easily turn into multi-month weakness.

—

—  —

—  —

—  —

—