September 21st 2009

Dollar Down, Everything Else Up

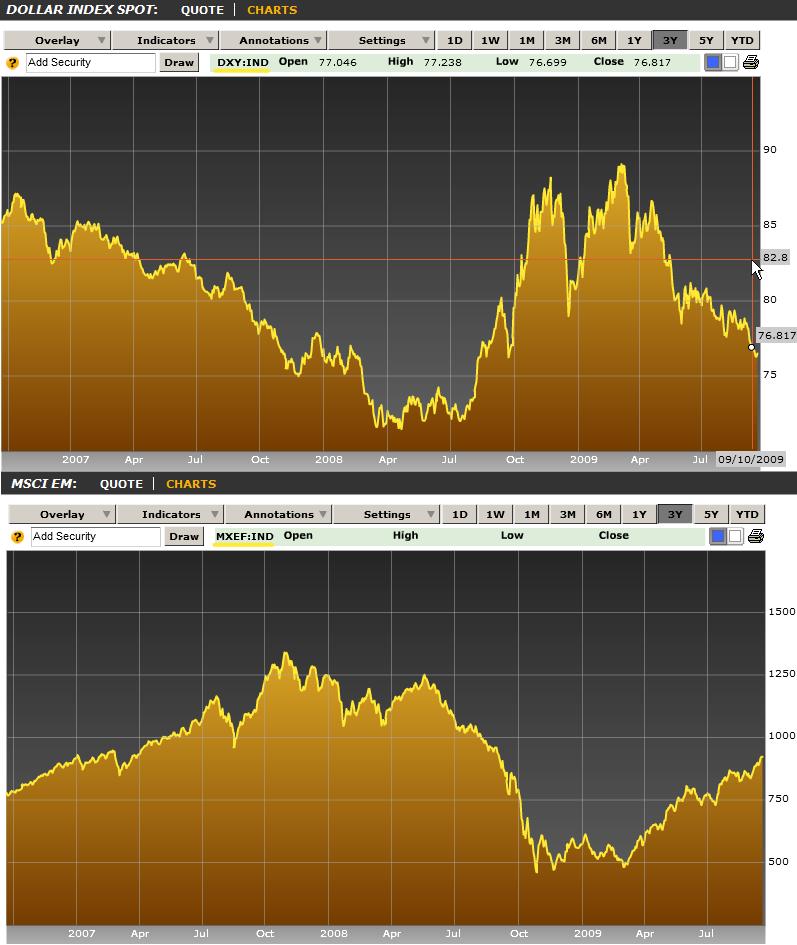

Since March, the financial markets have been characterized by several generalizable trends, which can pretty accurately be distilled into the title of this post: Dollar Down, Everything Else Up. To illustrate just how intertwined these two trends are, consider that on the same day, “U.S. stocks rose, sending the Standard & Poor’s 500 Index to an 11-month high,” and “The dollar slid to an almost one-year low.” Two perfect to be a coincidence. Look at the charts below, which show the performance of the US Dollar and Emerging Market Stocks, respectively. Subtract out the stochastic fluctuations, and you’re left with two mirror images!

In this case, connecting the dots is not difficult. In fact, I don’t know of any analyst that has argued against an airtight inverse correlation between the Dollar and virtually every other commodity/security/currency. A solid explanation can be found in an earlier Forex Blog post “Dollar Under Pressure on All Fronts,” which detailed both the short-term and long-term drags on the Dollar, but I’ll summarize and expand upon it below for those of you who didn’t read the first iteration.

In the short-term, the Fed’s easy monetary policy is one of the most salient factors. It has injected more than $2 Trillion in US capital markets since the start of the credit crisis, and lowered interest rates close to 0%. In fact, the Dollar is now the cheapest funding currency in the world, recently eclipsing Japan, the perennial home of cheap capital. Moreover, US rates are expected to remain low for the near future. According to one analyst, “Congressional elections in November 2010 represent a strong incentive for the Fed to stand pat. That is because going into an election, there often is political pressure to keep rates low and give a boost to the economy.” This belief is reflected clear in US Treasury rates, which remain relatively close to the all-time lows touched in 2008.

In other words, it’s a classic carry trade scenario, with the US footing the bill. Of course, there’s a twist, namely that there’s so much cash floating around the system, that all of it can’t be invested abroad. Hence, the whopping 58% rise in the S&P 500, from trough to present, as well as the recovery in gold, oil, and other commodity prices. You will find plenty of analysts who point to impressive graphs and quote equally impressive statistics to explain these seemingly distinct instances of appreciation. But from where I’m standing, the fact that everything is under the sun (except for real estate, but that’s another story) is rising would lead the proverbial alien watching from outer space to conclude that investors have adopted a bubble mentality, and are once again chasing returns wherever they can be found.

The strongest support for this explanation can be seen in the fact that signs of US recovery have not been accompanied by Dollar strength. By most estimations, the US economy is now stronger (despite the employment picture) than the UK and the EU, at the very least. Yet the Euro and British Pound have far outpaced the Dollar over the last few months, picking up steam once again over the last few weeks.

You don’t need me to tell you that this is a product of risk aversion; that, ironically, signs that the US economy is strengthening/stabilizing causes investors to move capital out of the US economy. If investors were betting on fundamentals, as stock market bulls would have you believe, this would be plain irrational. But the fact is, US economic growth makes investors more confident in global growth, and causes them to turn towards more speculative investments to achieve yield.

In analyzing whether this phenomenon is sustainable, then, it doesn’t make sense to look at the different markets, in isolation. Rather, you must be holistic in your approach, basically by examining whether investors are justified in their overall complacency. If ever it was the case, it certainly is now: perception is reality.

September 26th, 2009 at 12:02 pm

[…] Archives « Dollar Down, Everything Else Up | Home […]

November 11th, 2009 at 12:17 am

[…] two months ago, I wrote a series of posts (Dollar Down, Everything Else Up and Dollar Down, Gold Up) with self-explanatory titles. Last week, the Wall Street Journal finally […]