A Return to the Gold Standard?

In my last post, I explored the possibility that the role of the Chinese Yuan (CNY) will expand to the point that it could rival – or even overtake – the US Dollar as the world’s preeminent reserve currency. Ultimately, I concluded that the constraints on widespread foreign ownership of CNY assets are too great, and that as a result, the Dollar’s position is safe for the time being. What about the notion that all currencies are doomed? In this case, the biggest threat to the US Dollar won’t come from China, but rather from gold.

This possibility is no longer hypothetical. James Grant (of the eponymous Grant’s Interest Rate Observer) has for many years tried to advance the case for a return to the Gold Standard. In a much-discussed editorial in the NY Times, Grant reiterated the idea that Central Banker are increasingly out of touch with economic reality, and lack any checks on their ability to print money and debase their respective currencies. Grant singles out the Fed for its non-stop quantitative easing programs, which could lead to hyper-inflation and foment additional asset bubbles. At the very least, it will cause the Dollar to lose even more of its value.

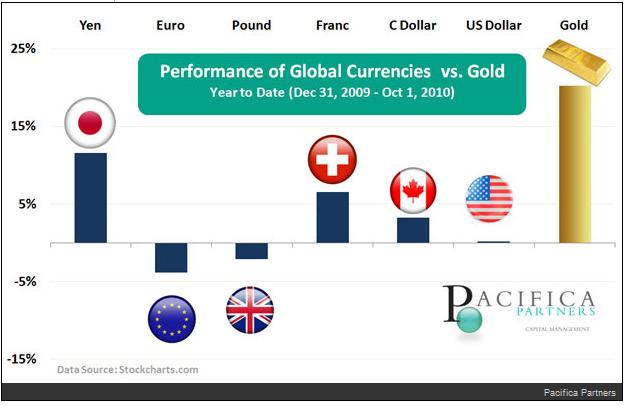

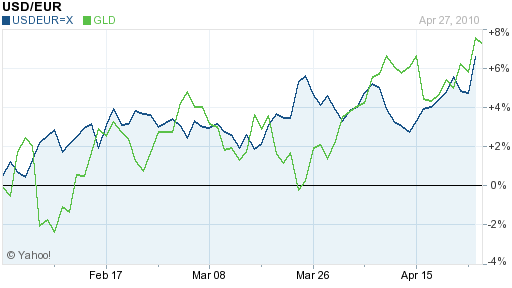

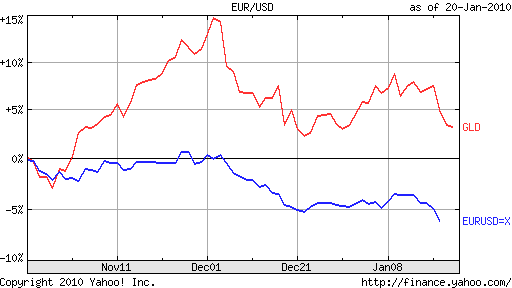

Grant’s editorial coincided perfectly (perhaps deliberately) with a proposal by Robert Zoellick, president of the World Bank, to reform the global economic system, with the goal of reducing economic imbalances. While most of Zoellick’s ideas are common-sense, his proposal to “build a co-operative monetary system that reflects emerging economic conditions.” and “consider employing gold as an international reference point of…currency values” stood out. While his comments created a veritable firestorm, they were grounded firmly in the reality that gold prices are rising and faith in the current fiat monetary system is declining.

The theoretical advantages and disadvantages of the gold standard have been mooted ad nauseum, and I don’t want to rehash all of them here. In sum, a gold standard is believed to be promote long-term price stability, eliminate hyper-inflation, a check on government debt issuance, and a transfer monetary power from Central Banks to the people (via the markets). Downsides include short-term price volatility, a heightened possibility of deflation, and the repudiation of modern monetary policy. Given the fact that paper currency in circulation vastly exceeds the supply of gold, a transition to the gold standard would be difficult to implement and would probably cause a substantial rise in the price of gold.

Personally, I’m not convinced that a return to the gold standard would promote economic/financial stability any more than the fiat money system. For example, just as large financial institutions dominate the current system, so they would be likely to dominate any other system, leading to the same lack of transparency and democracy. In addition, gold can also be lent out (with interest), leading to a similar propensity for asset bubbles and economic imbalances of every kind.

Just like currencies have relative value today (in terms of other currencies, commodities, assets, labor, etc.), so does gold. In that sense, saying seven units of gold is enough to buy a house is not really that different from saying it costs 10 units of paper currency to buy that same house. For instance, if Chinese producers charge 1 gold coin for their widgets while American producers charge 2, it will still result in a trade imbalance that will only correct when the Chinese standard of living catches up to the US standard of living.

Finally, gold is arbitrary. Why not a platinum standard or an oil standard? Based on the scarcity of those resources, prices would vary accordingly, much as they do under the paper currency system. Not to mention that gold is incredibly unwieldy, which means that it would be digitalized and used electronically just like paper currencies.

You could argue that this is actually a benefit of the gold standard, since it would be compatible with the current economic system, but at least it would lead to financial stability. Maybe I’m in denial like Ben Bernanke, but I just don’t see gold as the solution. Asset bubbles inflate, and then they collapse. Economic imbalances will persist for as long as they are allowed to. If emerging market exporters get tired of receiving Dollars for their wares, then they will stop accepting it, the Dollar’s value will crash, and the US economy will have to rebalance itself. In a perfect world, there would be no irrational exuberance. In reality, the current system will persist, and life will go on.