October 24th 2010

Currency War Devalues all Currencies…Except for Gold

Have you ever heard currency cheerleaders rave about how unique forex is because there is never a bear market? Since all currencies trade relative to each other (when one falls, another must necessarily rise), it couldn’t be possible for the entire market to drop at once, as happens with other financial markets. The ongoing currency war might be turning this logic on its head, as currencies embark on a collective downward spiral. Profiting in this kind of market might involve exiting it altogether, and turning to Gold.

For those of you who haven’t been following this story, a handful of the world’s largest Central Banks are now battling with each to see who can devalue their currency the fastest. [Of course, this war is being couched in euphemistic terms, but make no mistake: it is indeed a form of battle]. The principal participants are emerging market economies, which worry about the impact of rising currencies on their export sectors. However, industrialized countries have also intervened directly (namely Japan) and indirectly (US, UK).

Among the major currencies, there are only a few that continue to sit on the side-lines, including the Euro (to a certain extent), Canadian Dollar, and Australian Dollar. For as long as the currency war continues, these currencies and the handful of emerging market currencies that have forsworn intervention will be the winners (at least from the point of view of speculators that deliberately bet on them).

Then there are those that believe all currencies will suffer, and that even the currencies that are still rising are actually depreciating in real terms (due to inflation). Those who harbor such beliefs will often try to short the entire currency market, usually by betting on commodities or heavy metals, of which Gold is probably the most prominent.

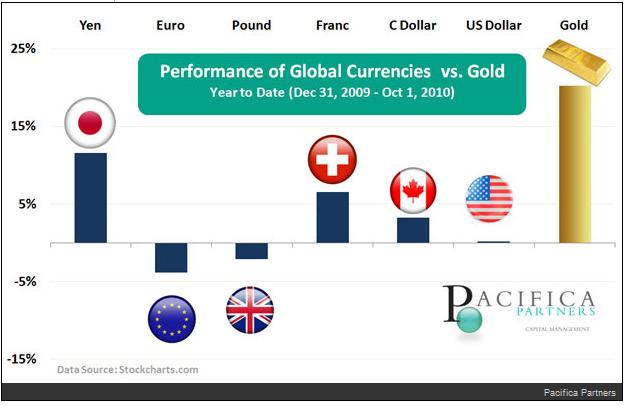

The price of Gold has risen more than 20% this year (in USD terms). Its backers claim that it is the ultimate store of value (where this derives from is unclear), and defend its lack of utility and inability to accrue interest by arguing that its appreciation is more than enough of a reason to own it. When you look at the performance of gold over the last five years, you begin to wonder if maybe they have a point.

Interest in Gold as an investment has surged in the last couple years (and especially the last few months), as the currency wars have heated up and the Federal Reserve Bank contemplates an expansion of its Quantitative Easing program (dubbed” QE2″). On the one hand, the notion that the only way to defend against real currency devaluation is to own “alternative” currencies is well-founded. On the other hand, regardless of the fact that the Fed has already minted $2 Trillion in cash and that the US national debt is expanding by $1 Trillion per year, inflation in the US is low. In fact, it’s at a 50-year low, and at an annualized .9%, it’s practically non-existent. You would think that with Gold’s unending appreciation, we would be in the midst of hyperinflation, but that’s simply not the case.

In the short-term, then, there’s really not a strong fundamental basis for investing in gold. That’s not to say that it won’t continue to appreciate and that investors will continue to buy into it merely to benefit from what has become self-fulfilling appreciation. From where I’m sitting, though, there’s really no foundation for this appreciation. Consider, for example, that gold investors still have to convert their gold back into paper currency in order for it to to be “used;” otherwise, it offers no benefit to the owner except that it looks pretty (though most investors wouldn’t know, since they buy gold indirectly). Not to mention that if/when the Dollar stops depreciating, there really isn’t really a justification to buy gold as a short-term store of value.

Over the long-term, the picture is certainly more nuanced. I’m not going to explore the viability of fiat currencies here, but suffice it to say that, “Positioning for significantly higher gold prices over the long run demands a very bold strategic bet: that the global monetary system as we know it will completely break down and be replaced with a gold standard.” Regardless of the merits of this point of view, those that invest in Gold should at least understand that this is really the only justifiable reason to hold it. Those who are buying it because of the ongoing currency war will be disappointed.

October 24th, 2010 at 1:37 pm

I agree. The fiat currency system is designed so that currencies and stocks produce a return, but commodities don’t. Unless you think that system is coming down (which is a very bold statement) then the only logical conclusion is that gold is a bubble (unless the high prices are a result of the actual demand for it’s usefulness).

October 24th, 2010 at 11:35 pm

All currencies can’t devalue at the same time against each other. But if most major countries are running the “print print print” strategy then of course that can drive up the prices of commodites. And if interest rates are held near 0 then it should be no surprise if that formula creates large volatile speculative bubbles in commodities.