October 21st 2010

Euro Due for a Correction

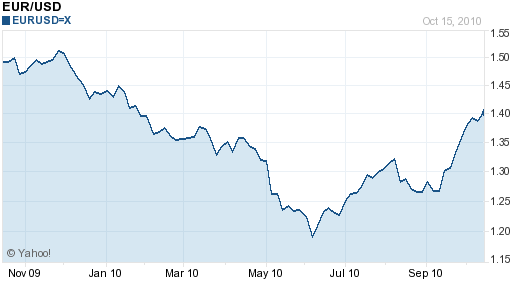

Since touching a four-year low in June, the Euro has risen a whopping 19% against the Dollar – a veritable surge! One has to wonder, however, if perhaps the Euro hasn’t gotten ahead of itself in its race back upward.

The Euro’s nonstop rise has perplexed me. During the throes of the Eurozone Sovereign debt crisis, it seemed as if the Euro was headed back towards parity, if it even remained in existence! The European Commission’s $500 Billion bailout plan seemed to assuage the markets, but didn’t do much to mitigate against the risk of sovereign default. Besides, it looks like all of the austerity measures will be undone after the next election cycle. Opposition to further budgets is so vehement, and unemployment is so high (12% in Greece, 20% in Spain) that it will be difficult for leaders to stay in office if they continue to push an agenda that reduces their deficits.

As evidence that bond investors remain skeptical, consider that Greek debt still trades at a 700 basis point premium to German bonds. EU cheerleaders love to point to the fact that at-risk Eurozone countries are having no trouble tapping the credit markets, but that’s not really surprising when you consider the lofty returns that investors receive for buying bonds that are essentially backed by the good credit of the EU.

Even ignoring the fiscal problems of the EU, the economic picture is not pretty. “The Economist Intelligence Unit, in its just-released report…is forecasting that growth in Western Europe will reach only 1.1% next year, and at or below 1.7% at least through 2015, beyond which it wisely declines to look.” When you subtract out Germany – the engine of the EU economy – GDP growth will be even more pathetic. And don’t even mention the peripheral economies, many of which are at serious risk for sliding back into recession.

Moreover, the European Central Bank (ECB) monetary policy is just as loose as in other industrialized countries. Through its quantitative easing program, the ECB has injected hundreds of billions of Euros into the banking system and credit markets. Jean Claude Trichet, President of the ECB, bristled at the idea of ending this support: “No! This is not the position of the Governing Council, with an overwhelming majority.This non-standard measure…was designed to help restore a more normal functioning of our monetary policy transmission mechanism.”

On the other hand, the ECB is sterilizing all of its market intervention, which means that most of the funds that it is injected into the economy will remain in the EU. Contrast this with the Fed’s quantitative easing program (which hasn’t been sterilized) and you begin to understand why the Euro has held up well. In addition, Eurozone inflation currently exceeds US inflation (at a 50-year low), which means that the ECB will hesitate before following the Fed in easing monetary policy further.

Still, I don’t think there is a strong foundation for the Euro’s rise. It’s understandable that the expansion of the Fed’s quantitative easing program (“QE2”) is making investors nervous, causing them to send cash out of the US as a preventative measure. However, this seems a little too much like the tail wagging the dog, since until QE2 is officially implemented, all anticipatory shifts in capital flows are purely speculative – not fundamental. And as a fundamental analyst, that concerns me.

I think investors got ahead of themselves when they pushed the Euro down 20% over the first half of 2010, but now they are in danger of making the same mistake, and are pushing the Euro too far in the opposite direction. According to the most recent Commitment of Traders report, investors are building up long positions in the Euro, to the point that trading is becoming lopsided. I’m not much for short-term technical analysis, but when the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both approaching 2-year highs, it tells me that a correction is coming.