Is Gold a Hedge Against Inflation and Currency Weakness?

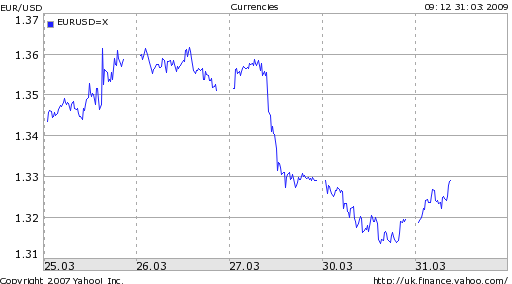

Until the Fed announced an expansion of its quantitative easing program two weeks ago, gold had begun to fade into relative obscurity. Sure, gold had risen in value from a low of $710/ounce back up to $900/ounce, but prices were still off 10% from the highs reached in 2008. Meanwhile, risk aversion had begun to decline and the stock market had begun to rise, such that pundits were talking more about stocks and less about gold.

Since the Fed’s announcement, however, gold has been thrust back into the spotlight. The same trading session that saw a record fall in the Dollar and a record rise in Treasury prices, also witnessed a 7% spike in gold futures prices. ” ‘Money is being pushed into the system and that’s creating the inflationary threats that the markets are contemplating…Commodities are a decent way to hedge against that potential threat,’ ” observed one trader.

Other analysts, however, caution that rising gold prices are a sign of the fear/crisis mentality, not inflation. “There are just not a lot of alternatives for global investors. You will see more and more investors moving into gold as a safe haven, and you will see more institutions putting money into commodities indexes.” In other words, gold is being driven by the safe-haven trade, which is evidenced by an increasing correlation with Treasury bonds. One commentator calls it a hedge against uncertainty: “The demand for gold is for gold coins, a massive flurry of bullion buying by ETF’s (and investors), and the institutions and traders buying the hell out of it. The reason is simple… pure fear.”

With the exception of the perennial gold bulls and conspiracy theorists, the short-term consensus is that due to “massive spare capacity now opening up in the global economy, soaring unemployment and a dysfunctional banking system – it would be very hard for central banks to generate a surge in inflation even if they wanted to.” This analyst further argues that the Fed is undertaking the expansionary program under the implicit assumption that it will have to siphon this money out of the financial system, if and when the economy recovers.

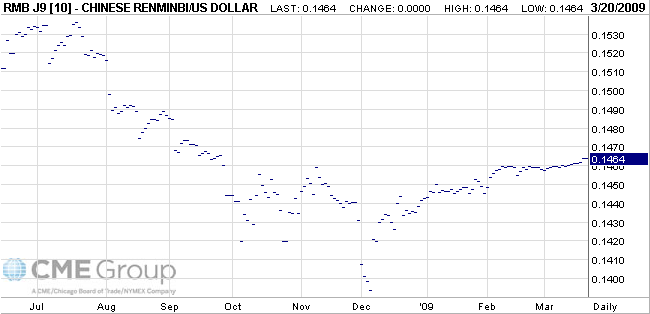

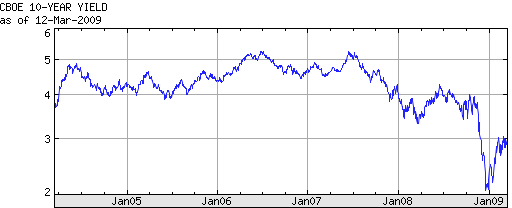

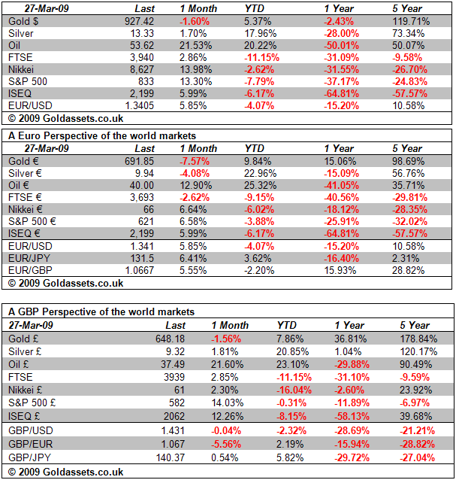

Of course, there is not even a consensus that gold is a good hedge against inflation. Mike Mish points out that the correlation between the US money supply and the price of gold is not very robust. When examined relative to a basket of currencies (rather than the Dollar), however, the relationship suddenly becomes much stronger. Especially when you filter out fluctuations in the value of the Dollar (which is affected by many factors unrelated to inflation), “gold is doing a reasonably good job of maintaining purchasing power parity on a worldwide basis.” This can be seen in the following chart:

Ascertaining a relationship ultimately depends on the time period of analysis, and the currency(s) in which prices are being tracked. Given also gold’s notorious volatility, it probably makes sense to use special inflation protected securities, rather than gold, as an inflation hedge.

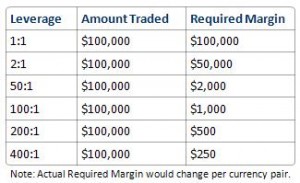

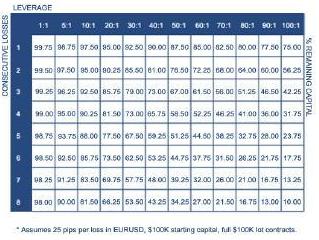

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 – 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (one Pip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be

While traders can theoretically use margin to trade any kind of financial instrument/security, leverage is especially common in forex. The reason is that currencies are typically bought and sold in units of 50,000 – 100,000, which is more than retail traders can afford, or are willing to commit. Moreover, currencies are not as volatile (outside of the credit crisis, that is) as other securities, and typically don’t fluctuate more than 1% in a given day. Changes are often so minuscule that 1/10000 of a unit (one Pip) has become the benchmark for measuring fluctuations. Accordingly, “currency transactions must be  To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a

To give you an idea as to how excessive forex leverage has become, consider that the Financial Industry Regulatory Authority (FINRA) recently submitted a

Even ignoring the potential political fallout from forex reserve diversification, such a move doesn’t really make practical sense. First of all, there isn’t a buyer sufficiently capitalized to relieve China of its US Treasury burden. “If China decided to sell off some of its U.S. Treasury holdings, it would scarcely be able to dump that in large blocks. And a partial selloff would surely lead to a slump in the Treasury market,

Even ignoring the potential political fallout from forex reserve diversification, such a move doesn’t really make practical sense. First of all, there isn’t a buyer sufficiently capitalized to relieve China of its US Treasury burden. “If China decided to sell off some of its U.S. Treasury holdings, it would scarcely be able to dump that in large blocks. And a partial selloff would surely lead to a slump in the Treasury market,