March 30th 2009

ECB Prepares to Lower Rates, Euro Rally Fades

On Thursday, the European Central Bank will conduct its monthly monetary policy meeting. The consensus among analysts is that the meeting will lead to a 50 basis point cut, leaving the EU’s benchmark lending rate at 1%, a record low. Investors are also bracing for the ECB to announce certain unconventional steps, similar to the Fed’s program of quantitative easing, although not to such an extent. Analysts have speculated that the ECB “could intervene in bond markets to help ease companies’ financing problems.”

This marks an about-face from current policy and recent rhetoric, in which the ECB insisted that guarding against inflation was more important than providing economic stimulus. In fact, Jean-Claude Trichet, President of the ECB, has recently found himself on the defensive: “I don’t think it is justified to say we are doing less on this side of the Atlantic. We have automatic stabilizers,” he said during his quarterly testimony in front of European Parliament. In fact, the ECB had become an outcast among Central Banks for waiting a long time before finally agreeing to cut interest rates. Since embarking on a program of monetary easing, it has been playing catch-up by cutting rates at breakneck speed.

It appears that the ECB’s arm was twisted by the most recent economic data; a sudden drop in German manufacturing suggests that the recession is both spreading and deepening. Combined with a record drop in the EU economic sentiment, this “suggests that the euro zone economy will have contracted by roughly 2 percent quarter on quarter in the first three months of the year.” In addition, both producer and consumer prices have eased, such that inflation has fallen well below the 2% target level, and the ECB lost its last excuse for not dropping rates.

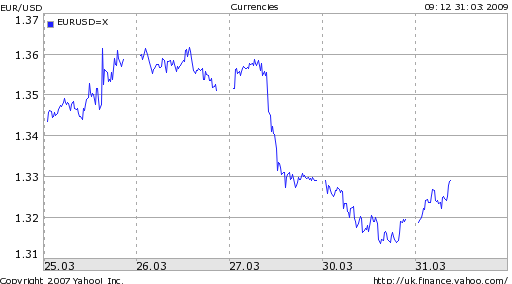

As a result both of the worsening economic situation, as well as the projected decline in yields, currency traders are once again questioning the Euro. The last couple weeks have been rife with commentary that the Dollar rally had come to an end as a result of the intensification of the Fed’s plan to use newly printed money to as a source of liquidity in the credit markets. “The dollar’s traditional trading patterns have been altered in the wake of new U.S. quantitative-easing measures. Risk appetite, stocks and funding currencies appear to hold lesser influence lately.”

This week, the narrative in forex markets favors the Dollar. It could be that the safe-haven trade has returned to lift the Greenback, but more likely is that investors are comparing economic fundamentals when making bets on currencies. One analyst summarized his firm’s position as follows: “We have argued that the leveraging-de-leveraging axis has been the key driver in the foreign exchange market. We expect a new driver, anticipated growth trajectories, to emerge…[and] for the dollar’s uptrend to resume in the second quarter.”

March 31st, 2009 at 1:10 pm

Expect the decline in the Euro to continue for the most part of the next 6 weeks, until Germany has its election and gets their heads out fo their butts!

April 1st, 2009 at 3:56 am

A weaker Euro is Europe’s interest in order to help exports. But they move so slowly, so I doubt that QE is a mesure they’ll take.

April 26th, 2010 at 8:10 pm

Hello,

I have been studying and lightly trading in the forex market for the past 2 years. My first venture started w/ $300 and turned into 3K in about 5 months. I lost it all when the SEC prohibited shorting of over 900+ financials. I was at work and did not place a stop loss. lesson learned the hard way. I finally licked my wounds and started trading this past March. My question is: Are the auto trading programs legit? I’m not asking the pitchmen for such programs. Do novice traders use them? Please email me at gmbyers2004@yahoo.com if anyone have serioius and truthful experience using auto trading programs.

Thank You,

GB