March 4th 2009

Forex Achieves New Prominence

The credit crisis has resulted in a collapse in prices for nearly every type of investable asset class (i.e. stocks, bonds, commodities, real estate)- with the notable exception of one: currencies. Of course, this is an inherent quality of forex: a rise in one currency must necessarily be offset by a fall in another currency. While you are probably rolling your eye at the obviousness of this observation, it is still worthwhile to make because it implies that there is always a bull market in forex. Accordingly, capital from both institutions and retail investors continues to pour in to the forex markets, causing daily turnover to surge by 41% (according to one survey), which would imply a total of $4.5 Trillion per day!

Investment banks, especially, are trying to increase their forex business in order to compensate for a decline in other divisions. Said one representative: “We have probably made more of an aggressive leapfrog in growing our revenue base, which has virtually doubled in 2008 versus 2007. With the situation that has been developing over the past six months, where banks are clearly re-embarking on a new role leading back to basics, foreign exchange has to be one of the products that tops that list.”

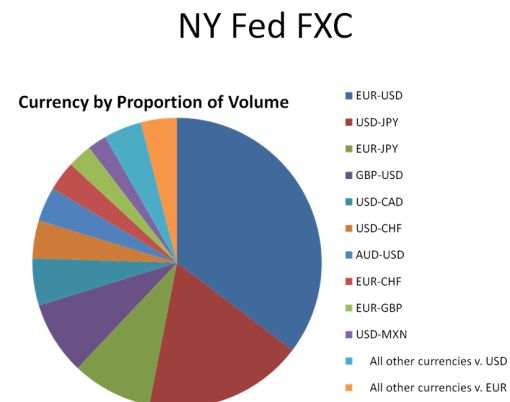

Based on New York data, which generally reflects global forex activity, transactions between the Dollar, Euro, and Yen (i.e. not involving outside currencies) now account for more than half of the total.

Contrary to popular belief, however, most foreign exchange transactions involve derivatives, rather than spot trades. In the case of swaps, it is the nominal value of the swap that is reported, which well exceeds the total amount of currency that is exchanged, and thus results in an inflated estimate of total daily turnover. Regardless, all measures point to increasing volume.

One would expect that the increase in both liquidity and the role of derivatives in forex markets would result in a corresponding decrease in volatility. Of course, this is quickly belied by the turbulence of the last six months, in which many currency pairs set daily, weekly, and/or monthly records for fluctuations and volatility.

I recently read an article about so-called “predictive markets,” which use a grassroots approach to make forecasts by “by giving people virtual trading accounts that allow them to buy and sell “shares” that correspond to a particular outcome. Shares in an outcome that is considered more likely to occur then trade at a higher price than those that represent a less likely outcome.” Given that the forex ‘experts’ are almost invariably wrong, I think this idea has tremendous potential to make forex markets even more transparent. Of course, that also means that it will become more difficult to turn a profit, which is why “it’s vitally important to be well-informed when investing in forex so as to enter and exit trades only at levels that are ‘fundamentally’ sound.”

March 5th, 2009 at 12:06 am

Really great info, but lately I just stay a side, wait and see only. Cause the economic are not really in a good shape.

Thanks for the great info.

March 8th, 2009 at 10:59 am

[…] now seems that investors are shifting to Forex: the Forex Blog reports that Forex Volume could be as high as $4.5 trillion dollars! It is based on data from 2007 and a […]

March 12th, 2009 at 6:26 am

very attractive info and i agree with FreedFX, many investors just waiting and looking only because of uncertain global economy state.

btw thanks for sharing a good info

March 15th, 2009 at 9:59 pm

Because of the current volatility in the markets, forex in my opinion is the best option available at the moment as you can trade both ways. As a scalper, this kind of volatility is where I trade in.