Pound Stagnates, Lacking Direction

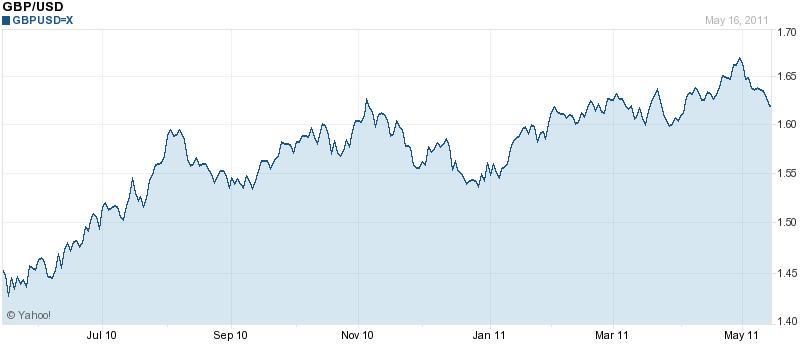

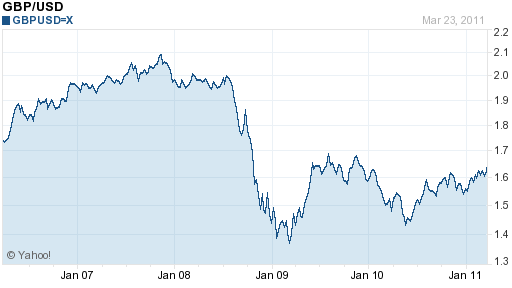

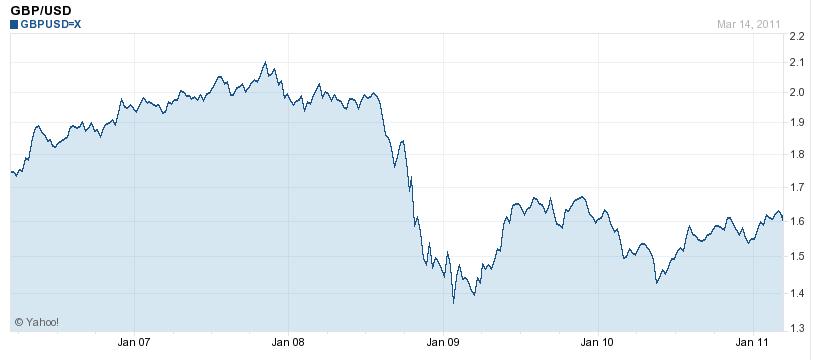

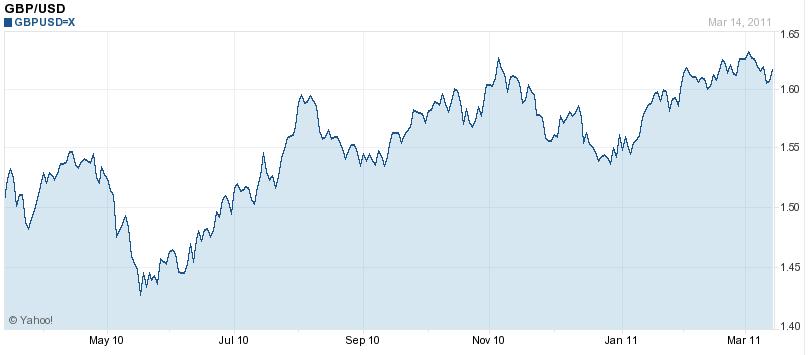

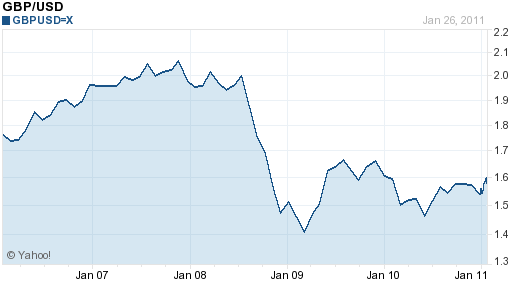

The British Pound has struggled to find direction in 2011. After getting off to a solid start – rising 4% against the US dollar in less than a month – the Pound has since stagnated. At 1.625 GBP/USD, it is now at the same level that it was at five months ago. Given the paltry state of UK fundamentals, the fact that it still has any gains to hold on to is itself something of a miracle.

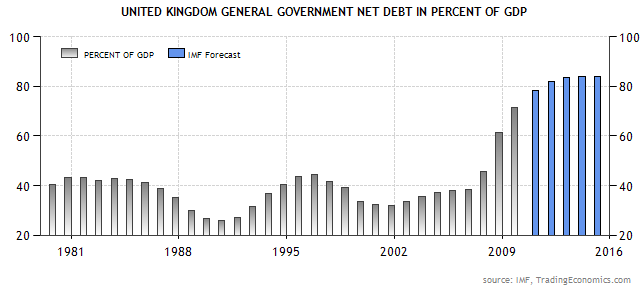

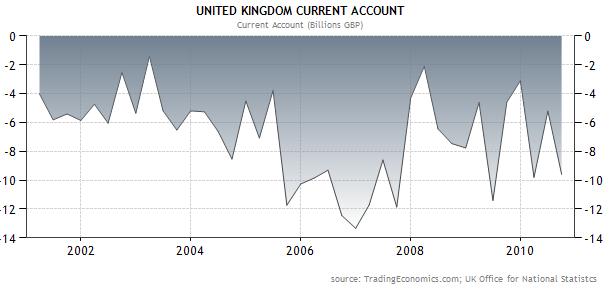

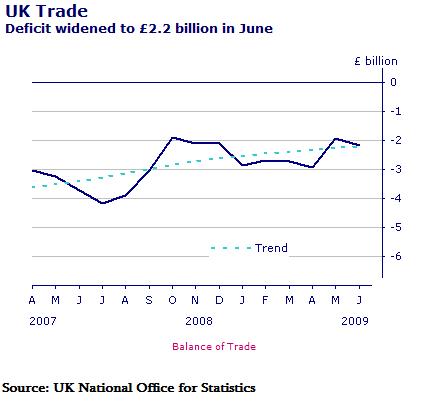

The Pound’s failure to make any additional headway shouldn’t come as a surprise. First of all, the Pound is not a safe haven currency. That means that the only chance it has to rise is when risk is “on.” Unfortunately, the Pound also scores pretty low in this regard. Annual GDP growth is currently a pathetic .5%, and is projected at only 1.8% for the entire year. Inflation is high, and both the trade balance and the current account balance are in deficit. Deficit spending has caused a surge in government debt, and there is a possibility that the UK could lose its AAA credit rating.

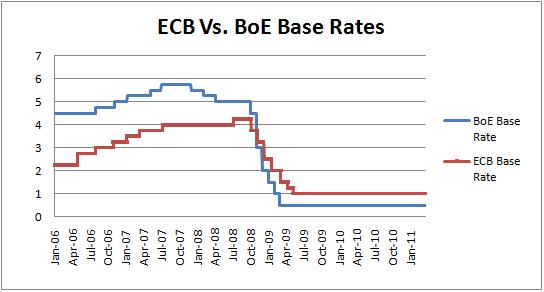

Investors might be willing to overlook all of this if interest rates were at an attractive level. Alas, at .5%, the Bank of England’s (BOE) benchmark rate is among the lowest in the world. Moreover, it isn’t expected to begin hiking rates for many months, and even then, the pace will be slow. Simply, the economy is too fragile to support a serious tightening of monetary policy. Interest rate futures reflect a consensus expectation that rates will be only 75 basis points higher one year from now.

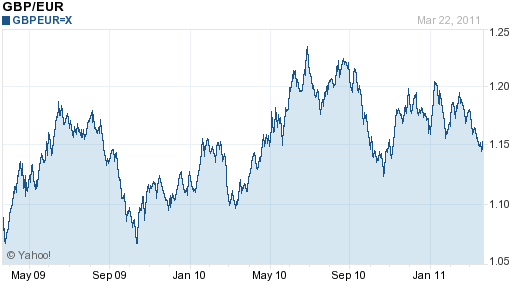

If that’s the case, why hasn’t the Pound crashed entirely? To be fair, the Pound is losing groroundround against both the euro and the franc, the former of which has it bested in economic grounds while the latter is cashing in on its status as a safe haven currency. On the other hand, the Pound is still up for the year against the US dollar and Japanese Yen, both of which are also safe haven currencies.

It could be the case that the Pound is simply not the ugliest currency, since all of the charges that can be leveled against it can similarly be leveled against the dollar. Head-to-head, it’s actually quite possible that the Pound still wins, if only because its interest rates are slightly higher than the US. Or, it could be the case that investors still believe the BOE will come around and begin hiking rates. After all, at the beginning of the year (when by no coincidence, the Pound was still rising), expectations were that the BOE would have already hiked twice by this time, bringing the benchmark to a level that would make the Pound attractive to carry traders. While the BOE hasn’t followed through, carry traders may be sticking around, since the opportunity cost of holding the Pound is basically nil.

As for whether the Pound correction (that I first observed last month) will continue, that depends entirely on the BOE. Unfortunately, there is very little reason to believe that the UK economy will suddenly pick up, and hence very little reason to expect the BOE to suddenly tighten. At some point, earning .5% interest on Pounds will become unattractive to investors. Until that day comes, that might stick with the Pound out of sheer inertia. While the Pound may hold its value for this reason, I don’t think it has any hope of appreciating further this year.

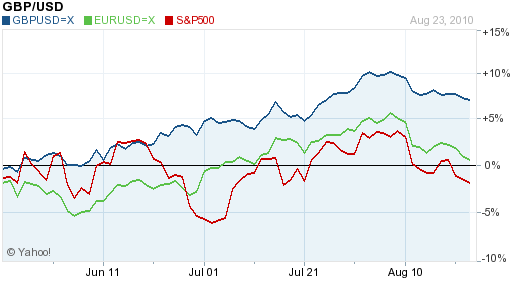

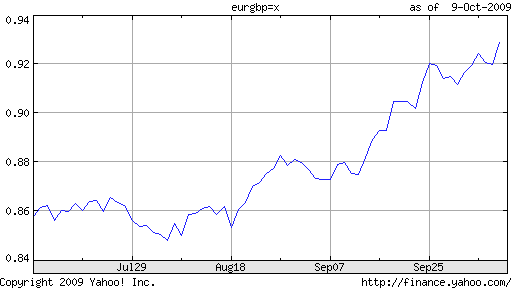

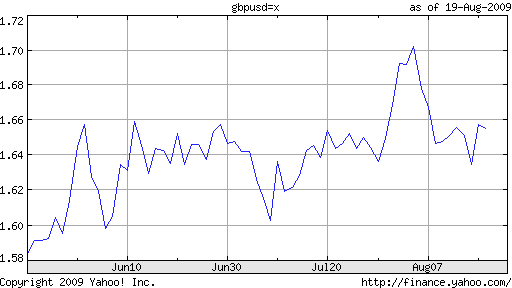

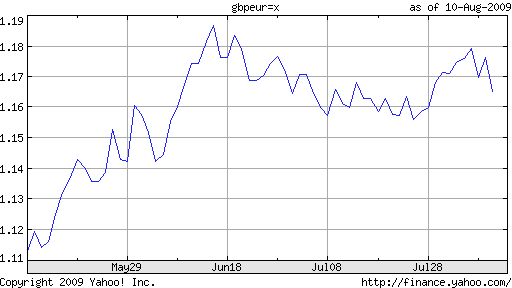

A theme in forex markets (as well as on the Forex Blog) is that as the Dollar has declined, virtually every other asset/currency has risen. The rationale for this phenomenon is that the global economic recovery is boosting risk appetite, such that investors are now comfortable looking outside the US for yield. However, this market snapshot may have to be tweaked slightly, in accordance with a recent WSJ article (

A theme in forex markets (as well as on the Forex Blog) is that as the Dollar has declined, virtually every other asset/currency has risen. The rationale for this phenomenon is that the global economic recovery is boosting risk appetite, such that investors are now comfortable looking outside the US for yield. However, this market snapshot may have to be tweaked slightly, in accordance with a recent WSJ article (

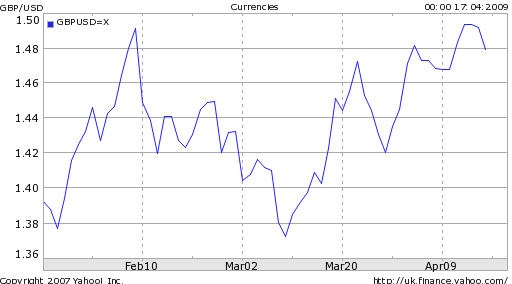

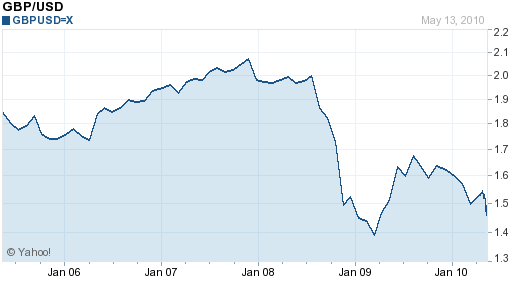

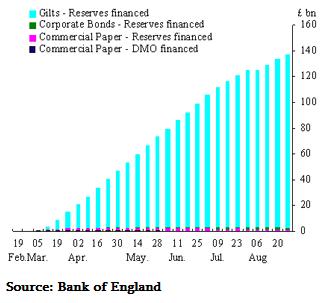

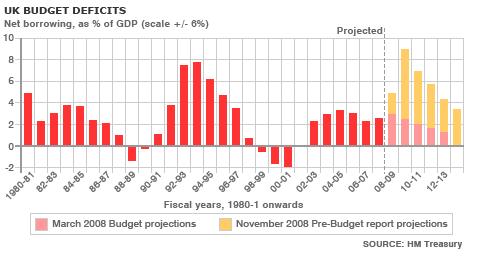

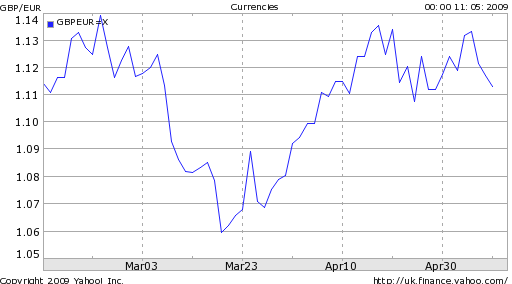

In short, there is potentially more downside than upside to these efforts, especially as far as the Pound is concerned. The BOE’s easy money policy makes the Pound an unattractive buy in the short term, while its QE program could stoke inflation in the long-term, without much benefit to the economy. Furthermore, it will be difficult to rein in this program because of the perennial budget deficits of the government, which “must sell about 900 billion pounds of gilts over five years…The Bank of England will buy a third of these gilts.” The recent rise in government bond yields as well as the rising cost of bond insurance (i.e. credit default swap premiums) confirm that investors are growing increasingly nervous. According to a

In short, there is potentially more downside than upside to these efforts, especially as far as the Pound is concerned. The BOE’s easy money policy makes the Pound an unattractive buy in the short term, while its QE program could stoke inflation in the long-term, without much benefit to the economy. Furthermore, it will be difficult to rein in this program because of the perennial budget deficits of the government, which “must sell about 900 billion pounds of gilts over five years…The Bank of England will buy a third of these gilts.” The recent rise in government bond yields as well as the rising cost of bond insurance (i.e. credit default swap premiums) confirm that investors are growing increasingly nervous. According to a

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….

In fact, the Bank of England just announced a huge expansion in its program, increasing total debt buying (i.e. money printing) by $50 Billion. One analyst summarized the impact of this announcement on forex markets as follows: “The Bank of England’s aggressive stance with regard to quantitative easing is adding to concern about the economy and that is negative for sterling.” Not much nuance there….