May 14th 2010

Is There Any Hope for the Pound?

Compared to the Euro, the Pound is Gold (figuratively speaking). Compared to everything else, well, the Pound is probably closer to linoleum. Bad geology metaphors notwithstanding, there really isn’t much to get excited about when looking at the Pound.

Let’s take the election, for example. Originally billed as a chance for a fresh start, politically, for the UK, the election has turned out to be nothing short of disastrous. Rather than producing a clear-cut victory, it has resulted in a hung Parliament. The way talks are currently shaping up, it looks like power will be shared by the Liberal Democrats and Conservatives. This is problematic,because neither party has a clear vision for dealing with the skyrocketing UK national debt; with the two parties working together, meanwhile, a compromise seems even more unlikely. “Investors are worried that a hung parliament will result in a weak government that will be unable to force through measures to reduce the UK’s high borrowing levels.”

As a result, many analysts now believe that the UK could lose its coveted AAA credit rating: “We believe that a downgrade…is more than likely since both parties agree that early expenditure cuts could harm the economy. The alternative could be that both parties agree on tax hikes to be implemented with the next budget. Both outcomes would be equally bearish for sterling.’ ”

Even aside from the imminent UK fiscal crisis, there is the fact that its economy continues to stagnate, its capital markets remain languid, and its balance of trade remains perennially mired in deficit. “Figures from the Office for National Statistics (ONS) showed that gap between the UK’s imports and exports hit a massive £7.5bn in March. The deficit — well ahead of an upwardly revised £6.3bn for |February — came as total imports surged £1.4bn over the month compared with a meagre £200m rise in exports.” From a fundamental standpoint, then, there is very little reason to own the Pound.

The picture is slightly more nuanced, when viewed through the lens of technical analysis. The most recent Commitment of Traders report, meanwhile, has showed short interest in the Pound building to record levels. In addition, the ratio of long/short positions is approaching 5:1. Some analysts believe this is inherently unsustainable, and that as net positions become more lopsided, a sharp reversal becomes even more likely. Then again, some analysts had the same theory about the Euro, which was solidly disproved after the short-squeeze rally was soon followed by a steady decline and a re-accumulation of short positions.

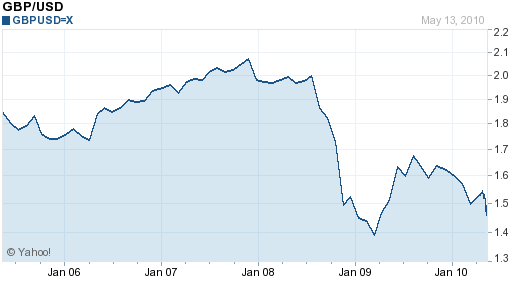

Other technical analysts are waiting to see where the Pound moves in the near-term before placing their bets. ” ‘Last week the market eroded the 15-month uptrend from the January 2009 low at $1.3500’…the $1.4255 Fibonacci level is the last defence for the pound ahead of the $1.3500 2009 low. For the downside pressure to be taken off, key resistance at $1.5055, the May 10 high, would need to break.’ ” The Pound is hovering dangerously close to a number of psychologically important levels. If it breaches $1.40, it would signal a 5-year low. Consider also that the Pound last touched $1.38 in 2001 and $1.35 in 1987.

To be fair, the Pound has hovered around $1.50 for most of the last 20 years, so its current level against the Dollar is not that low, relatively speaking. If investors come to their senses, and realize that the likelihood of UK sovereign default is probably not any higher than the US, and the coalition government is able to produce a convincing plan for reducing the deficit, then the Pound could bounce back. If the safe-haven mentality remains in force, however, the Pound will continue to be one of the big losers.