October 28th 2010

Much Ado About Debt

In addressing the financial/credit/economic crisis, governments around the world have lowered interest rates, bailed-out bankrupt financial insititutions, engaged in wholesale money printing, guaranteed debt, and pumped cash into their economies. However, while such programs may have had some mitigating impact on the crisis, they did little to address the underlying cause. Specifically, debt was merely moved from one institution – one balance sheet – to another. Most of the bad debt that was at the heart of the credit crisis is still outstanding; the only thing that has changed is who is responsible for repaying it.

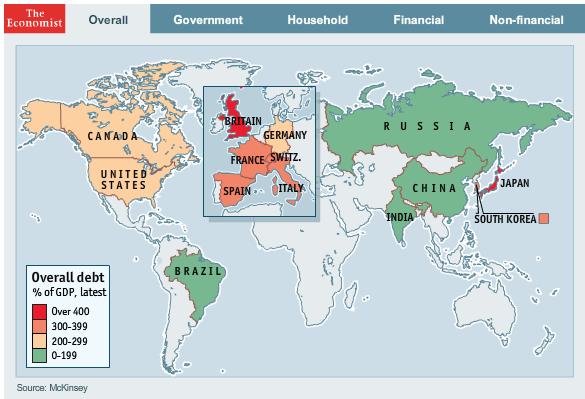

In many cases, it is governments which have assumed ownership of this debt. Fannie Mae and Freddie Mac remain in a US government conservatorship. The Federal Reserve Bank owns more than $2 Trillion in US Treasuries and Mortgage Backed Securities. The European Union has agreed to collectively back more than $500 Billion in debt belonging to Greece and other unspecified “troubled” member states. The Japanese government has managed to pass off 90% of its sovereign debt onto its own citizens. The UK Treasury has printed money and lent it to the government of the UK. [The graphic below is actually interactive, and is worth a few minutes of perusing].

So what are the possibilities for dealing with this debt? In terms of government debt, the first is to hope that economies can grow faster than the debt, so that it becomes more manageable in relative terms and that one day it can be repaid. Another option is to raise taxes and/or cut spending, and use the extra funds to retire the debt. Given the current economic environment, the former possibility is unlikely. Industrialized economies continue to stall, and much of this growth is being funded with new debt. The latter option would amount to political suicide; any government that is politically naive enough to approve any austerity measures will be voted out of office at the next election. (With the election season about to begin, we won’t have to wait long for confirmation!)

The only alternative then is to reduce the real amount of debt through monetary inflation or currency depreciation. In the US, inflation is at a 50-year low. In Japan, it is non-existent. In the UK and the EU, prices are hardly growing. Monetary policymakers around the world are now actively trying to spur inflation (for reasons unrelated to the reduction of debt), but to no avail. Interest rates are already at rock bottom, and Central Banks have injected Billions of newly minted money into circulation without any impact on prices.

Currency devaluation is already taking place, but the main participants are emerging market economies (which are incidentally more concerned about export competitiveness than reducing the size of the debts). The Japanese Yen is nearing an all-time high, while the Euro has recovered from its spring lows. The British Pound is near its long-term average, while the US Dollar has declined only slightly on a trade-weighted average. In the end, since all of these countries are characterized by high levels of debt, it would be impossible for all of them to devalue their currencies. In addition, the nature of the Euro currency union precludes Eurozone countries from being able to lower their debts through currency devaluation.

The story is the same for private debt. For example, most of the real estate (commercial and residential) debt associated with the collapse of the housing market has yet to be written off. Financial institutions and investors continue to hold onto it with the hope that the real estate market will soon recover, such that the losses will never need to be recognized. While this strategy could vindicate lenders/investors over the long-term, it continues to have a devastating effect in the short-term since it forces the holders of debt to keep more cash on their balance sheets, where it won’t find its way into the global economy.

What are the implications for forex markets? Namely, it would seem to support the notion that emerging market currencies will continue to outperform the G4 currencies over the long-term. Over the near-term, it’s possible that G4 currencies will experience some appreciation, due both to the ebb and flow of risk appetite and the interventions of emerging market Central Banks on behalf of their currencies. Over the long-term, however, the only realistic alternative to default is currency devaluation, and at some point, the forex markets will have to come to terms with the fact that the G4 currencies need to decline. [Chart above courtesy of The Economist].

February 28th, 2012 at 6:52 am

I have lost 200K dollars almost a month in the forex tradings therefore never believe again for some method after paid sing dollar 4k for the course fee registration to the Statistical Traders Singapore Pte Ltd, Singapore

Those technical was coached by trainer ryan ng was totally wrong and what they indicated so good, the powerful technics in the SMU, Singapore seminar is totally different and think that those sample just to cheat people to sign up for the course. Now, feel very disappointed, think to end my life. RIP