October 29th 2010

Why is the Japanese Yen Still Rising?

Most of today’s headlines regarding the Japanese Yen focus on one thing: Central Bank intervention. Basically, reporters have become focused on the likelihood of additional intervention in the currency markets by the Bank of Japan. However, this obsession has caused them to overlook the larger issue: Why is the Yen still rising?

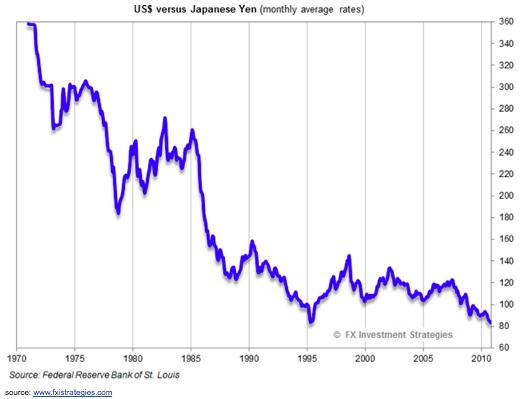

I was prompted to ask this question after coming across the above chart, which tracks the historical performance of the Japanese Yen against the US Dollar. You can see that since 1970, the Yen has risen by a whopping 350% against the Dollar. It has doubled in value since 1990 and risen 14% since the start of the year, en route to a 15-year high. Over the same period (actually since 1980; I couldn’t find data from the 1970), Japan’s economy has expanded by an average annualized growth rate of 2.2%. Over the last 10 years, the average is a paltry .9%. The contradiction between fundamentals and reality could not be more stark!

In addition, investor risk appetite has been reinvigorated. During most of the last decade, carry trading caused the Yen to decline to 120 USD/JPY as investors borrowed Yen in bulk in order to purchase high-yielding assets. The credit crisis spurred a short squeeze (i.e. rapid unwinding of carry trade positions) in early 2007, and caused the Yen to rocket upward. If anything, we would expect the Yen to mirror its performance of a few years ago, as investors take advantage of low Japanese interest rates and rebuild carry trade positions in the Yen.

The recent run-up in emerging market currencies, global equities, commodities, and other risky assets would certainly seem to support a carry trade strategy. For its part, the Bank of Japan is also doing its best to create a healthy environment for carry trading by printing currency, easing monetary policy, and fighting to keep the Yen from rising. And yet, if indeed there are still carry traders (and there certainly are!), the current trend in forex markets suggests that they are very much outnumbered by those betting on the Yen’s rise.

It’s difficult to understand this phenomenon. Those that hold Yen earn a nominal return of near 0%. Long-term interest rates (proxied by 10-year government bonds) are only slightly higher – at 1% – and certainly too low to attract any foreign institutional interest. Besides, it’s well-known that 90% of Japanese government debt is held by domestic savers. Meanwhile, the Japanese stock market has stagnated for more than 2 decades, and the Nikkei average is lower than at any point since 1985 (except for a brief period following the dot-com bust. Japanese real estate is equally unattractive.

As a result, there are only two conceivable reasons for the Yen’s continued upward push. The first is fundamental/structural and is connected to Japan’s trade surplus. In spite of an appreciating currency, the Japanese export sector continues to be the lone bright spot in an economy with otherwise limited sources of growth. Compared to 2009, the trade surplus is up 83%, helped by a rise of 50% in September. It is on pace to top $100 Billion for the year. In this regard, foreigners that buy Japanese Yen do so because they must- for purposes of trade.

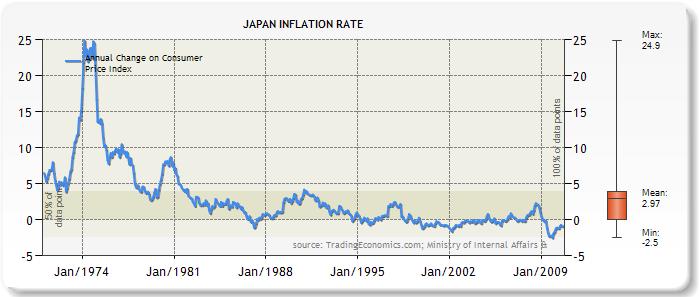

The second source of demand for Japanese Yen is so-called safe haven flows. While the Japanese Yen is not a high-yielding currency, it is actually an excellent store of value. [This is one of the three primary functions that a currency should fulfill. The other two are medium of exchange and unit of account]. That’s because inflation in Japan is the lowest in the world, often to the point of being nil. Since 1970, the inflation rate has averaged only 3%, compared to 4.5% in the US. Over the last 15 years, inflation has been 0%. In other words, even if they are invested in low-yielding savings accounts, Japanese savers can ensure that 1 Yen today will probably still be worth 1 Yen 5 years from now. Foreign investors can take advantage of the same phenomenon, when they bet that the exchange value of the Yen will be equally stable.

On the one hand, it is somewhat surprising that the Yen has been able to thrive in the current “risk-on” investing climate. On the other hand, there is a parallel thread of risk-aversion that will always exist and gravitate towards safe-haven currencies, such as the Yen. In fact, it can be argued that this contingent of investors is as large as the risk-taking contingent, as evidenced by the inexorable appreciation of gold (if not also by the Yen). Insofar as inflation in Japan remains nil and the Japanese export sector proves it can be competitive regardless of exchange rates, demand for Yen will continue to confound the gloomy forecasts and rebuff the best efforts of the Bank of Japan.