August 7th 2010

Euro Recovery: Paradigm Shift Confirmed

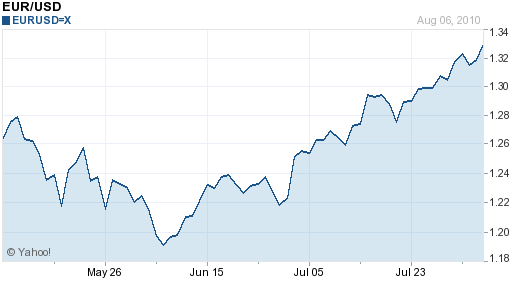

In early July, when the Euro rally was (in hindsight) just getting under way, I reported on the apparent paradigm shift in forex markets, whereby risk-driven trades that benefited the Dollar were giving way to trades driven by fundamentals, which could conceivably favor the Euro. Since then, the Euro has continued to rally (bringing the total to 12% since the beginning of June), confirming the paradigm shift. Or so it would seem.

Euro fundamentals are indeed improving, with an improvement in the German IFO Index, which measures business sentiment, seen as a harbinger for recovery in the entire Eurozone economy. To be sure, Spain and Italy, two of the weakest members, registered positive growth in the most recent quarter. Contrast that with the situation across the Atlantic, where a growing body of analysts is calling for a double-dip recession with a side of deflation. The Fed has certainly embraced this possibility, and seems set to further entrench – if not expand – its quantitative easing program at its meeting next week.

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to Pi Economics, “The dollar carry trade may now be worth more than $750bn, approaching the size of the yen carry trade at its peak in 2004-07.”

As a result, investors are rushing to reverse their short EUR/USD bets. What started as a minor correction – and inevitable backlash to the record short positions that had built up in April/May – has since turned into a flood. As a result, shorting the Dollar as part of a carry trade strategy is back in vogue. According to Pi Economics, “The dollar carry trade may now be worth more than $750bn, approaching the size of the yen carry trade at its peak in 2004-07.”

Naturally, all of the big banks were completely caught off guard, and are rushing to revise their forecasts, with UBS calling the Euro “exasperating” and HSBC comparing the USD/EUR to a “lunatic asylum.” An analyst at the Bank of New York summarized the frustration of Wall Street: ” ‘I’ll put my hands up on this—I have had a difficult time trying to call the market. The last time I remember it being this hard was in 2001 to 2002.’ ”

In this case, hindsight is 20/20, and if it wasn’t the stress tests that buoyed the Euro, it must be the acceptance that an outright sovereign default is unlikely. Personally, I’m not really sure what to think. There isn’t anyone who has come out to say I told you So, in the context of the Euro rally, which means it’s ultimately not clear who/what is driving it, and who is profting from it. In fact, you can recall that many hedge fund managers referred to shorting the Euro as the trade of the decade. It’s certainly possible that some of these investors took their profits from the Euro’s 20% depreciation in ran. It’s equally possible that investors are once again behaving irrationally.

The latter is supported by volatility levels which are gradually falling. Still, something smells fishy. A rally in the Euro only a few months after analysts were predicting its breakup is hard to fathom, even in these uncertain times. A columnist from the WSJ may have unwittingly hit the nail on the head, when he mused, “So, unless a European bank goes belly up or some other stink bomb explodes in the region’s debt markets, the old-fashioned relationship between [economic] data and currencies looks set to persist.”

To borrow his terminology, a stink bomb is probably inevitable. That’s not to say that investors aren’t focused on fundamentals; on the contrary, any stink bomb would probably directly harm the currency with which it is associated, rather than radiate through forex markets based on some convoluted sorting of risk . The only question is where the stink bomb will explode: the EU or the US?

August 7th, 2010 at 4:21 pm

I’m quite certain it’s just a corrective retrace we are in. The long term in still bearish on E/U. It will go down to 1.10’ish and possibly even parity by the end of the year.

August 8th, 2010 at 8:33 am

The market being what it is has done what its always done and thats run around the vast majority of traders .. weren’t we hearing the sky fall out of the euro a short while ago? instead ..what did it do .. the market went the other way. Sounds like the old adage.. when the taxi driver has a laptop with charts on it and driving the cab at the same time and gives you tips to buy .. YOU SELL.

August 18th, 2010 at 6:05 pm

The fundamentals of the Euro are not good. Then again, the US dollar fundamentals are even worse. When the bailout money runs out there is likely to be another “credit crisis” – another way of saying that “we need to borrow more money without paying back what we already owe”. This process can’t go on forever, and instability in the currency markets will be the ongoing symptom of our global financial malaise until the books get balanced, the debt is either written off or repaid, and a structure set up to ensure financial probity at all levels of the global financial system.

December 22nd, 2010 at 4:08 am

Euro fundamentals are indeed improving, with an improvement in the German IFO Index, which measures business sentiment, seen as a harbinger for recovery in the entire Eurozone economy.It’s certainly possible that some of these investors took their profits from the Euro’s 20% depreciation in ran. It’s equally possible that investors are once again behaving irrationally.