August 5th 2010

Fed Mulls Options for Next Week’s Meeting

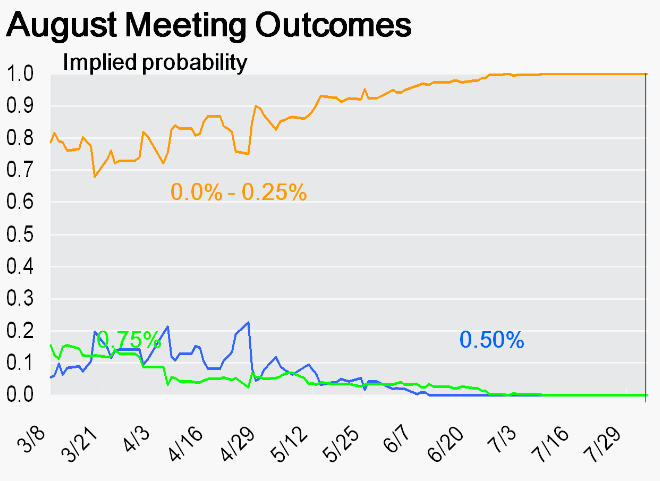

Next week, the Open Market Committee (OMC) of the Federal Reserve Bank will hold its monthly meeting. Even without checking futures prices, it’s obvious that the probability of an interest rate hike is nil. [In fact, the odds of a rate hike in November have already converged to 0%]. Why, then, are investors keenly awaiting the outcome of the meeting?

In a nutshell, they will be watching for two things. The first is any changes in the statement released at the close of the meeting. According to James Bullard, President of the St. Louis Fed, “If any new ‘negative shocks’ roiled the economy, the Fed should alter its position that interest rates would remain exceptionally low for ‘an extended period.’ ” If the OMC determines that the prospects for continued economic recovery are good, and/or the inflation hawks get their way, we could see subtle – but meaningful – changes to statement.

More importantly, the Fed must make a decision regarding the other tools in its monetary arsenal. Of immediate concern is what to do with the more than $200 Billion in mortgage bonds (representing less than 20% of the Fed’s total purchases of MBS) that mature in the next six months. The original plan was to allow the securities to mature and take no new action, as part of a gradual exit from the credit markets. As a result of changing economic conditions, however, the Fed is debating rolling the cash over into new mortgage securities or Treasury Bonds.

Inflation hawks (at the Fed) are skeptical and have vowed to press for the start of the unwinding the Fed’s portfolio. They have the support of traders in the MBS market, who insist that, ” ‘The MBS market currently does not need added Fed support.’ ” Meanwhile, “Treasury-market participants suggest the central bank should use the money to support small businesses or commercial real estate.”

Analysts are divided as to what the Fed will do. According to Nomura Securities, “We expect the Fed to at least stop the passive contraction of its balance sheet.” According to another analyst, “The temptation to jump from a decision to maintain the balance sheet’s size at current levels to a new round of easing is understandable but probably premature.” Based on the economic data, both sides have legitimate cases. On the one hand, the economy is still in recovery mode. On the other hand, unemployment remains stubbornly high, and certain leading indicators would seem to suggests a return to recession, which means there is pressure for the Fed to act. [“Since Fed officials last met in June, data on consumer confidence and spending have softened and job data haven’t improved. But overall financial conditions have improved somewhat, with a rebounding stock market”].

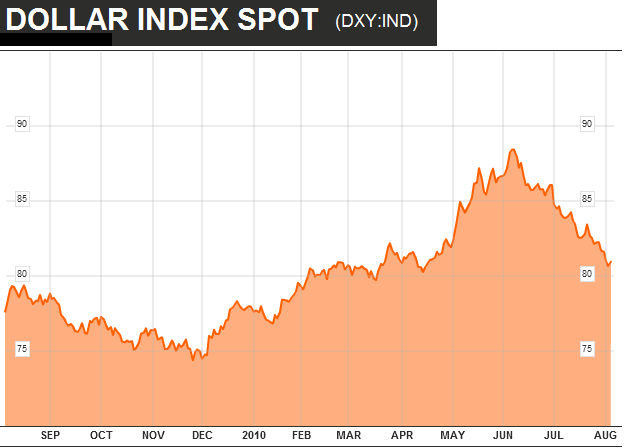

Currently, it is expected that the Fed won’t hike rates until the end of 2011. In addition, while it probably isn’t ready to embark on a fresh round of quantitative easing, it is more likely than not that it will channel the cash from the expiring bonds back into the markets. As far as forex markets are concerned, the Dollar will remain unmoved if the Fed conforms to these expectations. Dovishness – such as an expansion of quantitative easing – will almost certainly hurt the Dollar, while the flip side – exiting the credit markets and/or hinting towards rate hikes – would give the Greenback a solid boost.

August 10th, 2010 at 6:12 pm

Basically what the Fed did will not have any significant impact on the economy. Printing more money is not the solution and buying our debt is not either. Next year taxes will be going up an that will have a further negative effect on consumer spending. Is the Fed trapping themselves into a hyper inflationary cycle or are the forces of deflation so great, as some argue, that is what they need to combat. No one is certain that’s what makes this economic situation so difficult to manage and trade.