September 20th 2010

Keep an Eye on Central Banks

From monetary policy to quantitative easing to forex intervention, the world’s Central Banks are quite busy at the moment. Even though the worst of the credit crisis has past and the global economy has moved cautiously into recovery mode, there is still work to be done. Unemployment remains stubbornly high, inflation is too low, and asset prices are teetering on the edge of decline. In short, Central Banks will continue to hog the spotlight.

On the monetary policy front, Central Banks have begun to divide into two camps. One camp, consisting of the Federal Reserve Bank, European Central Bank, Bank of England, Bank of Japan, and Swiss National Bank (whose currencies, it should be noted, account for the majority of foreign exchange activity), remains frozen in place. Interest rates in all five countries/regions remain at rock bottom, near 0% in most cases. While the ECB’s benchmark interest rate is seemingly set higher than the others, its actual overnight rate is also close to 0%. Meanwhile, none of these Banks has given any indication that it will hike rates before the end of 2011.

In the other camp are the Banks of Canada, Australia, Brazil, and a handful of other emerging market Central Banks, all of which have cautiously moved to hike rates on the basis of economic recovery. Among industrialized countries, Australia (4.5%) is now at the head of the pack, with New Zealand (3%) in a distant second. Brazil’s benchmark Selic rate, at 10.75%, makes it the world leader among (widely-followed) emerging market countries. It is followed by Russia (7.75%), Turkey (7%), and India (6.1%), among others. The lone exception appears to be China, which maintains artificially low rates to influence the Yuan. [More on that below.]

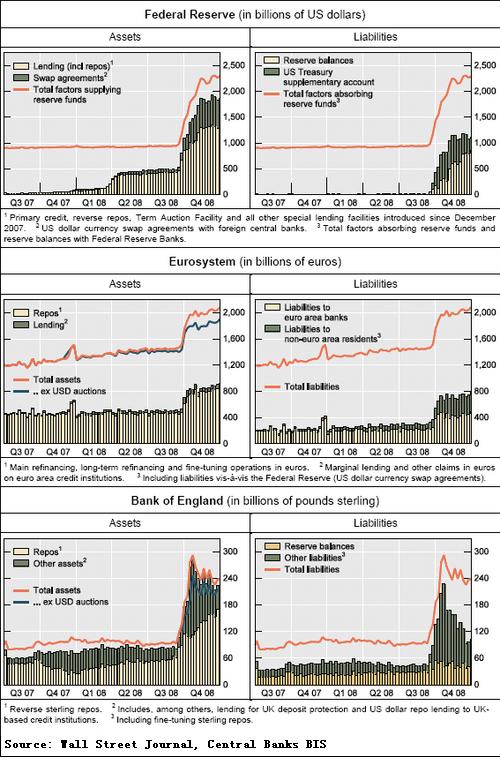

None of the industrialized Central Banks have yet unwound their quantitative easing programs, unveiled at the peak of the credit crisis. The Fed’s balance sheet currently exceeds $2 Trillion; its asset-purchase program has driven Treasury rates and mortgage rates to record lows. The same goes for the Banks of England and Japan, the latter of which has actually moved to expand its program in a bid to hold down the Yen. Meanwhile, many of the credit lines that the ECB extended to beleaguered banks and other businesses remain outstanding, and have even expanded in recent months.

Central Banks have been especially busy in the currency markets. The Swiss National Bank (SNB) was the first to intervene, and as a result of spending €200 Billion, it managed to hold the Franc below €1.50. As a result of the EU sovereign debt crisis, however, the Franc broke through the peg and his since risen to a record high against the Euro. Unsurprisingly, the SNB has abandoned its forex intervention program. Throughout the past year, the Central Banks of Canada, Brazil, Thailand, Korea have threatened to intervene, but only Brazil has taken action so far, in the form of a levy on all foreign capital inflows. Last week, the Bank of Japan broke its 6-year period of inaction by intervening on behalf of the Yen, which instantly rose 3% on the move. The BOJ has pledge to remain involved, but the extent and duration is not clear.

Finally, the Bank of China allowed the Yuan to appreciate for the first time in two years, but its pace has been carefully controlled, to say the least. In the last few weeks, the Yuan has actually picked up speed, but critics insist that it remains undervalued. In addition, China has contradicted the Yuan’s rise against the Dollar through its purchases of Japanese bonds, which has spurred a rise in the Yen. This is both ironic and counter-productive to global economic recovery: “Since China is growing at 10%, it can afford to undermine exports and boost domestic demand by letting the yuan appreciate more rapidly against the dollar. But China doesn’t want to do that. In fact, although China’s State Administration of Foreign Exchange deregulated the currency market overnight, the measures, which allow some exporters to retain their foreign currency holdings for a year, should boost private demand for dollars, not yuan.”

The efforts listed above have undoubtedly moderated the impacts of the financial crisis and consequent economic downturn. However, the banks have found it impossible to engineer a convincing recovery, and at this point, there probably isn’t much more that they do can do. As a result, many analysts are now pinning their hopes on fiscal policy (despite its equally dubious track record). Perhaps, the title of this post should have been: Keep an Eye on Governments and their Stimulus Plans.

September 26th, 2010 at 1:22 am

While we have the “run to cash” most notable the CHF and JPY the interventions are near term in the minor trend. Commitment of traders open interest shows little effect.

Your post is an excellent analysis of the current condition of the market intervention state we find ourselves in. Would you comment on the unwinding process that has to folow?