January 28th 2010

South African Rand Loses its Luster

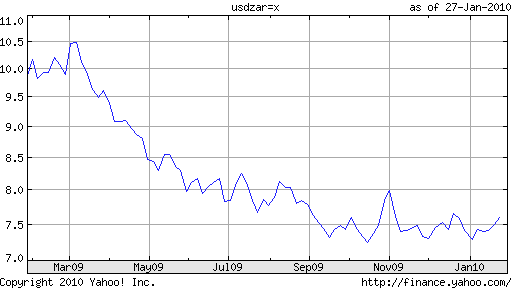

In 2009, the South African Rand was the world’s second best performing currency, after only the Brazilian Real. Since September, however, it has stagnated, and over the next year, it is projected to fall 10%. What happened?!

The Rand represents an interesting case study because it sits at the nexus of several trends. The first is the movement of funds into currencies with high interest rates. (The benchmark rate in South Africa is 7%). The second is the movement of funds into economies that are rich in natural resources. (South Africa is the world’s largest producer of platinum and the third largest producer of gold). The third is the movement of funds generally into emerging market economies. (South Africa’s economy was one of the world’s strongest [perhaps least weak is more apt] economies in 2009).

Thus, we should ask whether then Rand’s stagnation and projected decline is due to unique circumstances, or if instead it represents a reversal of one or more of these trends. Let’s start by looking specifically at South Africa. First of all, natural resource prices (gold and platinum) remain buoyant. Gold, as most of you are probably aware, is still hovering close to its (nominal) all-time high, while the price of platinum has resumed its upward trend, and is arguably closer to is all-time high than oil. In short, the pessimism can’t be explained by commodity prices.

How about interest rates? Well, South African rates are among the highest in the world. Despite a handful of cuts totaling 500 basis points over two years, the benchmark rate still stands at a healthy 7%, which is significantly higher than its counterparts in the developed world. Unfortunately, inflation in South Africa is also quite high (6%), which means real interest rates are closer to 1%. In addition, while Central Banks in other countries are contemplating raising rates, South Africa hasn’t ruled out cutting its benchmark further.

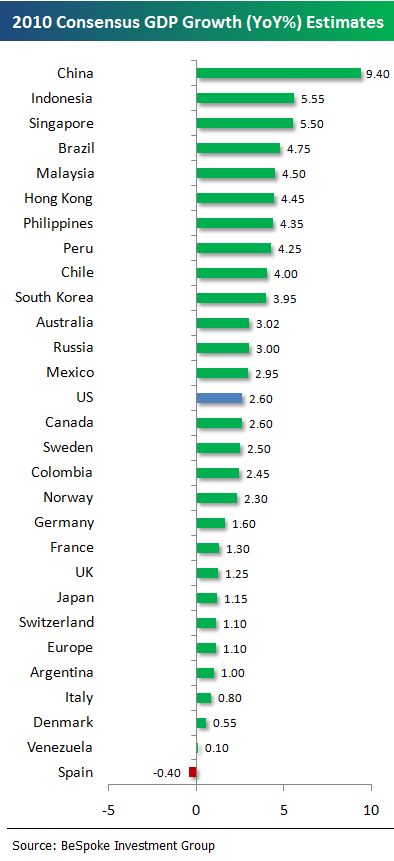

What about the fact that South Africa is considered to be one of the world’s vanguard emerging market economies? Well, this too, looks shaky. In contrast to the modest contraction in 2009 that made it a standout, 2010 may not be so kind. Analysts are expecting growth of only 2% in 2010, near the bottom of all economies, emerging market and industrialized. The US economy is projected to grow by 2.6%, in comparison.

With the exception of commodity prices (and perhaps the World Cup), there really isn’t much to be excited about when it comes to the South African Rand these days. For those looking for a growth play, South Africa isn’t it. For those employing a carry trade strategy, the Rand is also not an attractive candidate, since the positive interest rate spread it enjoys (small in real terms and shrinking) is hardly enough to compensate for the risk of currency depreciation. Those looking at Rand technicals (forgive me for not citing specifics here) must be worried that the Rand’s monumental surge in 2008 could only be followed by a correction. Not to mention the fact that various political factions in South Africa are calling for the Rand to be pegged to the Dollar at a rate 33% higher than current levels.

When you consider also that asset prices in emerging markets are now stalling, as investors fret about possible bubbles and contemplate bringing cash “home,” and also that the carry trade is slowly falling out of favor, it’s no wonder that analysts are gloomy about the Rand’s near-term prospects.