December 31st 2009

Korean Won Headed Up, Despite Unwinding of Carry Trade

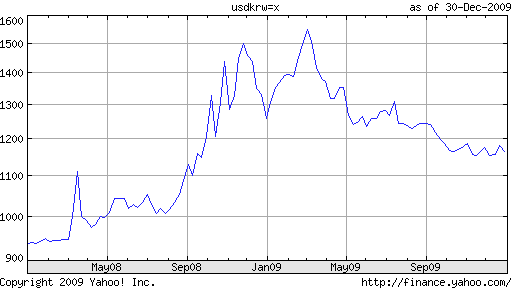

The Korean Won is up 32% since March, and 8.2% on the year. At the same time, it is 20% below is 2007 year-end level, as well as 13% weaker than the 2006 average of 955 and 15.5% weaker than the 2007 average.

Focusing only on the Won’s appreciation would probably cause some technical analysts to back off, while comparing it only to the highs of a couple years ago would lead others to pile in, without knowing examining other indicators. In my opinion, this is a situation in which technical analysis – because of the potential to send conflicting signals – falls short. Ergo, let’s turn to the fundamental picture.

The Korea Won has adhered closely to the overarching forex narrative. When the credit crisis struck, investors fled from Korea, and the Won lost 50% of its value practically overnight. With the return of risk-taking in the second quarter of 2009, however, the safe-haven appeal of the Dollar faded, and the Won rebounded strongly. With the potential end of the carry trade in sight, however, the Won has stuttered, and some analysts portend a decline in the near-term.

However, while many currencies will no doubt experience a correction if/when the Fed raises interest rates, the Korean Won probably won’t be one of them. Korean investments have certainly been buoyant of late, but not nearly to the same extent as in other emerging markets, where it could be argued speculative bubbles are now forming. In addition, Korean interest rates are hardly lofty; its benchmark rate is only 2%, hardly enough to justify a carry trade strategy in and of itself.

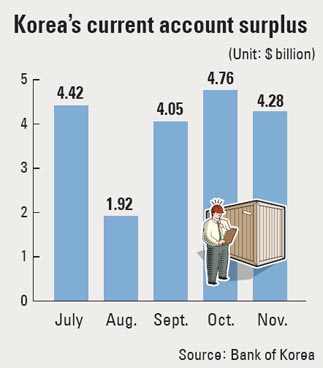

Instead, investors have been flocking to Korea for the economic fundamentals. Despite an appreciating currency, Korea’s trade surplus is on pace to hit a record $45 Billion this year, with a healthy $15-20 Billion forecast for 2010. In fact, the rising Won has has virtually no effect on exports, as Korean companies had prudently assumed that the Korean Won would be even more expensive (based on 2007 levels). In the automobile industry, for example, “New models being introduced now were designed and engineered two years ago to keep the company in the black even if the won strengthened to 900 to the dollar.” For that reason, analysts expect 2010 will be a banner year for the economy. After a modest expansion in 2009, GDP is projected to grow by 4.5-5% next year, the third highest among large economies, behind only China and India.

The Central Bank of Korea is also operating as though the Won will keep appreciating, irrespective of what happens to the carry trade. In one session last week, it intervened in forex markets to the tune of $500 million, with the goal of depressing the Won. With the recent expiration of a currency swap with the Fed, this is just as well, as Dollars could soon once again be in short supply. Korean monetary policy remains expansionary, but if the economy takes off in 2010 as expected, the Central Bank will have no choice but to raise rates and keep inflation within its target range.

In addition, there is now talk of turning the Korean Won into an international currency. ” ‘Korea has the opportunity to upgrade the won’s global status as a host country of the G20 2010 Summit.’ International use of the Korean won has been insignificant, although the nation’s share in international trade and finance has increased quickly,” analysts have observed. That the government of Korea is looking to promote the Won as a stable currency implies that it is comfortable with the prospect of further appreciation.

In short, the Won will probably be one of the standouts in 2010. Many currencies will suffer as changes in global monetary policy and the appearance of asset price bubbles cause investors to back off of the carry trade and exit certain emerging markets. South Korea won’t be one of them. With strong fundamentals and a growing profile, it’s no wonder that most analysts expect the Won to appreciate by another 10% in 2010.

Given that tomorrow is the first day of 2010, we won’t have to wait long to find out! On that note, happy new year!