July 19th 2010

Reflecting on the Chinese Yuan Revaluation

Today marks the one-month anniversary of China’s decision to remove the Yuan’s peg to the Dollar, and allow it to float. Now that the news has had a chance to wend its way through the financial markets, I think it’s time both to reflect and to forecast.

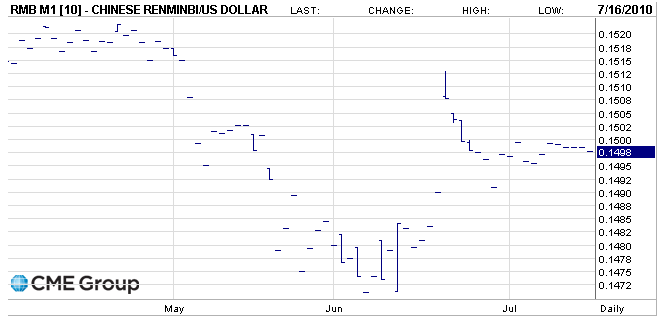

Over the last month, the Chinese RMB has appreciated by slightly less than 1% against the Dollar, although most of that jump took place in the day that followed the June 19 announcement. After the initial excitement faded, a sense of disappointment set in as it became clear that China had no intention of allowing the RMB to appreciate rapidly: “The subsequent appreciation of the yuan against the dollar is likely to be small, perhaps just a few percent over the remainder of the year.” In fact, futures prices reflect only an additional 1.5% appreciation over the next 12 months.

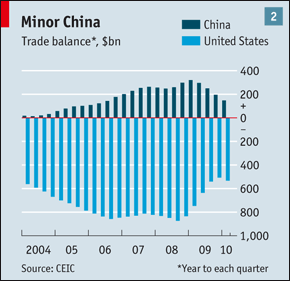

Due both to its slow speed and small scope, the revaluation could conceivably benefit the Chinese economy. That’s because in the short-term, a more expensive currency will mean higher prices paid for exports. The quantity of exports is unlikely to decline, such that total export revenues could actually increase. According to one analyst, “With Chinese imports, there are no substitutes in the short term. Maybe in 10 years, importers will have a choice, but right now they will just have to pay more. No other country…can build a manufacturing base and all the infrastructure that you need — transportation, energy, the entire value chain to the final good — takes many years.” As if on cue, China’s trade surplus expanded in June, in spite of the revaluation of the Yuan.

As a result, American manufacturers and other vested interests have announced that they will continue to lobbythe US government to pressure China on the currency issue, on the basis that the undervalued RMB is eroding both the US economy and the labor market. Argued the director of the Peterson Institute for International Economics, “The case for a substantial increase in the value of the renminbi is thus clear and overwhelming. An appreciation of 25% to 40% is needed to cut China’s global [account] surplus even to 3% to 4% of its GDP. This realignment would produce a reduction of $100 billion to $150 billion in the annual U.S. current account deficit.” It might also help to restore the estimated 1.4 million jobsthat have been lost due to China’s forex policy. According to analysts, however, political infighting make it unlikely that any new law or punitive tariffs will be imposed anytime soon.

At the very least, China will continue to make the Yuan more flexible, so that one day it can float freely. It has already moved to facilitate trade settlement in Yuan, and analysts expect ” ‘more than half of China’s total trade flows, primarily bilateral trade with emerging markets, to be settled in renminbi in the next three to five years.’ ” China is also making it more attractive for foreign investors to hold Yuan, by loosening controls that govern Chinese capital markets and creating new investment vehicles that will cater directly to foreigners. In the mean time, holding RMB is pretty unattractive given both “the hassle of getting money in and out of China” and the low rates offered by Chinese money market funds.

As for the impact on the rest of the forex market, I think that commodity currencies and growth currencies could come out ahead. The move signals an implicit confidence in the global economic recovery and can perhaps be seen as a harbinger for high commodity prices: In addition, it will “provide a boostto U.S. exports, employment, earnings and growth, reinforcing the case for growth sustainability at a time when investors are more fearful than they were in April.” The US Dollar, on the other hand, could emerge as one of the big losers. Already, China’s forex reserve growth has slowed to the weakest pace in 11 years. This trend will probably continue, since smaller purchases of Dollars will be required to maintain the floating peg. In fact, the Euro’s recovery against the Dollar has coincided mysteriously with the revaluation of the Yuan. While this is probably just a coincidence, it is nonetheless symptomatic of a declining role for the Dollar as the world’s reserve currency. But that is a topic for another day…