July 27th 2010

How About Those Stress Tests…

What’s the deal with those stress tests? It sounds like the setup for a Jerry Seinfeld joke, and given the way the tests were viewed by the markets, it might as well have been. According to the EU, the tests were a tremendous success. According to investors, the results were irrelevant at best, and patently misleading at worst.

The stress tests were first proposed last month as a way to gauge the health of the EU banking sector; it was hoped that the results would demonstrate the soundness of the banking system and mollify investors. Since then, momentum continued to build in the markets, as investors engaged in meta-speculation about the potential impact of the stress tests.

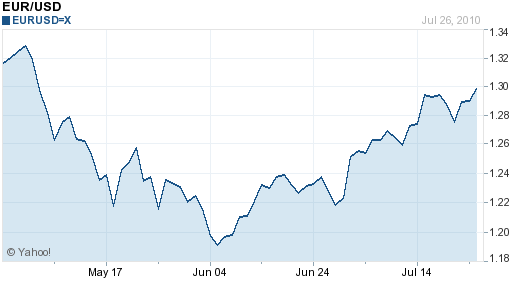

In the days leading up to the test, there was a mixture of apprehension and uncertainty. One trader warned: “No one seems to want to hold too much risk heading into the release of the European bank stress tests….A great deal of caution should be exercised…as the results of the stress tests are made public. There is definitely the potential for a huge swing in either direction…as there could be a freight train coming down the tracks.” The Euro traded sideways, capping an impressive 8% rally that began in June.

On Monday, the tests were finally conducted: “EU regulators scrutinized 91 of the bloc’s banks to assess whether they have enough capital to withstand a recession and sovereign-debt crisis, with a Tier 1 capital ratio of 6 percent as a floor. Regulators tested portfolios of sovereign five-year bonds, assuming a loss of 23.1 percent on Greek debt, 12.3 percent on Spanish bonds, 14 percent on Portuguese bonds and 4.7 percent on German state debt.” Officially, only 7 banks failed the tests – 5 in Spain, 1 in Germany, 1 in Greece – with a combined capital shortfall of €3.5 Billion.

When the news was initially released, the Euro sea-sawed – first rising, then falling – and analysts rushed to ascribe sometimes-contradicting sentiments. First, there was “concern,” then came “relief.” From where I was sitting, the markets’ reaction was basically somewhere between a shrug and a yawn. First of all, investors saw the tests for the charade that they essentially were. The only reason that EU regulators were willing to conduct them publicly was because they knew that the results would be positive. As I wrote above, it was intended in advance that the tests would “mollify investors.”

On a related note, the tests were not nearly strict enough: “Analysts were instantly dismissive of the tests, saying the bar was too low. ‘The prospect of an outright sovereign default, which is what has worried markets most, has not even been considered.’ ” Instead of examining the possibility of bonds becoming worthless and irredeemable, the tests only assumed modest losses.” By this standard, argue investors, it’s no wonder that virtually every bank was able to pass.

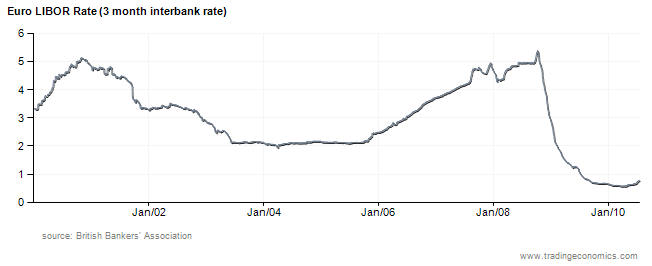

Ultimately, gauging the success of the stress tests will require waiting few weeks. Unlike currency, stock, and bond markets – which can and did offer instant feedback on the news – it will probably take some time before the impact is fully reflected in the money markets. In other words, while an uptick in the Euro, shares of bank stocks, and sovereign bond prices should all be seen as symbols of confidence, the real test is whether investors will be willing to lend directly to banks, at reasonable rates (proxied by 3-month Euro LIBOR, on display below).

In fact, that test could come quite soon, as the ECB continues to recall the hundreds of Billions of Euros in loans that it made to commercial banks. If LIBOR rates remain steady and the markets remain liquid, then the stress tests can be called a success. If private investors balk and/or the ECB is forced to extend its lending program, however, the tests will be seen in hindsight as a waste of time.