March 12th 2010

Yen Carry Trade is Back!

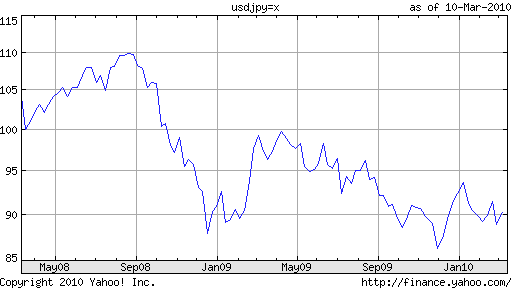

I can’t remember how long it’s been since I was hyping the Yen carry trade (though a browsing of the ForexBlog archives indicates 2 years). Upon the outset of the credit crisis, forex markets went haywire, and one of the main “beneficiaries” was the Yen, which soared as carry trades were unwound. Now, however, a similar set of circumstances that made the Yen carry trade attractive from 2006-2008 have re-appeared, and it looks like the trade could be on the verge of making a big comeback.

Practitioners of the carry trade understand that it has a few pre-conditions. The first is low interest rates. In this case, the benchmark Japanese interest rate is only .1%. While that would have meant something a few years ago, however, it no longer counts for much, since benchmark rates in other industrialized countries are just as low. Where Japan has the edge is in market interest rates. Long-term rates have historically been well below the global average, and short-term rates are finally following suit after a 3-year hiatus. In fact, for the first time since August, the 3-month Japanese LIBOR rate – a lending benchmark – fell below its US counterpart: “On Thursday, the yen Libor JPY3MFSR= was fixed at 0.25063 percent — its lowest level since May 2006 — and the dollar USD3MFSR= rate at 0.25219 percent.” In short, the Japanese Yen is once again the cheapest currency in the world to borrow.

In addition, interest rates in Japan will probably remain low for the immediate future, as the Bank of Japan is actually looking to make its monetary policy even more accommodative (I didn’t think this was possible with a benchmark rate of only .1%!), in order to further stimulate the economy and alleviate the risk of deflation. This contrasts with Central Banks in other countries, which are already contemplating interest rate hikes.

The second condition is low volatility. ” ‘Realized trading vols has not been so low for many years.’ For example, three-month implied vols in the euro have slipped from a 25-plus high at the peak of the subprime crisis to levels around 10.68 currently…’As volatility goes down,’ the FX market tends to move toward a ‘classic carry trade environment.’ ” Low volatility is important because it enables investors to make low-risk bets on interest rate differentials without worrying too much about currency fluctuation. However, it doesn’t hurt that aversion to risk is also trending lower, such that investors can borrow in Yen to make higher-risk bets. According to the Bank of International Settlements, “The carry-to-risk ratios, a measure of the appeal of carry trades, have ‘been steadily rising over the past 14 years, consistent with an increasing attractiveness of the yen-funded carry trades for Australia and New Zealand.’ ”

The pickup in risk aversion – as a result of the Greek debt crisis – may have delayed the return of the Yen carry trade. In January, volatility rose slightly and the Yen rallied as the safe-haven mentality set in. Personally, I find this somewhat ironic, since Japan’s debt problems are even more pronounced, and unlike Greece, it can’t count on a bailout from Greece if things really get rough. Still, the markets work in strange ways, and the fact that the Yen has benefited from the crisis is probably due to the fact that traders can’t short all currencies simultaneously.

The pickup in risk aversion – as a result of the Greek debt crisis – may have delayed the return of the Yen carry trade. In January, volatility rose slightly and the Yen rallied as the safe-haven mentality set in. Personally, I find this somewhat ironic, since Japan’s debt problems are even more pronounced, and unlike Greece, it can’t count on a bailout from Greece if things really get rough. Still, the markets work in strange ways, and the fact that the Yen has benefited from the crisis is probably due to the fact that traders can’t short all currencies simultaneously.

The third condition is really an outgrowth of the first two: belief that the funding currency will remain stable, or even decline. In this regard, the Yen is still hovering near an all-time high against the US Dollar, and given the confluence of bearish economic and political factors, it would seem to ne headed downward irrespective of the carry trade. For those looking for specific reasons to short the Yen, there are plenty from which to choose: low economic growth, dismal performance in finance markets, high public debt, dwindling savings and an upcoming retirement boom. As one analyst argued, “Tokyo is due to announce its medium-term fiscal plans in June. ‘Either this will mark the start of a prolonged period of fiscal restraint, weakening the economy again and requiring further monetary loosening, or the plans will lack credibility, in which case Japan’s financial markets would be hit hard. In either scenario, the yen looks vulnerable.’ ”

I don’t mean to get excited, but it’s hard to state a better case in favor of an imminent return of the Yen carry trade.

March 12th, 2010 at 5:01 pm

[…] Adam Kritzer announces the return of the Yen carry trade, following its recent weakness. […]

March 14th, 2010 at 12:37 am

[…] Forex « Yen Carry Trade is Back! | Home […]

March 14th, 2010 at 1:26 am

Not sure what the hype is about.

1. Libor is fake. Nobody can actually borrow at libor except some really good names.

2. Negative basis. The dollar yen basis has been very negative for a long time (around -20 in the 1yr), so that means you can borrow USD at libor in the market, swap it to yen and pay yen libor-20. USD is still far cheaper to borrow than yen. Similar effects using the fx swap in the 3m.

April 3rd, 2010 at 12:03 am

[…] impact on the exchange rate. It’s possible that an increase in risk appetite and consequent revival in the carry trade is behind the Yen’s weakness, but given that US interest rates remain just as low, it makes […]

April 3rd, 2010 at 12:03 am

[…] impact on the exchange rate. It’s possible that an increase in risk appetite and consequent revival in the carry trade is behind the Yen’s weakness, but given that US interest rates remain just as low, it makes […]

April 14th, 2010 at 5:13 am

[…] As I pointed out in last Friday’s post (Volatility, Carry, Risk, and the Forex Markets), volatility has been declining in forex markets since peaking after the collapse of Lehman Brothers. In fact, volatility among emerging market currencies has been falling particularly fast, and recently, something amazing happened: “Three-month implied volatility for the seven biggest developing country currencies fell to 10 percent in March compared with 11.4 percent for industrialized nations.” This inversion could rank as one of this year’s most important developments in terms of its impact on forex. The only runner-up that I can think of is Japanese LIBOR falling below American LIBOR. […]

April 15th, 2010 at 1:21 pm

I think we will shortly see carry trading on other currencies as people realize developed countries will stay with lower interest rates.