April 3rd 2010

Japanese Yen: Will We See Intervention?

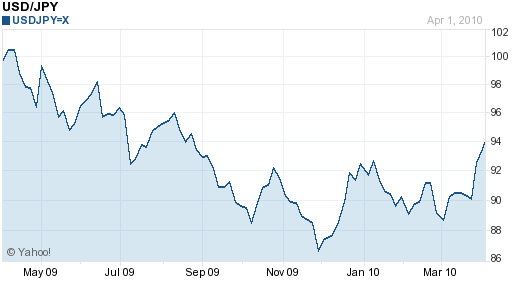

The Japanese yen has fallen 5% against the Dollar over the last month, and 10% since touching a record high in November. Since this certainly isn’t explainable in the context of the EU debt crisis, what’s going on?!

The primary factor behind the Yen’s decline appears to be seasonal, given the “end of the Japanese fiscal year on March 31, a time when Japanese corporations stop their annual repatriation of foreign profits by converting them into yen, which had kept demand for the currency high.” Analysts add that “A new fiscal year also is a chance for Japanese investors to reset strategies for sending capital abroad and for Japanese companies to set hedging bets for the coming year.” In short, this trend is short-term, and will likely abate in the coming weeks.

Beyond this, it’s difficult to explain the Yen’s decline in terms of financial and economic factors. Japans economy is still lackluster, though its stock market is performing well. I have blogged recently about Japan’s budget deficits and soaring national debt, but given that this debt is financed domestically, fluctuations in the risk of Japanese sovereign default have very little impact on the exchange rate. It’s possible that an increase in risk appetite and consequent revival in the carry trade is behind the Yen’s weakness, but given that US interest rates remain just as low, it makes little sense that the Yen should be falling so precipitously against the Dollar.

Rather, any full explanation must involve the the government of Japan, which appears to have grown increasingly uncomfortable with the persistent strength in the Japanese Yen. Previously, the government (through the Finance Minister) had vehemently denounced the possibility of, intervention on behalf of the Yen and that exchange rates should be determined by market forces, etc. After backtracking, that Minister was replaced (ostensibly for health reasons), and leaders are no longer mincing their words. Japanese Prime Minister Yukio Hatoyama recently declared, “the yen’s strength is out of step with the country’s fragile economic recovery, urging the government to take ‘firm steps’ to counter the growth-limiting effects of a strong currency.”

Even though the Japanese economy grew by a healthy 3.8% in the fourth quarter of 2009, there remain concerns of contraction and deflation. Many experts agree that the Yen is overvalued, which means that exports are less than what they could be. Analysts love to point out that Japan’s economy is so sensitive to changes in exchange rates, that a fall of one “unit” (100 pips) in the Japanese Yen would be enough to cause some companies to swing from profit to loss. Simply, there is too much at stake for the Japanese economy (and the incumbent Japanese government) to simply let the Yen be.

As a result, many analysts believe that intervention is now inevitable, unless the Yen continues to rise. According to Morgan Stanley, “The probability Japan will sell the yen has climbed to 47 percent, the highest since 2004…based on a company model that uses indicators such as market positioning and changes in momentum.” Other analysts believe that the markets will instead preemptively push down the Yen, which would achieve the same result as intervention: “Brown Brothers Harriman analyst Marc Chandler figures if the dollar breaks above 94 yen, because of the way investors place currency bets, the greenback could more easily extend its run as high as 96 or 98 yen.”

For now, the Central Bank of Japan will attempt to use monetary policy to coax down the Yen, perhaps through a combination of liquidity programs and money-printing, but there are a handful of important meeting coming up, during which time it could conceivably decide to join the ranks of a handful of other Central Banks which have already moved to depress their currencies. Let the Beggar Thy Neighbor Currency Devaluation begin.

April 4th, 2010 at 2:05 am

Thanks for the analysis. I’m following the Yen right now, not as you might expect for trading opportunities, but because I need to buy ‘real’ Yen for my holiday!

I think I’ll hold off a bit longer and hope the Yen goes down some more. Do you have any estimate as to what values the GBP/JPY will hit in the next month?