August 24th 2009

Australian Dollar Rises, Remains Closely Correlated with Stocks

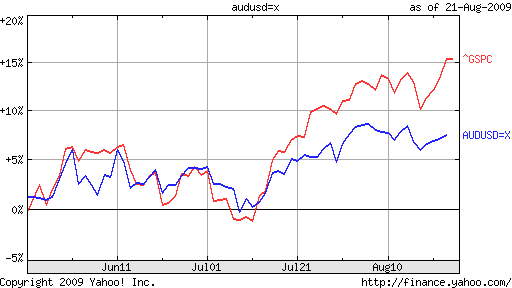

The performance of the Australian Dollar over the last six months has been nothing short of incredible: “Since the end of February, the Australian dollar has risen 29% against the U.S. currency,” and a still-impressive 18% if you backtrack to January, when the Aussie was still in free-fall.

As has been the trend in forex markets of late, the currency’s rise cannot be attributed to an improvement in fundamentals. The economic picture remains nuanced (that is putting a positive spin on it), and definitive proof of recovery has yet to emerge. “We really are trawling pretty deep to try and get any snippet of information that might have some backhanded relevance as far as Australia goes,” said one analyst.

As a result, fundamental analysts have been forced to wait for a “more precise picture about the timing [of] any Reserve Bank of Australia interest rate hike.” On this front, investors are ratcheting down their expectations of a rate hike anytime soon, as “The RBA has signaled that there’s a danger of raising rates too soon.” Futures prices reflect the expectation that rates will rise by only 37 basis points from current levels before 2010, and by 161 basis points 12 months from now.

With such economic uncertainty, investors have turned their attention elsewhere. “Nomura Chief economist Stephen Roberts said in the absence of any clues about the fundamental drivers of the currency, nearly all the cues in foreign exchange markets are being taken from equities.” Some analysts have posited a close relationship with the US stock market: “The correlation between the Aussie dollar and U.S. equity market in particular has been very strong over the past few weeks, with our analysis showing a correlation as high as 95 percent.”

For other analysts, the relationship is with the Chinese stock market. This correlation makes more sense logically, since the Australian economic recovery is largely contingent on continued growth in China and the concomitant purchases of Australian commodities. “Currency markets will be watching the Shanghai share market, which has been a pretty big influence on the Aussie recently,” summarized one analyst. A reporter for the WSJ tried to spell it out even more clearly in an article entitled, “Australian Dollar Up Late, Closely Tied To Chinese Stocks.”

Unfortunately, the correlation with (Chinese) stocks runs both ways. When the Chinese stock market tanks – often for inexplicable reasons – as it has for the last three weeks, the Australian Dollar follows suit. Another analyst is more blunt: “The story for the Australian dollar and other risk- and growth-oriented currencies is similar to the share markets. They’ve had a great run and are probably due a bit of a pullback.”

August 25th, 2009 at 8:36 am

The Aussie dollar follows oil too!

September 3rd, 2009 at 2:30 am

Australian dollar is always a bucket of of pain in the ##@@

October 23rd, 2009 at 3:50 am

i many time invest in australian dollar but i always bear loss, so i not buy australian dollar