June 25th 2011

NO QE3: What are the Implications for the Dollar?

The verdict is nearly in; there will be no QE3. The second round of quantitative easing (“QE2”) will expire at the end of this month, and while it will not be unwound for quite some time, the Fed has indicated that it will not be followed by yet another round. The question on the minds of forex traders, of course, is what does this mean for the Dollar?

In his most recent press conference, Ben Bernanke, himself, indicated that QE3 was unlikely. According to a survey conducted by Bloomberg News, the majority of FX analysts (65%) believe him. Simply, the circumstances don’t support further easing. To be sure, the unemployment rate remains high, and the economy is teetering on the verge of double-dip recession. However, the last two rounds did little to address either of these problems, and companies have hoarded cash rather than investing in new plant and workers.

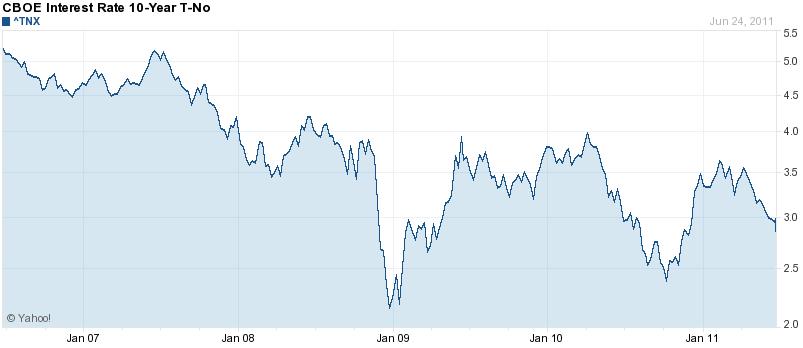

Interest rates are still hovering around record lows, and there isn’t anything to be gained from trying to lower them further. Besides, given that inflation is now above 3% – due to an explosion in good and energy prices – QE3 would simply be too risky. Economist Ken Goldstein summarized the situation as follows: “We will come to the end of QE2 and largely we mark about how little happened when it ended and that’s also an argument about why there may not be persuasive argument to do a QE3.”

On the other hand, there are some analysts who think that QE3 is inevitable (29%). PIMCO’s Bill Gross, manager of the world’s biggest bond fund, recently indicated that, “Next Jackson Hole in August will likely hint at QE3/interest rate caps.” (Personally, I think that he’s probably just bitter that his forecast of a decline in Treasury Bond prices hasn’t materialized). One columnist wrote that the Fed’s arm will be twisted by the ongoing collapse of the housing market, while others have argued that the recent decline in the S&P 500 will spur the Fed into action. Most of us, however, believe that the Fed will adopt a wait-and-see approach before ultimately conceding that more easing is necessary.

For now at least, then, the prevailing assumption is that there will not be a QE3. As for how forex markets have digested this news, they have taken it in stride. The Dollar is now holding its value, and as I wrote in a previous post, it may even have bottomed out. Of course, it doesn’t hurt that the Euro is being punished by another flare-up in the sovereign debt crisis and investors are getting nervous about bubbles in emerging market currencies, all of which provide support for the dollar.

The fact that QE2 will soon end without having triggered financial apocalypse or hyperinflation – as some cassandras initially predicted – is something that is worth nothing. Of course, the proceeds of QE1 and QE2 will be recycled indefinitely into the markets, and forex investors can’t completely put quantitative easing behind them. Still, that there won’t be any more additional cash injected into commodities markets and emerging economy asset markets means that one of the main sources of downward pressure on the dollar has been eliminated.

Ironically, it is possible that the unveiling of QE3 could actually cause the dollar to rally. The reason is that there is still a tremendous amount of uncertainty in the markets, which provides the dollar with some safe haven demand. If the Fed were to concede that all is not well on the economic front and respond by more money printing, it could drive some safe haven flows into the US, even to the extent that it would overwhelm outflows driven by concerns over inflation.

Personally, I think the dollar will continue to hold its value, and perhaps even appreciate slightly in the near-term, as forex markets dither over the way forward.

June 25th, 2011 at 9:19 am

I think the dollar will strengthen over the coming weeks, especially because of the weakness of Europe with several countries being downgraded (Italy,Portugal,Ireland,Spain etc).

I think short term we should see 1.3870 on the Eur/Usd but maybe even as low as 1.3000 again over the coming weeks and months.

June 27th, 2011 at 5:21 am

Thank you for the content in this blog. I will visit it again.