June 28th 2011

Emerging Market Currencies Brace for Correction

“It was the spring of hope, it was the winter of despair,” begins Charles Dickens’ The Tale of Two Cities. In 2011, the winter of despair was followed by the spring of uncertainty. Due to the earthquake/tsunami in Japan, the continued tribulations of Greece, rising commodity prices, and growing concern over the global economic recovery, volatility in the forex markets has risen, and investors are unclear as to how to proceed. For now at least, they are responding by dumping emerging market currencies.

As you can see from the chart above (which shows a cross-section of emerging market forex), most currencies peaked in the beginning of May and have since sold-off significantly. If not for the rally that started off the year, all emerging market currencies would probably be down for the year-to-date, and in fact many of them are anyway. Still, the returns for even the top performers are much less spectacular than in 2009 and 2010. Similarly, the MSCI Emerging Markets Stock Index is down 3.5% in the YTD, and the JP Morgan Emerging Market Bond Index (EMBI+) has risen 4.5% (which is reflects declining growth forecasts as much as perceptions of increasing creditworthiness).

There are a couple of factors that are driving this ebbing of sentiment. First of all, risk appetite is waning. Over the last couple months, every flareup in the eurozone debt crisis coincided with a sell-off in emerging markets. According to the Wall Street Journal, “Central and eastern European currencies that are seen as being most vulnerable to financial turmoil in the euro zone have underperformed.” Economies further afield, such as Turkey and Russia, have also experienced weakness in their respective currencies. Some analysts believe that because emerging economies are generally more fiscally sound than their fundamental counterparts, that they are inherently less risky. Unfortunately, while this proposition makes theoretical sense, you can be assured that a default by a member of the eurozone will trigger a mass exodus into safe havens – NOT into emerging markets.

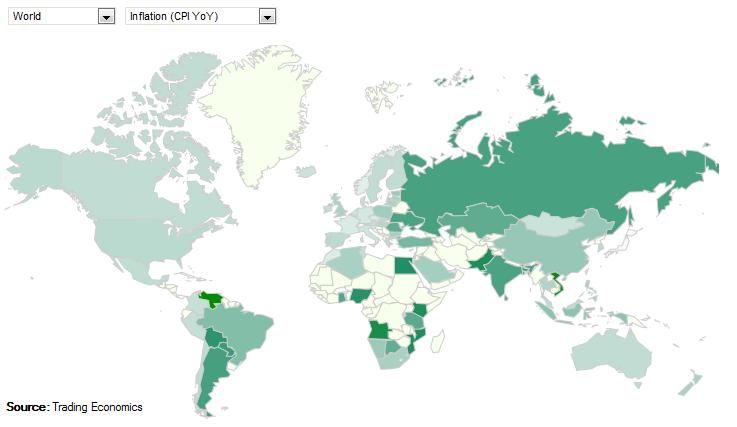

While emerging market Asia and South America is somewhat insulated from eurozone fiscal problems. On the other hand, they remain vulnerable to an economic slowdown in China and to rising inflation. Emerging market central banks have avoided making significant interest rate hikes (hence, rising bond prices) – for fear of inviting further capital inflow and stoking currency appreciation – and the result has been rising price inflation. You can see from the chart above that the darkest areas (symbolizing higher inflation) are all located in emerging economic regions. While high inflation is not inherently problematic, it is not difficult to conceive of a downward spiral into hyperinflation. Again, a sudden bout of monetary instability would send investors rushing to the exits.

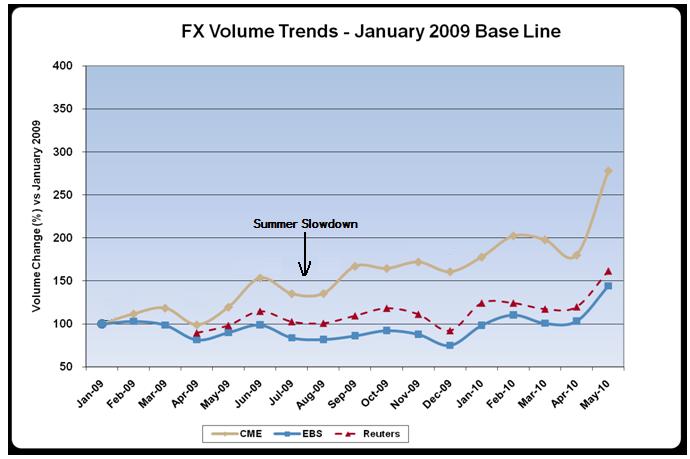

While most analysts (myself included) remain bullish on emerging markets over the long-term, many are laying off in the short-term. “RBC emerging market strategist Nick Chamie says his team has recommended ‘defensive posturing’ to clients since May 5 and isn’t recommending new bullish emerging currency bets right now….HSBC said Thursday that it isn’t recommending outright short positions on emerging market currencies to clients but suggested a more ‘cautious’ and selective approach in making currency bets.” This phenomenon will be exacerbated by the fact that market activity typically slows down in the summer chart above courtesy of Forex Magnates) as traders go on vacation. With less liquidity and an inability to constantly monitor one’s portfolio, traders will be loathe to take on risky positions.

July 5th, 2011 at 3:33 am

More and more investors are dumping emerging market currencies but this is just a temporary phase.

July 7th, 2011 at 3:29 pm

So do you think there is also a “Ghost Month” in Forex Trading because as with Stock Market August is what they say the “Ghost Month”. Do you believe in that?

August 1st, 2011 at 9:31 am

A very nicely written piece.

Indeed, in the midst of all the factors mentioned in the article we seem to be heading for a perfect volatility storm.

One thought from all this, is it possible in the midst of this storm, that the markets become so confused about which way to turn next, that in fact they don’t turn anywhere and that many key currencies will end up trading in a fairly narrow range?

November 3rd, 2011 at 2:48 pm

Companies producing in Turkey in particular should anticipate lower exchange rate-adjusted costs through next year, while companies selling indirectly to the market should anticipate reduced buying power for dollar-denominated goods. Fahhan Ozcelik, FSG Expert Advisor, also recommends that MNCs operating in Turkey take advantage of the government’s planned incentives for local exporters. One way MNCs can do this is by partnering with local suppliers for semi-finished goods, especially in industries such as textiles, motor vehicles, and electrical machinery.

November 27th, 2011 at 7:17 am

The reality of the market is in the trades. Real time account performance says it all: forexpros.com/directory/traders karin.b@forexpros.com

December 25th, 2011 at 4:39 pm

When markets are so volatile, you need to switch your timeframe to a bigger one. That seems to work for me.

January 7th, 2012 at 3:44 am

as expected the emerging market currencies have nose dived and all of a sudden the shining story turn to be a dooms day story.

its nice article can you work on the future trend of emerging market currency.

February 18th, 2012 at 9:39 pm

A very detailed discussion about the whole situation. Jonathan raised a valid point but i don’t think that this situation is very unlikely. When a trend starts to emerge than that trend is followed. I was really interested in forex trading and i came to the website of Banc De Binary. They offered to open an account for as low as $500. They have experience in forex trading but keeping in mind the situation in the world i would just say that i hope the trends start going to a good direction.

February 29th, 2012 at 11:55 am

I’m curious when Europe can be in normal condition from the ‘danger zone’, and will it affect the emerging market countries like Asia?