July 27th 2009

New Zealand Dollar Rise Threatens Economic Recovery

Having risen nearly 30% against the US Dollar since March, the New Zealand Dollar (NZD or Kiwi) is now close to a 9 1/2 month high. While still far from the record highs of 2008, the currency is already erased a large portion of the losses it racked up since the credit crisis gave way to economic recession.

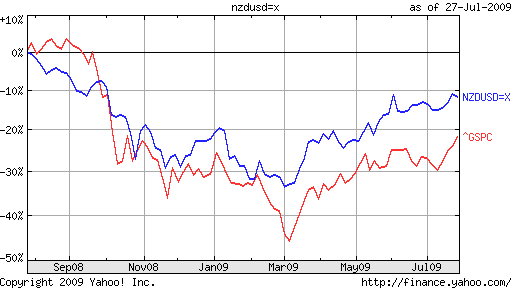

As part of last Friday’s coverage of the Japanese Yen, we included a chart which compared the performance of the AUD/JPY cross to the S&P 500. Even without calculating the correlation coefficient, a cursory review of the chart revealed an uncanny relationship! Unsurprisingly, it turns out the same relationship also applies to the New Zealand Dollar, whose recent performance closely mirrors US equities.

In other words, the interplay between risk appetite and risk aversion continues to dominate the forex markets, as traders move to calibrate the split of funds between so-called safe haven currencies and the riskier alternatives, among which the New Zealand Dollar is certainly counted. Much of the rally in the Kiwi, then, represents a correction, as investors acknowledge that the near 50% slide from-peak-to-trough was an overreaction.

Going forward, however, the Kiwi will have to rest on its own feet, as new themes move to the fore of investors’ minds. Specifically, they will begin to look more closely at the New Zealand economy, and demand evidence of a recovery. “Reserve Bank of New Zealand Governor Alan Bollard told a business audience the world has ‘avoided a repeat of the Great Depression. Now, we and the world, appear to be on our way to recovery. New Zealand looks likely to start recovering ahead of the pack.’ ”

At the same time, the most recent economic data showed an economy in freefall, as “New Zealand’s economy shrank for a fifth straight quarter…The economy contracted 2.7 per cent in the January-March quarter.” While forecasts vary, GDP is expected to fall by at least 2.1% in 2009, with a modest pickup expected in 2010. Investors are betting that the recovery will be driven by rising demand for commodities, which will help to buoy New Zealand exports. Once again, this conflicts with the data, which shows an annualized trade deficit of $3 Billion. Despite a fall in imports, the country is still importing more than its exporting. This could be a product of the stronger currency, which all stakeholders agree is not conducive to economic growth. In the end, the economy’s best chance for recovery lies in a resumption of debt-induced consumption and residential construction, the very forces which caused the current downturn. Says Mr. Bollard, “Reliance on past experience of strong house price inflation and easy credit will be untenable.”

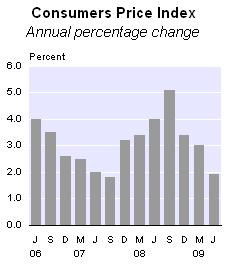

Given the uncertain prospects for growth, combined with moderating price inflation, the RBNZ can be expected to hold interest rates at current levels for the near-term. “Bollard will leave the benchmark interest rate unchanged at a record low 2.5 percent on July 30, according to all 10 economists surveyed by Bloomberg.” Based on swap rates, the markets feel similarly, and are pricing a mere 25 basis point hike over the next twelve months. With such a dubious prognosis, one has to wonder whether the Kiwi’s rally is really sustainable.

July 28th, 2009 at 6:49 pm

[…] « New Zealand Dollar Rise Threatens Economic Recovery | Home […]

July 28th, 2009 at 11:38 pm

For God’s sake, can nobody see it all revolves around the price of oil. Why do you think every currency in the world has followed exactly the same path. If you super-imposed a graph of oil prices over most western currencies you would see they follow the exact same path.

Why is this? because every drop of oil produced in the world is traded in US dollars. No other commoditiy effects any country’s inflation more than the price of oil, so doesn’t it make sense for central banks to control their currency against the greenback to counter the movements in oil prices, so they can control internal inflation.

The question that really needs to be asked is what caused the price of oil to escalate in 2008? Do you think this may have been manipulated up by maybe, the Middle Eastern bloc, the Chinese or Russians, all major oil producers, to put pressure on the US internal economy prior to the presidential elections to get rid of a certain GWB.

Just a little conspiracy theory, but rather ironical that the price of oil plummeted after he was gone? I think more than anything this sudden drop in oil prices is the reason behind the severity of the recession, as it was so out of left field it caight the financial markets out.

Maybe the answer is for the world to stop trading oil in US dollars?

July 30th, 2009 at 3:18 am

[…] the same vein as Monday’s and Tuesday’s posts (covering the New Zealand Dollar and Australian Dollar, respectively), […]