July 24th 2009

Japanese Yen: Exports Versus Carry

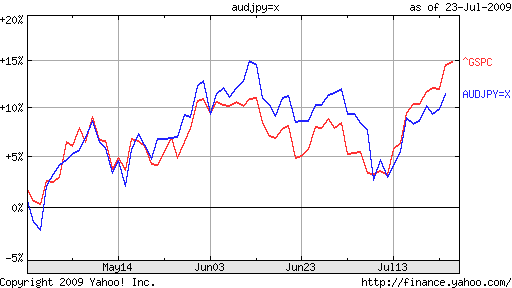

Plot the Japanese Yen against almost any “major” currency over the last few months (or few weeks for that matter) and you get a pretty consistent picture. Moreover, when you graph most Yen currency pairs against the S&P 500 (I like the AUD/JPY), the correlation is uncanny! Sure enough, it was reported recently that “Japan’s currency also fell the most in a week against the euro as futures on the Standard & Poor’s 500 Index rose 0.5 percent.”

This suggests that the main driver for the Yen is proximally, the demand for US equities, and ultimately, appetite for risk. “We’re seeing high-yielding currencies still rallying along with stock markets…The market is reverting to business as usual. That’s just spurring risk currencies forward,” explains one analyst. In other words, the carry trade is back, and investors are borrowing in the world’s cheapest currency (Japanese overnight interest rates are only .1%) and investing in higher-yielding alternatives. “There’s strong momentum behind this risk taking. You cannot keep your money in cash for zero returns unless you believe in deflation,” added a trader.

Experts on both sides of the Pacific Ocean are now encouraging their clients to short the Yen. “Japanese financial institutions are encouraging investors to put money into mutual funds focused on assets denominated in currencies such as the Turkish lira, South African rand and Brazilian real…Japanese investors were net buyers of 709.4 billion yen of overseas assets in the week ended July 11…” Goldman Sachs, meanwhile, has declared that the Yen is still overvalued, and “recommended investors use three-month forward contracts to sell the yen.”

There’s certainly some second-guessing taking place, especially with earnings season upon us. “Risk aversion is likely to stay prominent, given earnings announcements by companies including CIT. The bias is for haven currencies such as the yen to be bought,” insisted one analyst. In addition, Central Bank diversification has created some demand for the Yen and the Euro, but this is more of a Dollar-negative story than a Yen-positive story.

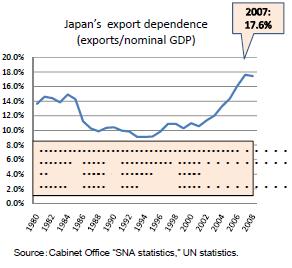

There are also signs that the Japanese economy is recovering, thanks to a pickup in exports. The fact that its economy remains so dependent on exports to drive growth certainly exacerbated the impact of the credit crisis. On the other hand, it could also magnify any recovery. “Japan’s merchandise trade surplus widened in June…to 508 billion yen ($5.42 billion) from 104.1 billion yen a year earlier. The nation’s trade performance appears to be improving, as the surplus was bigger than May’s 299.8 billion yen figure.”

Still, prices in Japan are falling (by 1.1% at last count), and there are strong concerns among economic officials that deflation could take hold. Accordingly, carry traders borrowing in Yen can rest easy, knowing that Japan is probably the least likely of any industrialized country to raise interest rates in the near-term.

July 28th, 2009 at 2:37 am

[…] « Japanese Yen: Exports Versus Carry | Home […]