January 20th 2011

Aussie May Have Peaked in 2010

When offering forecasts for 2011, I feel like I can just take the stock phrase “______ is due for a correction” and apply it to one of any number of currencies. But let’s face it: 2009 – 2010 were banner years for commodity currencies and emerging market currencies, as investors shook off the credit crisis and piled back into risky assets. As a result, a widespread correction might be just what the doctor ordered, starting with the Australian Dollar.

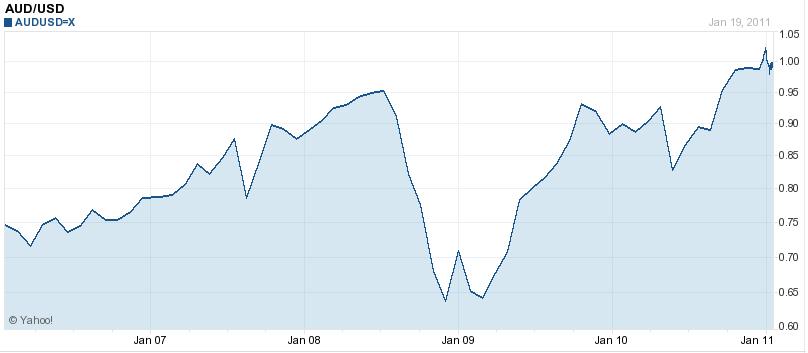

By any measure, the Aussie was a standout in the forex markets in 2010. After getting off to a slow start, it rose a whopping 25% against the US Dollar, and breached parity (1:1) for the first time since it was launched in 1983. Just like with every currency, there is a narrative that can be used to explain the Aussie’s rise. High interest rates. Strong economic growth. In the end, though, it comes down to commodities.

If you chart the recent performance of the Australian Dollar, you will notice that it almost perfectly tracks the movement of commodities prices. (In fact, if not for the fact that commodities are more volatile than currencies, the two charts might line up perfectly!) By no coincidence, the structure of Australia’s economy is increasingly tilted towards the extraction, processing, and export of raw materials. As prices for these commodities have risen (tripling over the last decade), so, too, has demand for Australian currency.

To take this line of reasoning one step further, China represents the primary market for Australian commodities. “China, according to the Reserve Bank of Australia, accounts for around two-thirds of world iron ore demand, about one-third of aluminium ore demand and more than 45 per cent of global demand for coal.” In other words, saying that the Australian Dollar closely mirrors commodities prices is really an indirect way of saying that the Australian Dollar is simply a function of Chinese economic growth.

Going forward, there are many analysts who are trying to forecast the Aussie based on interest rates and risk appetite and the impact of this fall’s catastrophic floods. (For the record, the former will gradually rise from the current level of 4.75%, and the latter will shave .5% or so from Australian GDP, while it’s unclear to what extent the EU sovereign debt crisis will curtail risk appetite…but this is all beside the point.) What we should be focusing on is commodity prices, and more importantly, the Chinese economy.

Chinese GDP probably grew 10% in 2010, exceeding both economists’ forecasts and the goals of Chinese policymakers. The concern, however, is that the Chinese economic steamer is now powering forward at an uncontrollable speed, leaving asset bubbles and inflation in its wake. The People’s Bank of China has begun to cautiously lift interest rates, raise reserve ratios, and tighten the supply of credit. This should gradually trickle down in the form of price stability and more sustainable growth.

Some analysts don’t expect the Chinese economic juggernaut to slow down: “While there is always a chance of a slowdown in China, the authorities there have proved remarkably adept at getting that economy going again should it falter.” But remember- the issue is not whether its economy will suddenly falter, but whether those same “authorities” will deliberately engineer a slowdown, in order to prevent consumer prices and asset prices from rising inexorably.

The impact on the Aussie would be devastating. “A recent study by Fitch concluded that if China’s growth falls to 5pc this year rather than the expected 10pc, global commodity prices would plunge by as much as 20pc.” [According to that same article, the number of hedge funds that is betting on a Chinese economic slowdown is increasing dramatically]. If the Aussie maintains its close correlation with commodity prices, then we can expect it to decline proportionately if/when China’s economy finally slows down.

January 21st, 2011 at 11:18 am

What China is doing to reverse Inflation trends is they are coming out into the world and are going to become the Producer at the Location of the resource and by holding their currency value low they can drive the cost down to produce , so wages trend lower so how does a consumer driven market recovery evolve in this general trend of wage decline in the Higher valued markets of the world like the USA ???

January 21st, 2011 at 11:20 am

A Conversation about America on the Decline because its Trapped in a Trade Policy thats made it Dependent instead of Independent …..

poor in USA is $15,000 to $20,000

poor in china is $125 a month or year

eventually both nations have to close the gap

china goes higher and we go much lower in standard of living

the transition is what is confusing people its gradual

based on what you describe as the valuation for the trend here in this activity logic would suggest that the average American wage in this type of labor would be heading south towards the average labor scale in China then , right ?? 21.5 million rural population live below the official “absolute poverty” line (approximately $90 per year); an additional 35.5 million rural population live above that level but below the official “low income” line (approximately $125 per year) (2007)

I pulled the wage scale off this site and that other Info I got from this site too . I heard Beck has a Research Group hired that is like 100 plus people looking for this stuff to chart the trend America is heading in .

I question if this Globalism and International market effort is working out for America any longer ???

http://www.glennbeck.com/2011/01/18/do-your-own-homework-1182011/

availability of credit, varying currency valuations and politics

the bond market takes em all down and we all start over

might take 5 years who knows

Why is it that there is Value for the Chinese to come to America and develop this , but there is No Value for Domestic Americans to develop this and sell it to the Chinese ???

Chinese national company is interested in Boise ……

http://www.idahostatesman.com/2010/10/11/1374846/chinese-politics-spotlight-idahos.html

http://www.idahostatesman.com/2010/12/31/1472023/chinese-company-eyes-boise.html

Chinese national company is interested in developing a 10,000- to 30,000-acre technology zone for industry, retail centers and homes south of the Boise Airport. Officials of the China National Machinery Industry Corp. have broached the idea — based on a concept popular in China today — to city and state leaders.

They are also interested in helping build and finance a fertilizer plant near American Falls, an idea company officials returned to Idaho this month to pursue.

Hoku Materials Inc., a subsidiary of a Chinese energy firm, already has 500 people building its $400 million plant to make polysilicon for solar panels in Pocatello. It expects to begin production in 2011, employing 250 people, said Scott Paul, Hoku’s president and CEO.

“Idaho’s the last state that should say we don’t want to do business with Asia,” said Lt. Gov. Brad Little. “Asia’s where the money is.”

January 22nd, 2011 at 5:58 am

I watch both AUD and CAD against the dollar and it is interesting they are both hovering around parity as we start 2011.

In terms of the Aussie dollar, I think the recent flooding in the country could have major economic implications and may help to curtail the strength of its currency.

February 25th, 2011 at 12:10 am

The Chinese economy will crash in 2011, and so will commodities and the AUD. Something that can’t go on forever, won’t. There are so many measures of China’s unsustainable investment boom that no further evidence is required, given that Chinese authorities are trying to pop their own bubble is the best piece of evidence. Sadly you can’t pop a bubble carefully, however well intentioned you are. When it pops, the stuff goes everywhere in all directions. Try this at home with a soap bubble if you don’t believe me.

March 8th, 2011 at 11:56 pm

The AUD/USD has continued to trade with in its .99/1.02 range and I think that it will continue to do so until the commodity markets really run out of steam. The Chinese inflationary environment is going to be very interesting to see how it plays out. Increasing borrow costs and th e Reserve ratios at the banks seems to be having little effect as yet. The one thing that will work is if they are forced to appreciate the Yuan faster than the gradual pace we are currently seeing. In the meantime the US will do anything and everything to maintain a weak USD, it was not too long ago there was massive fear about deflation in the US, they are going to fuel this economic recovery until it has scary momentum. The Employment situation has only now just started to improve. I would not expect anything in the way of cash rate hikes in the US in 2011 and probably not until mid 2012. But when they do, watch the fire works because that economy will be spring loaded and they will have to hike rates aggressively.